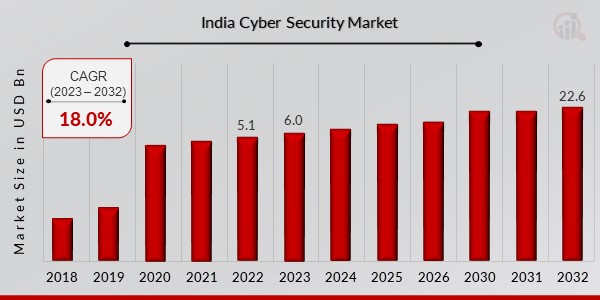

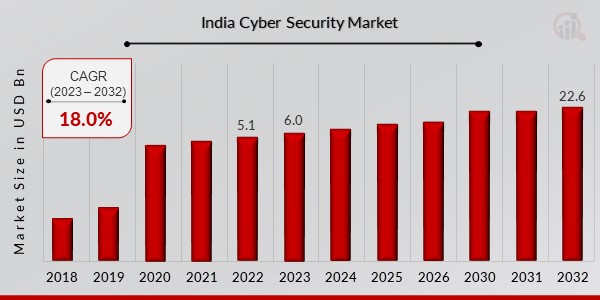

India Cyber Security Market Overview

The India Cyber Security Market size is projected to grow from USD 6.0 Billion in 2023 to USD 22.6 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 18.0% during the forecast period (2023 - 2032). Additionally, the market size for India Cyber Security was valued at USD 5.1 Billion in 2022.

The proliferation and intensification of cyber assaults targeting Indian enterprises and governmental establishments act as a market driver for the expansion of the cybersecurity industry in India.

Figure1: India Cyber Security Market, 2018 - 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

India Cyber Security Market Trends

A notable focus on cybersecurity is driving the market growth.

A notable development in the cybersecurity industry, both domestically and internationally, has been the exponential growth of cloud-based security solutions in recent times. With the ongoing digitization of business operations and the adoption of cloud computing to enhance flexibility and scalability, safeguarding sensitive data and infrastructure with robust security measures becomes of the utmost importance. Cloud-based security solutions are gaining traction in the Indian market due to the numerous benefits they provide compared to conventional on-premises security systems. Primarily, cloud-based security solutions offer improved flexibility and scalability. When utilizing conventional on-premises security solutions, organizations frequently encounter difficulties when attempting to expand their security infrastructure in response to rapid increases in demand or expansion. Cloud-based security solutions, on the other hand, are readily scalable up or down in accordance with an organization's requirements, enabling rapid adaptation to changing conditions without requiring substantial hardware or infrastructure investments in the beginning.

An additional noteworthy development in the cybersecurity industry, specifically in India, is the growing emphasis on endpoint protection. In an effort to safeguard sensitive data and intellectual property, organizations have recognized the critical nature of securing these devices against cyber threats in light of the widespread adoption of endpoints such as mobile devices, laptops, and others within the workplace. Endpoint security pertains to the safeguarding of specific devices against malicious assaults, unauthorized access, and data breaches, including but not limited to laptops, desktops, smartphones, and tablets. In the past, endpoint security solutions primarily concentrated on antivirus software and firewalls as means to identify and thwart established threats that aim to compromise devices. In light of the proliferation of advanced cyber threats (e.g., ransomware, phishing, and zero-day exploits), conventional endpoint security measures have become inadequate in safeguarding against contemporary dangers. Consequently, there has been a surge in investments by Indian organizations towards sophisticated endpoint security solutions that provide proactive threat detection and response capabilities via endpoint detection and response (EDR), machine learning, and behavioral analysis.

India Cyber Security Market Segment Insights

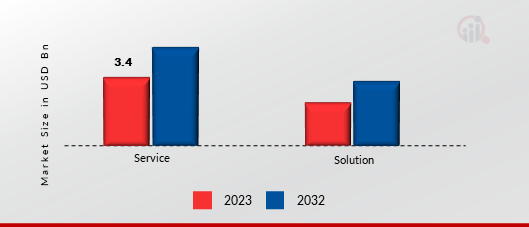

Cyber Security Offering Insights

The India Cyber Security market segmentation, based on offering, includes solutions and services. In the cybersecurity industry, the "Services" segment generally holds the greatest market share among the segments provided. This is due to the diverse array of offerings that services entail, including but not limited to consulting, managed security services, training, and support. In order to assess their cybersecurity posture, implement effective security measures, and manage ongoing threats, organizations frequently require the assistance of experts. As a result, continuous high demand exists for cybersecurity services, which propels the industry's market share to significant levels. In addition, as cybersecurity threats continue to develop, organizations depend on service providers to provide customized solutions and specialized knowledge in order to safeguard their assets efficiently.

Figure 1: India Cyber Security Market by Offering, 2023 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Cyber Security Solution Type Insights

The India Cyber Security market segmentation, based on solution type, includes IAM, antivirus/antimalware, log management & SIEM, firewall, encryption & tokenization, compliance & policy management, patch management, and others. In the cybersecurity industry, the "Antivirus/Antimalware" segment generally holds the greatest market share among the segments provided. Antivirus and antimalware solutions are critical constituents of any organization's cybersecurity strategy. They function as primary safeguards against an extensive spectrum of nasty threats, including malware, viruses, and ransomware. Considering the widespread occurrence of cyber threats and the imperative to safeguard sensitive data and systems, enterprises in every sector allocate considerable resources towards acquiring resilient antivirus and antimalware solutions. This sector's substantial market share within the industry can be attributed to these investments.

Cyber Security Deployment Mode Insights

The India Cyber Security market segmentation, based on deployment mode, includes on-premises, cloud, and hybrid. In the present cybersecurity environment, the "Cloud" segment generally holds the greatest market share among the segments provided. The proliferation of cloud-based security solutions can be attributed to their cost-effectiveness, scalability, and accessibility, among other benefits. As enterprises further transition their activities to the cloud in order to capitalize on its advantages, a concomitant need arises for security solutions that are native to the cloud and safeguard assets and data stored in the cloud. As a result, the market share is dominated by the cloud segment, which is where organizations place a premium on solutions designed to secure their cloud environments while embracing digital transformation initiatives effectively.

Cyber Security Organization Size Insights

The India Cyber Security market segmentation, based on organization size, includes large organizations and SMEs. The "Large Organizations" segment generally holds the most substantial market share within the cybersecurity industry among the segments provided. Large organizations frequently possess more substantial infrastructure and resources, which renders them highly susceptible to cyber threats. As a result, they place a high value on the procurement of comprehensive cybersecurity solutions in order to safeguard their extensive networks, confidential information, and intellectual property. Moreover, due to increased reputational risks and regulatory compliance obligations, large organizations are even more compelled to prioritize cybersecurity. Large organizations, therefore, have a greater demand for sophisticated security technologies and services, which contributes to their substantial market share in the cybersecurity sector.

Cyber Security Network Type Insights

The India Cyber Security market segmentation, based on security Type, includes network security, endpoint IoT security, cloud security, and Network Type security. In the cybersecurity industry, the "Network Security" segment generally holds the greatest market share among the segments provided. The objective of network security is to protect the network infrastructure of an organization against unauthorized access, data intrusions, and other forms of cyber threats. Given that networks serve as the foundation for digital communication and data exchange within organizations, it is critical to prioritize their security in order to avert unauthorized access and safeguard sensitive data. Moreover, network security solutions are indispensable investments for organizations across all sectors and scales, as they serve as fundamental elements of a strong cybersecurity stance. By virtue of this, the network security sector holds a substantial portion of the overall cybersecurity industry.

Cyber Security Vertical Insights

The India Cyber Security market segmentation, based on vertical, includes government, BFSI, healthcare & life sciences, aerospace & defense, retail & e-commerce, manufacturing, energy & utilities, telecommunication, transportation & logistics, media & entertainment, and others. The "BFSI" category generally holds the most substantial market share within the cybersecurity industry among the segments provided. The sector's high-value assets, stringent regulatory requirements, and heightened vulnerability to cyber threats contribute to its dominance. In order to protect against cyber-attacks, fraud, and data breaches, financial institutions prioritize robust cybersecurity measures due to the sensitive nature of the consumer data, transactions, and assets they manage. As a result, the banking, finance, and securities (BFSI) sector allocates considerable resources towards cybersecurity solutions that are specifically designed to tackle the obstacles it faces. This substantial market share is a direct consequence of this.

Cyber Security Country Insights

Multiple factors are contributing to the cybersecurity market's explosive expansion in India, including escalating cyber threats, rising digitization efforts, regulatory compliance requirements, and organizations' increasing awareness of the significance of cybersecurity. With the rise of India as a prominent international center for technology, propelled by endeavors like Make in India and Digital India, safeguarding critical infrastructure, sensitive data, and intellectual property against cyber threats has assumed the utmost importance. An important factor propelling market expansion in India is the increasing sophistication and frequency of cyber assaults that specifically target individuals, government entities, and businesses. In order to exploit vulnerabilities and infiltrate networks, cybercriminals' strategies, methods, and procedures continue to develop, resulting in an increased need for cybersecurity solutions and services. Furthermore, the exponential growth of digitalization across multiple industries—including banking, financial services, healthcare, e-commerce, and government services—has resulted in an enlargement of the potential vulnerabilities that can be exploited. Consequently, the protection of digital assets and the maintenance of the trustworthiness of online transactions and services have become imperative, demanding robust cybersecurity protocols.

India Cyber Security Key Market Players & Competitive Insights

Leading market players are making significant investments in R&D to broaden their product offerings, which will support further growth in the India Cyber Security market. In addition, market players are engaging in a range of calculated initiatives to increase their presence, with significant market developments involving the introduction of new products, contracts, M&A transactions, increased investment, and cooperation with other enterprises. To expand and survive in a more competitive and rising market climate, India Cyber Security industry must provide reasonably priced goods.

Major players in the India Cyber Security market are engaging in research and development activities in an effort to boost market demand, including IBM, Cisco, Microsoft, Palo Alto Networks, Fortinet, Check Point, Trellix, Trend Micro, Rapid7, Micro Focus (Open text), Oracle, Accenture, CyberArk, SentinelOne, Qualys, F-secure, F5, RSA Security, Sophos, Forcepoint, Proofpoint, Juniper Networks, SonicWall, Zscaler, Google, Fortra, Crowdstrike, Broadcom, Redington, Nozomi Networks, Revbits, and Aristi Labs.

Key Companies in the Indian Cyber Security market include

- IBM

- Cisco

- Microsoft

- Palo Alto Networks

- Fortinet

- Check Point

- Trellix

- Trend Micro

- Rapid7

- Micro Focus (Open text)

- Oracle

- Accenture

- CyberArk

- SentinelOne

- Qualys

- F-secure

- F5

- RSA Security

- Sophos

- Forcepoint

- Proofpoint

- Juniper Networks

- SonicWall

- Zscaler

- Google

- Fortra

- Crowdstrike

- Broadcom

- Redington

- Nozomi Networks

- Revbits

- Aristi Labs

- Illumio

India Cyber Security Market Segmentation

India Cyber Security Offering Outlook

India Cyber Security Solution Type Outlook

- IAM

- Antivirus/Antimalware

- Log Management & SIEM

- Firewall

- Encryption & Tokenization

- Compliance & Policy Management

- Patch Management

- Others

India Cyber Security Deployment Mode Outlook

India Cyber Security Organization Size Outlook

India Carbon Security Network Type Outlook

- Network Security

- Endpoint IoT Security

- Cloud Security

- Network Type Security

India Cyber Security Vertical Outlook

- Government

- BFSI

- Healthcare & Lifesciences

- Aerospace & Defense

- Retail & eCommerce

- Manufacturing

- Energy & Utilities

- Telecommunication

- Transportation & Logistics

- Media & Entertainment

- Others

| Report Attribute/Metric |

Details |

| Market Size 2022 |

USD 5.1 Billion |

| Market Size 2023 |

USD 6.0 Billion |

| Market Size 2032 |

USD 22.6 Billion |

| Compound Annual Growth Rate (CAGR) |

18.0% (2024-2032) |

| Base Year |

2023 |

| Market Forecast Period |

2024-2032 |

| Historical Data |

2019- 2022 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Offering, Solution Type, Deployment Mode, Organization Size, Security Type, End-Use Industry, and Region |

| Countries Covered |

India |

| Key Companies Profiled |

IBM, Cisco, Microsoft, Palo Alto Networks, Fortinet, Check Point, Trellix, Trend Micro, Rapid7, Micro Focus (Open text), Oracle, Accenture, CyberArk, SentinelOne, Qualys, F-secure, F5, RSA Security, Sophos, Forcepoint, Proofpoint, Juniper Networks, SonicWall, Zscaler, Google, Fortra, Crowdstrike, Broadcom, Redington, Nozomi Networks, Revbits, and Aristi Labs |

| Key Market Opportunities |

· Growing IoT deployments create demand for specialized IoT security solutions. · Opportunity to provide comprehensive security solutions for IoT devices and networks. |

| Key Market Dynamics |

· Rising frequency and sophistication of cyber attacks. · Drive organizations to invest in robust cybersecurity solutions. |

Frequently Asked Questions (FAQ) :

India's Cyber Security market size was valued at USD 6.0 billion in 2023.

The market is projected to grow at a CAGR of 18.0% during the forecast period, 2024-2032.

The key players in the market are IBM, Cisco, Microsoft, Palo Alto Networks, Fortinet, Check Point, Trellix, Trend Micro, Rapid7, Micro Focus (Open text), Oracle, Accenture, CyberArk, SentinelOne, Qualys, F-secure, F5, RSA Security, Sophos, Forcepoint, Proofpoint, Juniper Networks, SonicWall, Zscaler, Google, Fortra, Crowdstrike, Broadcom, Redington, Nozomi Networks, Revbits, and Aristi Lab, among others.

The services category dominated the market in 2023.

The Antivirus/Antimalware Security category dominated the market in 2023.