United States Used Car Market Overview

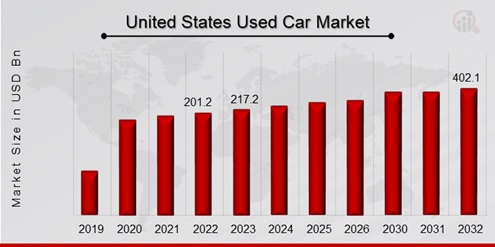

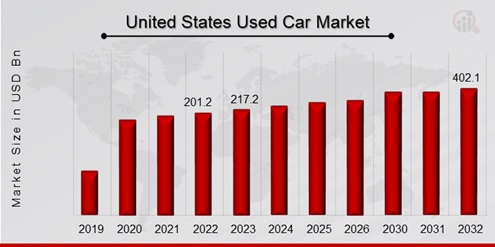

United States used car market size was valued at USD 201.2 Billion in 2022. The used car market industry is projected to grow from USD 217.2 Billion in 2023 to USD 402.1 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 8.00% during the forecast period (2024 - 2032). Economic uncertainty, including fluctuations in employment, income levels, and consumer confidence, often leads individuals to opt for used cars over new ones due to their lower cost, resulting in increased demand for pre-owned vehicles. These are the main factors driving the market growth.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Used Car Market Trends

- The rise of Certified Pre-Owned (CPO) vehicles is driving the market growth

The United States used car market CAGR is expanding due to the upward thrust of Certified Pre-Owned (CPO) vehicles, which has notably contributed to the boom of United States used car marketplace. CPO vehicles provide purchasers with a compelling alternative to buying new automobiles by offering a warranty of exceptional reliability and warranty-sponsored coverage. According to information from Autotrader, CPO vehicle sales in the United States reached a record high in recent years, with an amazing growth in consumer calls for for inspected, refurbished, and manufacturer-licensed used automobiles. Manufacturers and dealerships offer rigorous inspections, complete warranties, and additional perks with CPO automobiles, attracting consumers seeking peace of mind and value for their funding. As a result, the supply and recognition of CPO programs have reinforced self-belief within the used car market, driving income and increasing the overall market length.

Economic uncertainty has emerged as a vast driving force influencing customer conduct inside the United States used car marketplace. During periods of financial downturns or volatility, purchasers regularly prioritize value-saving measures and search for alternatives to huge purchases, together with new cars. According to facts from Edmunds, economic factors, along with process insecurity, fluctuating interest prices, and modifications in disposable earnings tiers can have an effect on patron decisions to choose used vehicles over new ones. The affordability and decreased depreciation quotes of used cars at some stage in financial downturns make them an attractive option for budget-aware buyers seeking to preserve mobility whilst managing charges. Thus, monetary uncertainty plays a pivotal role in driving demand for used motors and shaping marketplace dynamics in the United States. Vehicle age and mileage concerns play an essential role in driving client alternatives and buying choices inside the United States used vehicle market. According to analysis from IHS Markit, the common age of motors on U.S. Roads has been steadily increasing over the years, accomplishing a file excessive of over 12 years. Additionally, enhancements in vehicle sturdiness, reliability, and renovation have contributed to consumers' willingness to keep in mind older, better-mileage vehicles. With improvements in the automotive era and engineering, many used cars provide reliable performance and longevity, making them possible options for price-aware customers. The availability of properly maintained, past due-version used vehicles with especially low mileage similarly complements their appeal, using income and fueling growth within the used car market. Thus driving the used car market revenue.

Used Car Market Segment Insights

- Used Car Vendor Type Insights

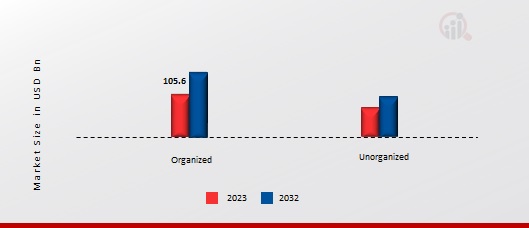

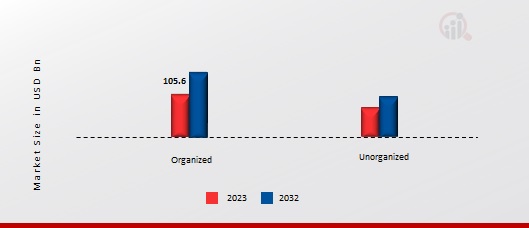

The United States used car market segmentation, based on Vendor Type, includes Organized and Unorganized. The organized segment dominated the market. New cars experience rapid depreciation in their first few years, making them less attractive to budget-conscious buyers. Used cars offer better value retention, as they are organized, driving consumers towards the pre-owned vehicle market.

Figure 1: United States Used Car Market, by Vendor Type, 2023 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Used Car Propulsion Insights

The United States used car market segmentation, based on Propulsion, includes Petrol, Diesel, CNG, LPG, Electric, and Others. The petrol category generated the most income. Used cars typically come with lower price tags compared to their new counterparts, like the usage of petrol, making them more accessible to a broader range of consumers, including first-time buyers, students, and individuals on a tight budget.

Used Car Engine Capacity Segment Insights

The United States used car market segmentation, based on Engine Capacity, includes Full Size (Above 2500 CC), Mid-size (Between 1500-2499 CC), and Small (Below 1499 CC). The small (below 1499 CC) category generated the most income. Vehicles with engine displacements under 1,200 cc are classified as small cars, whereas those with displacements beyond 1,500 cc are classified as big cars. Due to the strong demand for reasonably priced and fuel-efficient cars in the nation, the compact car category is anticipated to have the highest proportion of the used car market in India.

Used Car Dealership Segment Insights

The United States used car market segmentation, based on Dealership, includes Franchised and independent. The independent category generated the most income. Improvements in vehicle technology and manufacturing standards have led to increased durability and longevity of vehicles. Consumers are more inclined to consider older, independent, higher-mileage used cars that offer reliable performance at a lower cost.

Used Car Sales Channel Segment Insights

The United States used car market segmentation, based on Sales Channel, includes Online and Offline. The offline category generated the most income. Certified pre-owned (CPO) programs offered by manufacturers and dealers provide buyers with added confidence and peace of mind by offering inspected, refurbished, and warranty-backed used cars, boosting consumer trust and driving sales.

Used Cr Vehicle Type Segment Insights

The United States used car market segmentation, based on Vehicle Type, includes Passenger Car, LCV, HCV, and Electric Vehicle. The LCV category generated the most income. The advent of e-commerce and last-mile delivery services are examples of how shifting business models might influence the demand for LCVs in the used automobile market. Businesses may look to the used LCV segment for cost-effective solutions to fulfill their transportation demands as they adjust to changing market conditions.

Used Car Regional Insights

States alongside the West Coast, inclusive of California, Oregon, and Washington, show off a robust call for used cars, driven by elements like high population density, urbanization, and a choice for green vehicles. Consumers in this place frequently prioritize gas-green and environmentally friendly vehicles, which include hybrids and electric powered vehicles (EVs). Additionally, the tech-savvy nature of West Coast purchasers results in a choice for motors ready with superior infotainment and connectivity functions. The Midwest location, encompassing states like Illinois, Michigan, and Ohio, has a sturdy used automobile marketplace influenced by factors including manufacturing presence, affordability, and seasonal versions. Consumers in this place often prioritize dependable, sensible motors suitable for navigating various climate situations, such as snow and ice, all through the winter months. Additionally, the affordability of used vehicles compared to new vehicles makes them a famous choice amongst finances-conscious buyers in the Midwest.

Used Car Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the used car market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the used car industry must offer cost-effective items.

Major players in the used car market are attempting to increase market demand by investing in research and development operations includes Group1 Automotive, Inc. (U.S.), AutoNation, Inc. (U.S.), HELLMAN & FRIEDMAN LLC (U.S.), PENDRAGON (U.K.), CarMax Business Services, LLC (U.S.), Manheim (U.S.), THE HERTZ CORPORATION (U.S.), Cox Automotive (U.S.), Sun Toyota (U.S.), eBay Inc. (U.S.), TrueCar, Inc. (U.S.), VROOM (U.S.), Asbury Automotive Group (U.S.), MARUTI SUZUKI INDIA LIMITED (India), Lithia Motors, Inc. (U.S.), Hendrick Automotive Group (U.S.).

Key Companies in the used car market include

- Group1 Automotive, Inc. (U.S.)

- AutoNation, Inc. (U.S.)

- HELLMAN & FRIEDMAN LLC (U.S.)

- PENDRAGON (U.K.)

- CarMax Business Services, LLC (U.S.)

- Manheim (U.S.)

- THE HERTZ CORPORATION (U.S.)

- Cox Automotive (U.S.)

- Sun Toyota (U.S.)

- eBay Inc. (U.S.)

- TrueCar, Inc. (U.S.)

- VROOM (U.S.)

- Asbury Automotive Group (U.S.)

- Lithia Motors, Inc. (U.S.)

- Hendrick Automotive Group (U.S.)

Used Car Industry Developments

December 2019: A deal to buy the business from AutoScout24 has been made by HELLMAN & FRIEDMAN LLC. The company continues to digitise its business models in the automotive sector, and with this purchase, it hopes to offer value-added marketing solutions.

Used Car Market Segmentation

Used Car Vendor Type Outlook

Used Car Propulsion Outlook

- Petrol

- Diesel

- CNG

- LPG

- Electric

- Others

Used Car Engine Capacity Segment Outlook

- Full Size (Above 2500 CC)

- Mid-size (Between 1500-2499 CC)

- Small (Below 1499 CC)

Used Car Dealership Segment Outlook

Used Car Sales Channel Segment Outlook

Used Car Vehicle Type Segment Outlook

- Passenger Car

- LCV

- HCV

- Electric Vehicle

| Report Attribute/Metric |

Details |

| Market Size 2022 |

USD 201.2 Billion |

| Market Size 2023 |

USD 217.2 Billion |

| Market Size 2032 |

USD 402.1 Billion |

| Compound Annual Growth Rate (CAGR) |

8.00% (2024-2032) |

| Base Year |

2023 |

| Market Forecast Period |

2024-2032 |

| Historical Data |

2019- 2022 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Vendor Type, Propulsion, Engine Capacity, Dealership, Sales Channel, Vehicle Type, and Region |

| Region Covered |

United States |

| Countries Covered |

The US, Canada, Mexico, and the Rest of United States |

| Key Companies Profiled |

Group1 Automotive, Inc. (U.S.), AutoNation, Inc. (U.S.), HELLMAN & FRIEDMAN LLC (U.S.), PENDRAGON (U.K.), CarMax Business Services, LLC (U.S.), Manheim (U.S.), THE HERTZ CORPORATION (U.S.), Cox Automotive (U.S.), Sun Toyota (U.S.), eBay Inc. (U.S.), TrueCar, Inc. (U.S.), VROOM (U.S.), Asbury Automotive Group (U.S.), MARUTI SUZUKI INDIA LIMITED (India), Lithia Motors, Inc. (U.S.) and Hendrick Automotive Group (U.S.) |

| Key Market Opportunities |

· Catering to niche markets like classic car enthusiasts, budget-conscious buyers, or specific vehicle types can offer differentiation. |

| Key Market Dynamics |

· Used cars offer a more affordable alternative to new cars, attracting budget-conscious buyers and those seeking specific models no longer in production. · Increasing reliability and features in newer models push many well-maintained used cars onto the market, further widening the choice and affordability gap. |

Frequently Asked Questions (FAQ) :

The United States used car market size was valued at USD 217.2 Billion in 2023.

The market is projected to grow at a CAGR of 8.00% during the forecast period, 2024-2032.

The key players in the market are Group1 Automotive, Inc. (U.S.), AutoNation, Inc. (U.S.), HELLMAN & FRIEDMAN LLC (U.S.), PENDRAGON (U.K.), CarMax Business Services, LLC (U.S.), Manheim (U.S.), THE HERTZ CORPORATION (U.S.), Cox Automotive (U.S.), Sun Toyota (U.S.), eBay Inc. (U.S.), TrueCar, Inc. (U.S.), VROOM (U.S.), Asbury Automotive Group (U.S.), MARUTI SUZUKI INDIA LIMITED (India), Lithia Motors, Inc. (U.S.) and Hendrick Automotive Group (U.S.)

The Organized category dominated the market in 2023.

The Petrol category had the HCV share in the market.