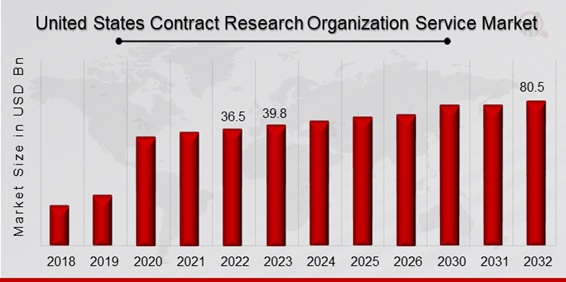

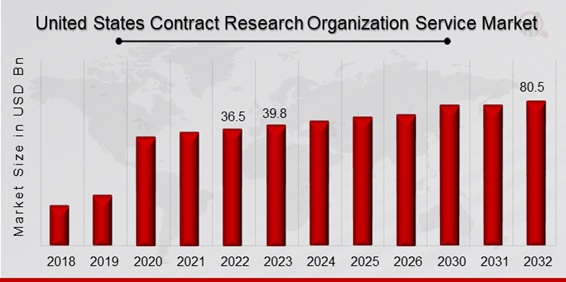

United States Contract Research Organization Service Market Overview

United States Contract Research Organization Service Market Size was valued at USD 36.5 Billion in 2022. The Contract Research Organization Service market industry is projected to grow from USD 39.8 Billion in 2023 to USD 80.5 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 9.20% during the forecast period (2023 - 2032). Increased incidence of chronic disease and a growing number of drugs in the pipeline are the main market drivers anticipated to propel the Contract Research Organization Service market in the United States.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

United States Contract Research Organization Service Market Trends

- Growing early-phase development services are driving market growth

Medicine manufacturers are pressured to make up for the money they lose to generic competitors as more and more medicine patents expire, increasing the danger posed by these versions of the pharmaceutical industry in the United States. Costs associated with research and development are rising due to increasingly complex medicinal compounds and stringent regulations. Prominent CROs have also amassed a great deal of knowledge in the early-phase development space, and they are using this knowledge to provide extremely accurate and efficient early-phase development services. Due to CROs, small and medium businesses can join the intricate drug development process without making a major capital equipment investment in the United States. Early phase trials are more successful because of excellent data quality, better safety judgments, lower trial operating expenses, and quicker research execution, according to an article released in March 2021 by Anju Life Sciences Software. As a result, the early-phase development services market is expected to experience rapid expansion.

Many biopharmaceutical, pharmaceutical, and medical device companies continue to devote substantial resources to creating novel drugs and technological advancements. Sponsors typically contract independent service providers for therapeutic and other product development duties. This allows sponsors to employ more flexible cost structures and avoid having redundant development capabilities in the country. United States CRO market expansion is driven by rising investments made by several major corporations in clinical and non-clinical research endeavors and by services outsourced to United States Contract research firms that offer affordable development solutions. Based on the trend, the major pharmaceutical companies are working together to do further research and are improving the efficiency of their R&D. Pharma research and development is evolving as businesses seek to enable more employees to work from home and concentrate on improving trial endpoints in terms of responsiveness and patient-centeredness. These factors will aid market expansion. Thus, driving the United States Contract Research Organization Service market revenue.

United States Contract Research Organization Service Market Segment Insights

- Contract Research Organization Service Type Insights

Based on Type, the United States Contract Research Organization Service market segmentation includes clinical research services (phase, [phase III, phase II, phase I, phase IV], and study design (for phase III & IV), [interventional, real-world evidence (RWE)]), early phase development services, [chemistry, manufacturing and controls services, preclinical services, discovery studies], laboratory services, [analytical testing services, bioanalytical testing services], consulting services, and data management services. The clinical research services segment mostly dominated the market. The growing prevalence of chronic disorders and the rising need for efficient drugs and diagnostics are the reasons for the segment's expansion. Additionally, United States Contract research businesses assist in many areas of medication and medical device development and provide a wide range of clinical trial research services.

The data management services category is anticipated to be the fastest growing. The availability of technologically sophisticated systems for efficient data management and the need for effective data collection, management, and analysis for the successful execution of clinical trials are two factors contributing to the market segment's growth.

Contract Research Organization Service Therapeutic Area Insights

Based on Therapeutic Area, the United States Contract Research Organization Service market segmentation includes oncology (breast cancer, lung cancer, colorectal cancer, prostate cancer, and other cancers), infectious diseases, CNS disorders, neurology, vaccines, metabolic disorders/endocrinology, immunological disorders, psychiatry, respiratory disorders, dermatology, ophthalmology, gastrointestinal diseases, genitourinary & women’s health, hematology, and other therapeutic areas. The oncology category generated the most income. Sponsors are now forced to concentrate on creating new treatments and medical technologies for improved cancer management due to the rising incidence of cancer. As a result, more clinical studies are being conducted, and new medications for cancer treatment are being discovered.

The CNS disorder category is expected to have the quickest rate. CROs that specialize in the discovery of medicines for CNS disorders are in high demand due to the rising prevalence of these problems, which include neurodegenerative diseases like Parkinson's and Alzheimer's.Advanced neuroimaging technology development and implementation are essential to studying CNS disorders. It can be highly sought after for CROs with expertise in neuroimaging analysis.

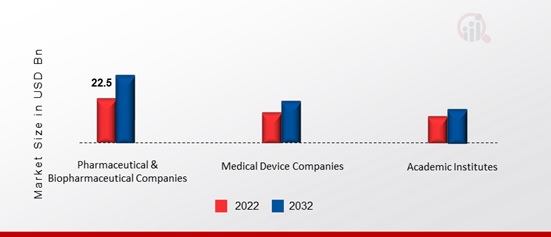

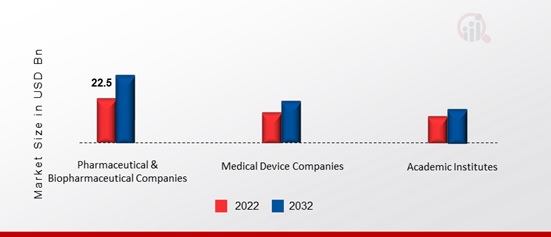

Contract Research Organization Service End User Insights

Based on End User, the United States Contract Research Organization Service market segmentation includes Pharmaceutical & Biopharmaceutical Companies, Medical Device Companies, and Academic Institutes. The pharmaceutical & biopharmaceutical companies’ category generated the most income. Pharmaceutical sponsors are increasing their R&D expenditures and contracting out a greater percentage of this work to outside service providers. According to Credit Suisse, just 41% of clinical development was outsourced in 2016. Due to the high cost and complexity of research, the burdensome reimbursement and regulatory environment, and the usage of CRO partners in their pursuit of more effective solutions, this percentage was projected to rise to 50% by 2020.

The medical device company’s category is expected to have the quickest rate. The CRO service providers' management of medical technology and recent advancements in healthcare have expanded the medical device market share.

Figure 1: United States Contract Research Organization Service Market by End User, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Contract Research Organization Service Country Insights

The National Library of Medicine reported in July 2022 that overall pharmaceutical expenditures in the United States in 2021 were USD 576.9 billion, an increase of 7.7% from 2020. Consequently, the growing pharmaceutical expenditure in the nation also supports the studied market's growth. Pharmaceutical companies are increasing their spending on research and development to create new medicines. Furthermore, Federal departments and agencies hold most of the money for research and development (R&D), according to Federal Research and Development (R&D) money: FY2022. The Department of Health and Human Services received 27.6% of all federal R&D funds in FY 2021 out of five agencies that received 93.0%. Health and Human Services would receive the biggest increases in R&D funding, up to USD 7.7 billion (17.8%).

United States Contract Research Organization Service Key Market Players & Competitive Insights

The Contract Research Organization Service market is expected to grow even more due to major players in the industry making significant R&D investments to extend their lines of equipment. Alongside these significant market developments, market participants engage in various strategic actions to broaden their market reach. These activities include introducing new Types of contractual agreements, mergers and acquisitions, increased investments, and cooperation with other organizations. The Contract Research Organization Service sector needs to provide affordable products to grow and thrive in a more cutthroat and dynamic market.

By investing in research and development operations, major US companies in the contract research organization services market are trying to boost market demand, including IQVIA Inc., Laboratory Corporation of America Holdings, Thermo Fisher Scientific Inc., Syneos Health, Charles River Laboratories, Fortrea, Inc., and Medpace.

Key Companies in the United States Contract Research Organization Service market include

- IQVIA Inc.

- Laboratory Corporation of America Holdings

- Thermo Fisher Scientific Inc.

- Syneos Health

- Charles River Laboratories

- Fortrea, Inc.

- Medpace

Contract Research Organization Service Industry Developments

October 2023: A collaborative partnership has been established between IQVIA Inc. (US) and argenx (US) to provide comprehensive and innovative technology-enabled pharmacovigilance (PV) safety services and solutions to patients with uncommon autoimmune illnesses.

October 2023: LabCorp announced that it had acquired the outreach laboratory business and a portion of Baystate Health's operating assets, which include the laboratory service centers that Baystate Health runs across the US state of Massachusetts.

United States Contract Research Organization Service Market Segmentation

Contract Research Organization Service Type Outlook

- Clinical Research Services

- Phase

- Phase III

- Phase II

- Phase I

- Phase IV

- Study Design (For Phase III & IV)

- Interventional

- Real World Evidence (RWE)

- Early phase development Services

- Chemistry, Manufacturing, and Controls Services

- Preclinical Services

- Discovery Studies

- Laboratory Services

- Analytical Testing Services

- Bioanalytical Testing Services

- Consulting Services

- Data Management Services

Contract Research Organization Service Therapeutic Area Outlook

- Oncology

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Prostate Cancer

- Other Cancer

- Infectious Diseases

- CNS Disorders

- Neurology

- Vaccines

- Metabolic Disorders/Endocrinology

- Immunological Disorders

- Psychiatry

- Respiratory Disorders

- Dermatology

- Ophthalmology

- Gastrointestinal Diseases

- Genitourinary & Women’s Health

- Hematology

- Other Therapeutic Areas

Contract Research Organization Service End User Outlook

- Pharmaceutical & Biopharmaceutical Companies

- Medical Device Companies

- Academic Institutes

|

Report Attribute/Metric

|

Details

|

|

Market Size 2022

|

USD 36.5 Billion

|

|

Market Size 2023

|

USD 39.8 Billion

|

|

Market Size 2032

|

USD 80.5 Billion

|

|

Compound Annual Growth Rate (CAGR)

|

9.20% (2022-2032)

|

|

Base Year

|

2022

|

|

Market Forecast Period

|

2022-2032

|

|

Historical Data

|

2019- 2022

|

|

Market Forecast Units

|

Value (USD Billion)

|

|

Report Coverage

|

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends

|

|

Segments Covered

|

Type, Therapeutic Area, and End User

|

|

Countries Covered

|

United States

|

|

Key Companies Profiled

|

IQVIA Inc., Laboratory Corporation of America Holdings, Thermo Fisher Scientific Inc., Syneos Health, Charles River Laboratories, Fortrea, Inc., and Medpace

|

|

Key Market Opportunities

|

· Increasing emphasis on personalized and precision medicine

· Increasing product approval rate

|

|

Key Market Dynamics

|

· Increase in incidence of chronic disease

· Growing number of drugs are in the pipeline.

|

Frequently Asked Questions (FAQ) :

The United States Contract Research Organization Service market size was valued at USD 39.8 Billion in 2023.

The market is projected to grow at a CAGR of 9.20% during the forecast period, 2022-2032.

The key players in the market are IQVIA Inc., Laboratory Corporation of America Holdings, Thermo Fisher Scientific Inc., Syneos Health, Charles River Laboratories, Fortrea, Inc., and Medpace, among others.

The clinical research services category dominated the market in 2023.

The oncology category had the largest share of the market.