India Water Treatment Market Overview

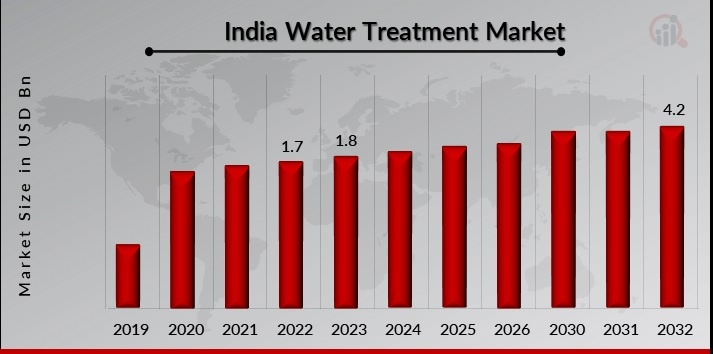

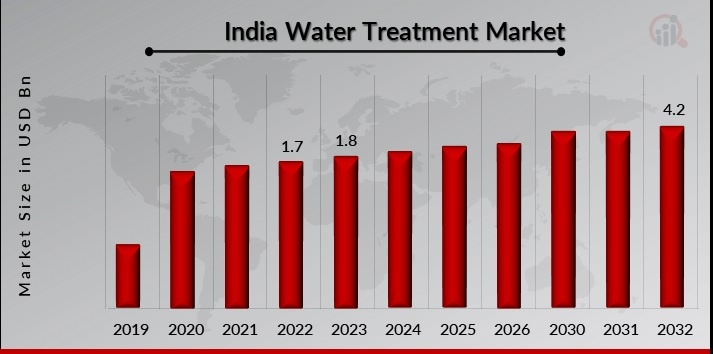

India Water Treatment Market Size was valued at USD 1.7 Billion in 2022. The Water Treatment industry is projected to grow from USD 1.8 Billion in 2023 to USD 4.2 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 10.60% during the forecast period (2024 - 2032). Increasing water pollution and growing population demand are the main market drivers anticipated to propel the Water Treatment Market in India. Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

India Water Treatment Market Trends

-

Expanding pulp and paper industry drives market growth

The growing pulp and paper sector drives the market CAGR for Water Treatment. Water and wastewater treatment technologies used in the pulp and paper industry include reverse osmosis, ion exchange, UV disinfection, membrane filtering, biological treatment, and others. For instance, the Canadian government maintains that the pulp and paper industry is growing. In 2021, the Minister of Natural Resources announced a US$3.8 million investment in Red Leaf Pulp, a Kelowna-based startup, under Sustainable Development Technology Canada (SDTC). Furthermore, Invest India forecasts that India's paper and paperboard industry will grow at a 6-7% yearly rate. India consumes 15 kg of paper per person each year. The rising pulp and paper sector will require extra water and wastewater treatment technologies to control waste streams, which will drive industrial growth during the forecast period.

Moreover, in recent years, there has been a greater emphasis on environmental sustainability and reducing the environmental impact of industrial activity. As a result, governments around the world, including India, have implemented severe effluent treatment rules to ensure that enterprises meet wastewater discharge criteria. In India, the Central Pollution Control Board (CPCB) and State Pollution Control Boards (SPCBs) are in charge of implementing these policies and ensuring that enterprises meet the required criteria. In India, effluent treatment laws establish allowable limitations for different parameters such as chemical oxygen demand (COD), total dissolved solids (TDS), total suspended solids (TSS), and biological oxygen demand (BOD) in industrial wastewater. Industries are required to establish effluent treatment plants (ETPs) to clean wastewater before it is discharged into aquatic bodies. The laws also require enterprises to get SPCB permits for their ETPs and submit regular effluent quality reports. Industries that fail to comply with the regulations face consequences, which may include fines, facility closure, or imprisonment for the responsible staff. The strict laws governing effluent treatment have raised demand for advanced wastewater treatment methods and equipment, such as membrane separation, biological treatment, and disinfection equipment. It has also generated opportunities for enterprises to offer specialized effluent treatment services, such as consultation and testing. Thus, driving the India Water Treatment market revenue.

India Water Treatment Market Segment Insights

Water Treatment Equipment Insights

The India Water Treatment Market segmentation, based on Equipment, includes Membrane Separation, Biological, Disinfection and Sludge Treatment. The membrane separation category leads India's water and wastewater treatment market. Membrane separation technology is utilized in a variety of applications, including reverse osmosis, nanofiltration, and ultrafiltration, and it is extremely successful at removing contaminants from water and wastewater. The increased requirement for clean water for numerous industrial uses as well as home use is driving up demand for membrane separation equipment. The biological segment is also expanding rapidly due to a greater emphasis on sustainability and the need to reduce the environmental impact of wastewater discharge.

Water Treatment Process Insights

The India Water Treatment Market segmentation, based on Process, includes Primary Treatment, Secondary Treatment and Tertiary Treatment. The secondary treatment sector has the biggest market share. Secondary treatment removes dissolved and suspended organic matter and nutrients from wastewater using biological treatment methods, including activated sludge and sequencing batch reactors. The initial treatment procedure, which involves physically removing big solids and grit from wastewater, is very significant, particularly in businesses that produce a lot of solid waste. However, secondary treatment is more commonly utilized because it helps to remove the majority of organic matter and nutrients from wastewater.

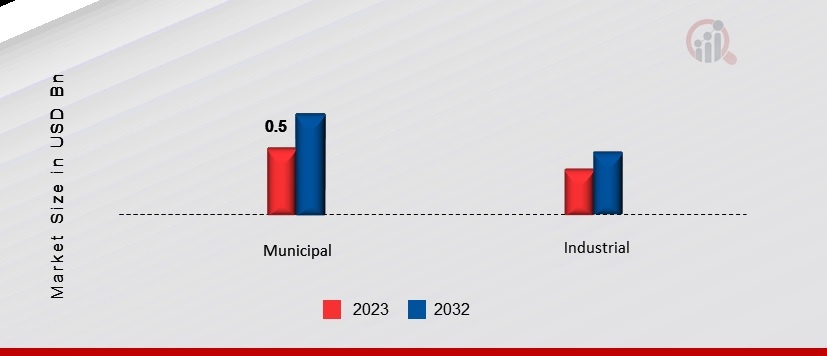

Water Treatment Application Insights

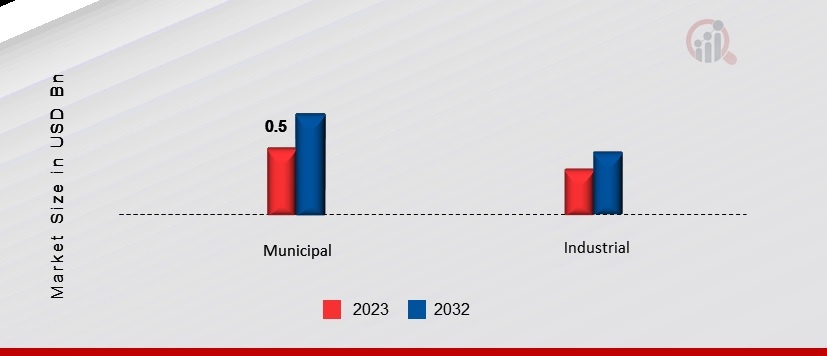

The India Water Treatment Market is segmented by Application, which includes Municipal and Industrial. The municipal segment dominated the market. Wastewater treatment is necessary and done in several cities in India. Treatment methods are used for several purposes, including preliminary, main, and secondary treatment, tertiary treatment, biological nutrient removal (BNR), resource recovery, and energy generation. Biomass is widely employed in municipal wastewater treatment. As a result, biological treatment is a key step in the treatment of biowaste. Municipal administrations in numerous places across India use wastewater technology to treat municipal wastewater.

Figure 1: India Water Treatment Market, By Application, 2023 & 2032 (USD Billion) Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

India Water Treatment Country Insights

India's water and wastewater treatment market is divided into four regions: north India, south India, east India, and west India. The West India division dominated the market. The fundamental cause was the high level of industry in Maharashtra and Gujarat. South India is the second-largest contributor. North India swiftly followed suit, particularly after the announcement of Ganga clean-up efforts and a Supreme Court pollution-control decision. Due to poor execution and little industrial penetration, eastern India contributes the least to water treatment.

India Water Treatment Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their Type lines, which will help the Water Treatment Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new Type launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the Water Treatment industry must offer cost-effective items.

Major players in the Water Treatment Market are attempting to increase market demand by investing in research and development operations, including Ecolab Inc., Veolia Group, Evoqua Water Technologies LLC, Aquatech International Corporation, Calgon Carbon Corporation, Toshiba Water Solutions Private Limited, VA Tech Wabag.

Key Companies in the Water Treatment Market include

India Water Treatment Industry Developments

In November 2022, WABAG LTD inked an agreement with the Asian Development Bank (ADB) to fund INR 200 crores (USD 24.6 million) through unlisted Non-Convertible Debentures with tenors of five years and three months. ADB will subscribe to it for its water treatment business for a 12-month period.

In August 2022, Huliot Pipes, an Israeli firm, created the ClearBlack Sewage Treatment Plant, which is designed for the Indian market to recover and reuse wastewater.

India Water Treatment Market Segmentation

Water Treatment Equipment Outlook

-

Membrane Separation

-

Biological

-

Disinfection

-

Sludge Treatment

Water Treatment Process Outlook

-

Primary Treatment

-

Secondary Treatment

-

Tertiary Treatment

Water Treatment Application Outlook

| Report Attribute/Metric |

Details |

| Market Size 2022 |

USD 1.7 Billion |

| Market Size 2023 |

USD 1.8 Billion |

| Market Size 2032 |

USD 4.2 Billion |

| Compound Annual Growth Rate (CAGR) |

10.60% (2024-2032) |

| Base Year |

2023 |

| Market Forecast Period |

2024-2032 |

| Historical Data |

2019-2022 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Form, Technology, Application, and Region |

| Countries Covered |

India |

| Key Companies Profiled |

Ecolab Inc., Veolia Group, Evoqua Water Technologies LLC, Aquatech International Corporation, Calgon Carbon Corporation, Toshiba Water Solutions Private Limited, VA Tech Wabag. |

| Key Market Opportunities |

Advancements in water treatment technologies Government initiatives promoting clean water and sustainability |

| Key Market Dynamics |

Growing population demand |

Frequently Asked Questions (FAQ) :

The India Water Treatment Market size was valued at USD 1.8 Billion in 2023.

The market is projected to grow at a CAGR of 10.60% during the forecast period, 2024-2032.

The key players in the market are Ecolab Inc., Veolia Group, Evoqua Water Technologies LLC, Aquatech International Corporation, and others.

The membrane separation category dominated the market in 2023.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review