India Manufacturing Sector Market Overview

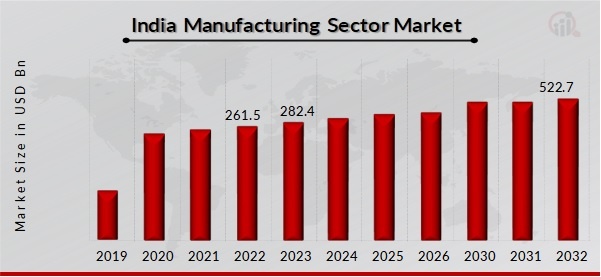

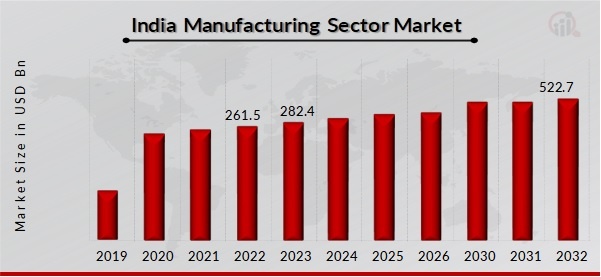

India's Manufacturing Sector Market Size was valued at USD 261.5 Billion in 2022. The Manufacturing Sector market industry is projected to grow from USD 282.4 Billion in 2023 to USD 522.7 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 8.00% during the forecast period (2024 - 2032). The 'Make in India' initiative is a government-driven campaign designed to promote domestic manufacturing. Furthermore, through policy reforms and incentives, comprising the Production Linked Incentive (PLI) scheme, the government has pro-actively incentivized various manufacturing industries, such as automobiles, electronics, and textiles. These are the main market drivers anticipated to propel the Manufacturing Sector market in India.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

India Manufacturing Sector Market Trends

- Growing government spending and the large and growing population, coupled with a rising middle class, are driving the market growth

Manufacturing has emerged as a key growth sector in India, with Prime Minister Narendra Modi launching the 'Make in India' program to position the country as a global manufacturing hub and enhance its economic standing worldwide. The government of India has implemented various initiatives to foster a conducive environment for the expansion of the manufacturing sector, which is driving the market CAGR. In the Union Budget 2022-23, Rs. 2,403 crores (USD 315 million) were allocated for promoting electronics and IT hardware manufacturing, while a substantial Rs. 760 billion (USD 9.71 billion) was earmarked for the Production Linked Incentive (PLI) scheme aimed at semiconductor manufacturing, to position India as a major global producer in this crucial area. The PLI scheme, spanning 13 sectors including electronics, pharmaceuticals, and textiles, has catalyzed investment and is anticipated to yield a production value of Rs. 14.3 lakh crore over the next five years, underscoring the government's commitment to fostering a conducive manufacturing environment, a commitment likely to persist in the future.

India's vast and expanding population, alongside a burgeoning middle class, is poised to create a favorable demand landscape for the manufacturing sector. According to the United Nations projections, India's population is expected to reach 1.5 billion by 2030, with the middle-class segment projected to swell from 600 million in 2020 to 1.3 billion by 2030. This substantial increase in the middle-class demographic is anticipated to drive demand for manufactured goods, further enhancing the growth prospects of the manufacturing industry. Therefore, the market is expanding due to the Growing Government Spending and the large and growing population, coupled with a rising middle class. Thus, driving the India Manufacturing Sector market revenue.

Manufacturing Sector Market Segment Insights

-

Manufacturing Sector Ownership Insights

The India Manufacturing Sector market segmentation, based on Ownership, includes Public Sector, Private Sector, Joint Sector, and Cooperative Sector. The public sector segment dominated the market mostly. The government's emphasis on infrastructure development has created a favorable environment for the expansion of the public sector manufacturing segment. Investments in critical areas such as roads, railways, ports, and power have stimulated demand for products manufactured by the public sector. In an effort to enhance rail connectivity and facilitate commuter travel, the Union Cabinet sanctioned seven projects for the Ministry of Railways in August 2023, totaling approximately Rs. 32,500 crore (US$ 3.93 billion). These projects, spanning 35 districts across nine states including Uttar Pradesh, Bihar, Telangana, Andhra Pradesh, Maharashtra, Gujarat, Odisha, Jharkhand, and West Bengal, will extend the existing railway network by 2,339 kilometers. In the fiscal year 2022-23, the North Western Railway recorded the highest growth in freight earnings, amounting to Rs. 6,839.93 crore (US$ 832.39 million), marking a 30.82% increase compared to the previous year's earnings of Rs. 5,228.13 crore (US$ 636.3 million). Additionally, freight loading surged to 32.69 million tonnes, representing a 10.07% rise from the previous year's loading of 29.70 million tonnes.

Manufacturing Sector Raw Materials Used Insights

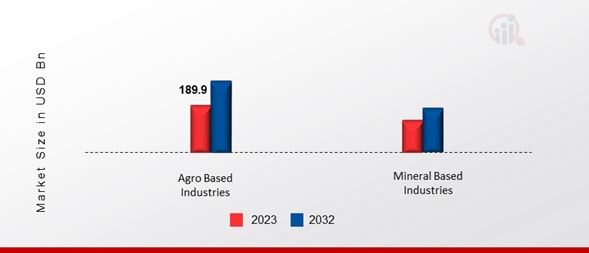

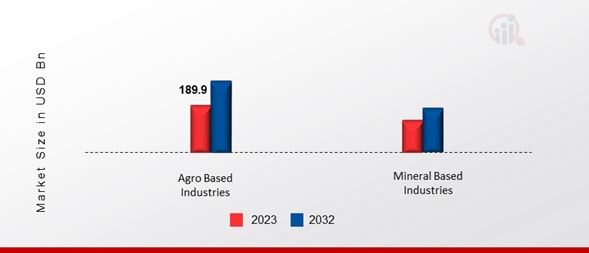

The India Manufacturing Sector market segmentation, based on Raw Materials Used, includes Agro Based Industries and Mineral Based Industries. The agro-based industries generated the most income. India's diverse agro-climatic conditions enable the cultivation of a wide range of crops, forming a robust foundation for the growth of agro-based industries that utilize agricultural produce as raw materials for various products. According to Inc42, the Indian agricultural sector is projected to reach US$ 24 billion by 2025. The Agriculture and Allied industry sector has witnessed significant developments, investments, and government support in recent years. Between April 2000 and September 2023, Foreign Direct Investment (FDI) in agriculture services amounted to US$ 4.77 billion. The Indian food processing industry, as per the Department for Promotion of Industry and Internal Trade (DPIIT), has cumulatively attracted an FDI equity inflow of approximately US$ 12.35 billion between April 2000 and September 2023, accounting for 1.89% of total FDI inflows across industries. In December 2023, NBCC signed a Memorandum of Understanding (MoU) with the National Cooperative Development Cooperation (NCDC) and NABARD for the construction of the world's largest grain storage plan in the cooperative sector, consisting of 1,469 grain storage units.

Figure 1: India Manufacturing Sector Market, by Raw Materials Used, 2023 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Manufacturing Sector End-user Industries Insights

The India Manufacturing Sector market segmentation, based on End-user Industries, includes Automotive, Manufacturing, Textile and Apparel, Consumer Electronics, Construction, Food and Beverages, and Other End-user Industries. The automotive category generated the most income. In India, in November 2023, the combined production of passenger vehicles, three-wheelers, two-wheelers, and quadricycles amounted to 2.22 million units. From April to November 2023-24, the total production of passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles reached 15.56 million units, positioning India as one of the leading countries globally in terms of vehicle manufacturing. The electric vehicle (EV) market in India is forecasted to achieve a valuation of Rs. 50,000 crore (US$ 7.09 billion) by 2025, with a study by CEEW Centre for Energy Finance identifying a US$ 206 billion opportunity for electric vehicles in India by 2030. To realize this potential, an investment of US$ 180 billion in vehicle manufacturing and charging infrastructure will be required. The Production Linked Incentive (PLI) scheme, with an outlay of USD 3.5 billion for the automobile sector, proposes financial incentives of up to 18% to stimulate domestic manufacturing of advanced automotive technology products and attract investments across the automotive manufacturing value chain.

Manufacturing Sector Country Insights

The demand for skilled labor is anticipated to fuel the growth of India's manufacturing industry. The government's Skill India Mission aims to upskill 400 million individuals by 2022, with 8.7 million people trained under this initiative as of March 2022. By focusing on upskilling the workforce to meet the requirements of Industry 4.0, the manufacturing sector can ensure access to the skilled labor necessary for its expansion. The adoption of Industry 4.0 technologies is projected to accelerate, with a focus on enhancing efficiency and reducing costs. As per projections from the Civil Aviation Ministry, the Indian drone industry is expected to generate a turnover ranging from INR 120-150 billion by 2026. Over the next three years, the government aims to secure investments totaling INR 5,000 crore in the drone manufacturing sector, aiming to create more than 10,000 job opportunities. The government's National Policy on Advanced Manufacturing aims to promote the utilization of advanced technologies in manufacturing, further driving the adoption of Industry 4.0 technologies. Indian manufacturing is shifting towards digitalization, with an estimated expenditure of $5.5 - $6.5 billion on Industry 4.0 in FY21. Approximately 50% of this expenditure is allocated to foundational technologies such as Cloud and IoT. Additionally, 35 - 40% of companies are at the Proof of Concept (PoC) stage and will require a rapid transition from PoC to production.

Manufacturing Sector Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help the Manufacturing Sector market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the Manufacturing Sector industry must offer cost-effective items.

Major players in the Manufacturing Sector market are attempting to increase market demand by investing in research and development operations, including Tata Motors Ltd, Mahindra & Mahindra Limited, Ashok Leyland, Hindustan Unilever Limited, Godrej Group, Maruti Suzuki Limited, Tata Steel Limited, Larsen & Toubro Limited, Apollo Tyres, Moser Baer.

Key Companies in the Manufacturing Sector market include

- Tata Motors Ltd

- Mahindra & Mahindra Limited

- Ashok Leyland

- Hindustan Unilever Limited

- Godrej group

- Maruti Suzuki Limited

- Tata Steel Limited

- Larsen & Toubro Limited

- Apollo Tyres

- Moser Baer

India Manufacturing Sector Industry Developments

January 2023: Sundram Fasteners, an auto component manufacturer, secured its largest-ever EV contract in its six-decade history. The Chennai-based company clinched a USD 250 million deal from a prominent global automobile manufacturer to supply sub-assemblies for its electric vehicle (EV) platform. Sundram Fasteners anticipates reaching an annual sales peak of USD 52 million by 2026, with a supply of 1.5 million drive unit sub-assemblies per annum.

January 2023: Tata Motors, a multinational automotive manufacturing company based in India, disclosed plans to potentially establish plants in India and Europe for manufacturing battery cells dedicated to electric vehicles (EVs). The Chief Financial Officer of Tata Motors' auto unit revealed this information in an interview with Reuters. Tata Motors, which has sold a total of 50,000 electric cars thus far, dominates India's EV market and aims to introduce 10 electric models by March 2026.

India Manufacturing Sector Market Segmentation

Manufacturing Sector Ownership Outlook

- Public Sector

- Private Sector

- Joint Sector

- Cooperative Sector

Manufacturing Sector Raw Materials Used Outlook

- Agro Based Industries

- Mineral Based Industries

Manufacturing Sector End-User Industries Outlook

- Automotive

- Manufacturing

- Textile and Apparel

- Consumer Electronics

- Construction

- Food and Beverages

- Other End-use Industries

| Report Attribute/Metric |

Details |

| Market Size 2022 |

USD 261.5 Billion |

| Market Size 2023 |

USD 282.4 Billion |

| Market Size 2032 |

USD 522.7 Billion |

| Compound Annual Growth Rate (CAGR) |

8.00% (2024-2032) |

| Base Year |

2023 |

| Market Forecast Period |

2024-2032 |

| Historical Data |

2019-2022 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Ownership, Raw Materials Used, End-User Industries, and Region |

| Countries Covered |

India |

| Key Companies Profiled |

Tata Motors Ltd, Mahindra & Mahindra Limited, Ashok Leyland, Hindustan Unilever Limited, Godrej Group, Maruti Suzuki Limited, Tata Steel Limited, Larsen & Toubro Limited, Apollo Tyres, Moser Baer |

| Key Market Opportunities |

· The adoption of Industry 4.0 technologies |

| Key Market Dynamics |

· Rising income levels, urbanization, and increased consumer spending |

Frequently Asked Questions (FAQ) :

The India Manufacturing Sector market size was valued at USD 282.4 Billion in 2023.

The market is projected to grow at a CAGR of 8.00% during the forecast period, 2024-2032.

The key players in the market are Tata Motors Ltd, Mahindra & Mahindra Limited, Ashok Leyland, Hindustan Unilever Limited, Godrej Group, Maruti Suzuki Limited, Tata Steel Limited, Larsen & Toubro Limited, Apollo Tyres, Moser Baer.

The Public Sector category dominated the market in 2023.

The Automotive segment had the largest share of the market.