India Automotive Wiring Harness Market Overview

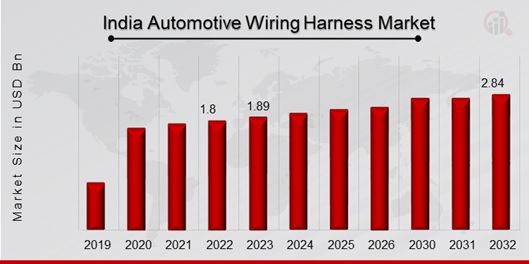

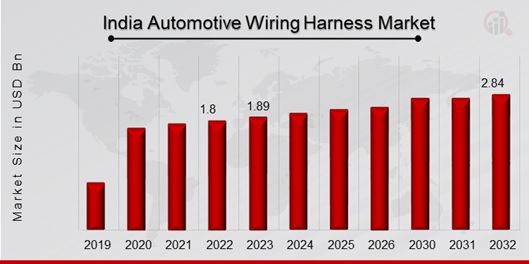

India Automotive Wiring Harness Market Size was valued at USD 1.8 Billion in 2022. The Automotive Wiring Harness market industry is projected to grow from USD 1.89 Billion in 2023 to USD 2.84 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 5.20% during the forecast period (2024 - 2032). The growing demand for electric vehicles, intricate wiring systems, and the increasing integration of advanced safety and connectivity features are the main market drivers anticipated to propel the Automotive Wiring Harness market in India.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

India Automotive Wiring Harness Market Trends

-

Electrification of vehicles is driving the market growth

The accelerating shift towards vehicle electrification is shaping the market. The global automotive industry is undergoing a profound transformation with the increasing adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs). As governments worldwide implement stringent emission norms and promote sustainable transportation solutions, automakers are compelled to invest heavily in electric mobility. This paradigm shift necessitates a fundamental reconfiguration of vehicle architecture, with a primary focus on powertrain electrification. Consequently, the demand for intricate and specialized wiring harnesses has surged. Traditional internal combustion engine (ICE) vehicles have a relatively simpler electrical architecture compared to electric and hybrid vehicles. In EVs, a complex network of wiring is required to connect and manage various components such as batteries, electric motors, inverters, and charging systems. The wiring harness plays a crucial role in ensuring seamless communication and power distribution within the electric vehicle. This has led to a significant increase in the complexity and sophistication of wiring systems, driving the market for advanced automotive wiring harnesses. Moreover, the rising consumer interest in electric vehicles, coupled with favorable government incentives, further propels the trend. As automakers race to develop and launch a diverse range of electric models, the demand for high-performance wiring solutions continues to rise. Manufacturers in the automotive wiring harness market are innovating to meet these evolving requirements, developing harnesses that can handle high voltage, ensure efficient energy transmission, and withstand the unique challenges posed by electric propulsion systems.

Another key trend influencing the automotive wiring harness market is the increasing integration of advanced safety and connectivity features in modern vehicles. The automotive industry is experiencing a technological renaissance, with vehicles becoming more intelligent, connected, and equipped with a plethora of safety features. This trend is driven by the growing consumer demand for enhanced driving experiences, improved safety, and seamless connectivity. Advanced driver assistance systems (ADAS), infotainment systems, telematics, and connectivity solutions are becoming standard features in many vehicles. These features rely heavily on sophisticated electronic components and sensors that require seamless integration through intricate wiring systems. The wiring harness acts as the central nervous system, facilitating communication between various vehicle components and ensuring the reliable operation of these advanced features. For instance, ADAS technologies such as lane departure warning, adaptive cruise control, and automatic emergency braking involve a network of sensors and actuators that must communicate in real-time. The wiring harness plays a critical role in linking these components, enabling quick and accurate data transfer. Similarly, the demand for advanced infotainment and connectivity features requires robust wiring solutions to support the increasing complexity of in-vehicle electronics.

India Automotive Wiring Harness Market Segment Insights

-

Automotive Wiring Harness ICE, By Application Insights

The India Automotive Wiring Harness market segmentation, based on ICE, By Application, includes Engine harness, Battery harness, Seat harness, Sunroof harness, Door harness, Chassis wiring harness, Body & lighting harness, HVAC harness, and Dashboard/ cabin harness. The dominating segment in the automotive wiring harness market is the Engine Harness category. The engine harness is a critical component in ICE vehicles, connecting various sensors, actuators, and the engine control unit (ECU). It carries signals and power essential for the proper functioning of the internal combustion engine. Given the central role of the engine in traditional vehicles, the engine harness holds paramount importance, making it a dominating segment in ICE vehicles.

-

Automotive Wiring Harness EV, By Application Insights

The India Automotive Wiring Harness market segmentation, based on EV, By Application, includes Traction harness, Engine harness, Dashboard/ cabin harness, Battery harness, Seat harness, Sunroof harness, Door harness, Chassis wiring harness, Body & lighting harness, and HVAC harness. The dominating EV Application in the automotive wiring harness market is the Traction Harness category. This is due to its role in connecting the electric motor to the power source (battery) and controlling the power distribution for propulsion. As the primary component responsible for the vehicle's movement, the traction harness plays a pivotal role in EV functionality. With the focus on electrification, the traction harness has become a dominating segment in electric vehicles.

-

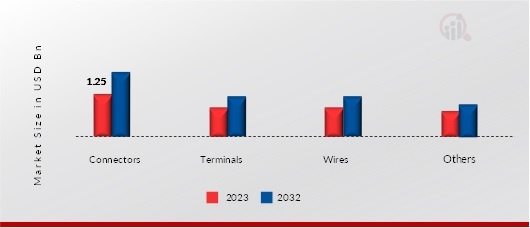

Automotive Wiring Harness Components Insights

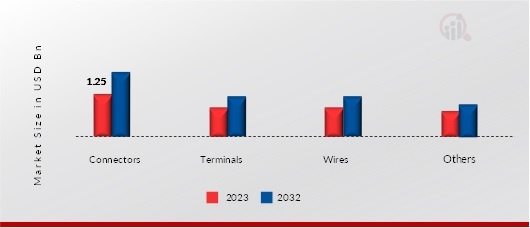

The India Automotive Wiring Harness market segmentation is based on components that include connectors, terminals, wires, and others. The dominating component in the automotive wiring harness market is the connectors category. Connectors are fundamental to the functionality of wiring harnesses as they facilitate the connection and disconnection of various components in the vehicle's electrical system. The reliability, durability, and efficiency of connectors significantly impact the overall performance of the wiring harness. As vehicles become more complex and technologically advanced, the demand for high-quality connectors is on the rise, making it the dominating segment in the component category.

Figure 1: India Automotive Wiring Harness Market, by Component, 2023 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Automotive Wiring Harness Material Type Insights

The India Automotive Wiring Harness market segmentation, based on Material Type, includes Metallic (Copper, Aluminum, Other Materials) and Optical Fiber (Plastic Optical Fiber, Glass Optical Fiber). The dominating material type in the automotive wiring harness market is the Metallic category. Metallic materials, such as copper and aluminum, are traditionally used in wiring harnesses due to their excellent conductivity and durability. These materials ensure efficient electrical transmission and can withstand the harsh automotive environment. While optical fiber is gaining attention for its data transmission capabilities, metallic materials remain dominant in the majority of automotive wiring harness applications.

Automotive Wiring Harness Transmission Type Insights

The India Automotive Wiring Harness market segmentation, based on Transmission Type, includes electrical wiring and data transmission. The dominating transmission type in the automotive wiring harness market is the electrical wiring category. Electrical wiring is the conventional and primary means of transmitting power and signals in automotive applications. It is well-established, reliable, and proven over decades of automotive engineering. While data transmission is crucial for modern vehicles, the foundational power and signal transmission within a vehicle is predominantly handled by electrical wiring, making it the dominating segment in transmission types.

Automotive Wiring Harness High Voltage Wiring Harness Insights

The India Automotive Wiring Harness market segmentation, based on High Voltage Wiring Harness, includes Battery and battery management system and Motor management harness. The dominating segment in the automotive wiring harness market is the Battery and Battery Management System category. The high-voltage wiring harness for the battery and battery management system is a critical component in electric vehicles. It ensures the safe and efficient transmission of high-voltage power between the battery and the various vehicle systems. As the battery is a central and complex component in EVs, the wiring harness associated with its management and power distribution becomes the dominating segment in the high voltage category.

Automotive Wiring Harness Country Insights

The automotive wiring harness market is experiencing substantial growth in India due to several interconnected factors. Firstly, the rapid expansion of the Indian automotive industry, fueled by a burgeoning middle class and increasing disposable income, has led to a surge in demand for vehicles. As automakers introduce more advanced features and technologies in their vehicles to cater to evolving consumer preferences, the complexity and sophistication of wiring harnesses have increased. Additionally, the Indian government's emphasis on promoting electric mobility to address environmental concerns and reduce dependence on conventional fuels has accelerated the adoption of electric vehicles (EVs). This shift towards electrification requires a significant overhaul of vehicle architecture, driving up the demand for specialized wiring harnesses designed for electric powertrains.

Furthermore, the integration of advanced safety and connectivity features in vehicles to enhance the overall driving experience has become a key trend in the Indian automotive market. This trend necessitates the deployment of intricate wiring systems, contributing to the overall growth of the automotive wiring harness market in the region. The convergence of these factors positions India as a dynamic and expanding market for automotive wiring harnesses.

India Automotive Wiring Harness Key Market Players & Competitive Insights

Leading market players are actively investing in research and development to introduce technologically advanced solutions. This includes the development of high-performance wiring harnesses capable of handling the increasing complexity of vehicle electronics, as well as innovations in materials and manufacturing processes. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new Engine Type launches, contractual agreements, mergers and acquisitions, diversification of product portfolio, cost competitiveness, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Automotive Wiring Harness industry must offer cost-effective items.

Major players in the Automotive Wiring Harness market are attempting to increase market demand by investing in research and development operations, including Yazaki Corporation, Sumitomo Electric Industries, Aptiv PLC, Furukawa Electric, and Leoni AG.

Key Companies in the India Automotive Wiring Harness market include

India Automotive Wiring Harness Industry Developments

May 2023: Sumitomo Electric, in collaboration with the National Institute of Information and Communications Technology (NICT), has achieved a groundbreaking milestone by developing the world's first 19-core optical fiber with a standardized outer diameter. This achievement has set a new global record for transmission capacity, enabling the fiber to transmit an impressive 1.6 terabits per second (Tbps) over a distance of 10,000 kilometers. This capacity is twice that of the previous record holder. The successful development of this advanced optical fiber marks a significant breakthrough in long-distance optical communication and holds immense potential for applications in upcoming 5G and beyond 5G networks.

June 2022: Furukawa Electric has successfully secured contracts with eight major automakers to incorporate its aluminum wire harnesses into a hundred vehicle models by 2025, with a primary focus on European automakers. This strategic move aligns with the company's commitment to address the evolving automotive landscape, particularly the global acceleration towards electric vehicles (EVs). Furukawa Electric aims to continue its dedication to the development of aluminum harnesses, emphasizing weight reduction as a crucial factor amid the increasing prevalence of EVs worldwide.

India Automotive Wiring Harness Market Segmentation

Automotive Wiring Harness ICE, By Application Outlook

- Engine harness

- Battery harness

- Seat harness

- Sunroof harness

- Door harness

- Chassis wiring harness

- Body & lighting harness

- HVAC harness

- Dashboard/ cabin harness

Automotive Wiring Harness EV, By Application Outlook

- Traction harness

- Engine harness

- Dashboard/ cabin harness

- Battery harness

- Seat harness

- Sunroof harness

- Door harness

- Chassis wiring harness

- Body & lighting harness

- HVAC harness

Automotive Wiring Harness Component Outlook

- Connectors

- Terminals

- Wires

- Others

Automotive Wiring Harness Transmission Type Outlook

- Electrical wiring

- Data transmission

Automotive Wiring Harness High Voltage Wiring Harness Outlook

- Battery and battery management system

- Motor management harness

| Report Attribute/Metric |

Details |

| Market Size 2022 |

USD 1.8 Billion |

| Market Size 2023 |

USD 1.89 Billion |

| Market Size 2032 |

USD 2.84 Billion |

| Compound Annual Growth Rate (CAGR) |

5.20% (2024-2032) |

| Base Year |

2023 |

| Market Forecast Period |

2024-2032 |

| Historical Data |

2019- 2022 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

ICE By Application, EV By Application, Component, Material Type, Transmission Type, High Voltage Wiring Harness, and Region |

| Countries Covered |

India |

| Key Companies Profiled |

Yazaki Corporation, Sumitomo Electric Industries, Aptiv PLC, Furukawa Electric, and Leoni AG |

| Key Market Opportunities |

· With the Indian automotive sector gaining recognition for its manufacturing capabilities, there is a significant opportunity for companies in the automotive wiring harness market to explore export markets. · The ongoing advancements in automotive technology present an opportunity for companies in the Indian automotive wiring harness market to invest in research and development. |

| Key Market Dynamics |

· The increasing production of automobiles in India is driven by the growing middle-class population, rising disposable incomes, and government initiatives. · The Indian government's push towards electric mobility and the increasing awareness of environmental sustainability are propelling the country's adoption of electric vehicles. |

Frequently Asked Questions (FAQ) :

The India Automotive Wiring Harness market size was valued at USD 1.89 Billion in 2023.

The market is projected to grow at a CAGR of 5.20% during the forecast period, 2024-2032.

The key players in the market are Yazaki Corporation, Sumitomo Electric Industries, Aptiv PLC, Furukawa Electric, and Leoni AG, among others.

The connectors category dominated the market in 2023.

The Metallic category dominated the market in 2023.