FPGA in Telecom Sector Market Overview

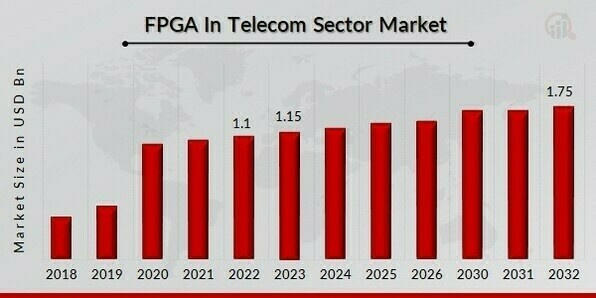

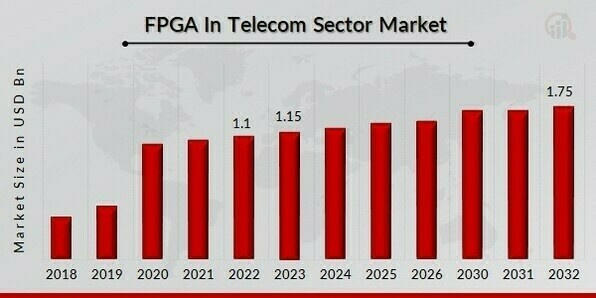

FPGA in Telecom Sector Market Size was valued at USD 1.1 Billion in 2022. The FPGA in Telecom Sector market industry is projected to grow from USD 1.15 Billion in 2023 to USD 1.75 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 5.30% during the forecast period (2023 - 2032). Network function virtualization (NFV), customization and upgradeability, security and encryption, and data center acceleration, are the key market drivers enhancing the market growth.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

FPGA in Telecom Sector Market Trends

Ability to offer solutions that are both adaptable and high-performing is driving the market growth

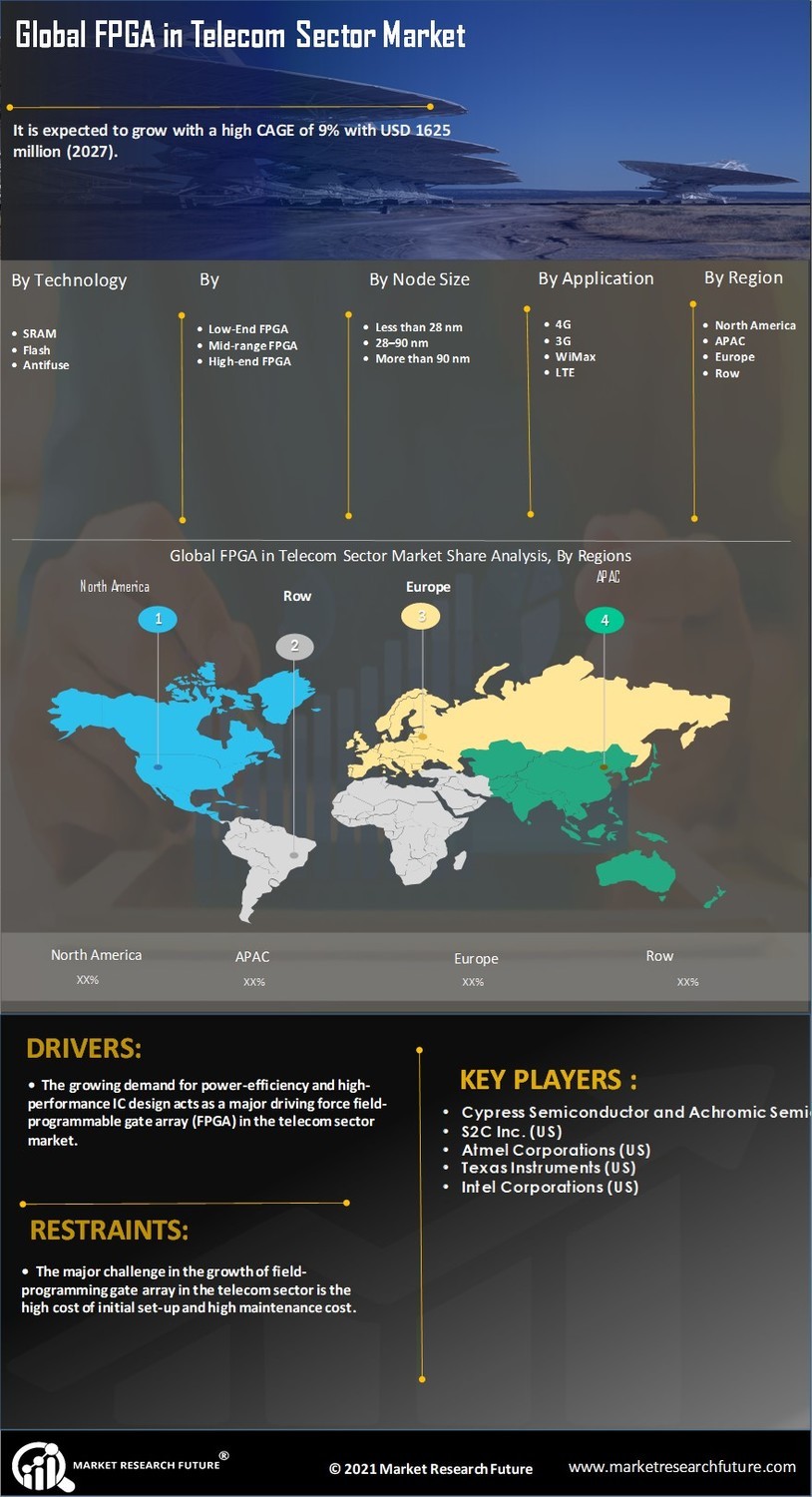

In recent years, the use of field-programmable gate arrays (FPGAs) in the telecom industry has grown and changed significantly. In order to meet the intricate requirements of the telecommunications industry, FPGAs provide a flexible and highly programmable hardware solution. This market analysis will provide light on the state of FPGA usage in the telecom industry today. The rollout of 5G networks is one of the main factors encouraging the use of FPGAs in the telecom industry. There is a requirement for higher speeds, extremely low latency, and enhanced network capacity with the introduction of 5G technology. Telecom companies can use FPGAs to develop cutting-edge features like dynamic spectrum sharing, huge MIMO, and beamforming. These programmable gadgets offer the adaptability and processing power necessary to satisfy the rigorous performance standards of 5G networks. In the telecom industry, data centres are also quite important, and FPGAs are being used more and more to speed up data centre workloads. FPGAs can be used to offload tasks like data compression, encryption/decryption, network packet processing, and real-time analytics, which improves performance and uses less power. FPGAs are a great option for boosting data centre operations because of their programmability and capacity for parallel processing. Network Function Virtualization (NFV), where conventional network functions are virtualized and operate on general-purpose hardware, is another significant trend in the telecom industry. FPGAs are a desirable option for NFV installations because they can be reprogrammed to effectively carry out a variety of network operations. With more scalability and cost effectiveness in their networks, telecom operators are able to do so thanks to this flexibility.

With the growth of IoT devices and the demand for low-latency processing, edge computing has become more popular. Because they can handle real-time data processing, sensor integration, and local analytics, FPGAs are a good fit for edge computing environments. Telecom firms can reduce the amount of data that must be sent to centralised systems, resulting in quicker response times and increased productivity. In the telecom industry, security is a high priority, and FPGAs provide hardware-level security capabilities. Secure key storage, data encryption, and secure boot are some of these characteristics. When it comes to protecting sensitive information, securing communication channels, and reducing security risks like DDoS assaults, FPGAs offer strong security capabilities. In the telecom industry, FPGAs have a number of advantages, including customization and upgradeability. FPGA solutions can be tailored by telecom firms to match their unique needs and change with the needs of the network. Remote programming and upgrade capabilities of FPGAs allow operators to launch new services, adopt developing standards, and increase the useful life of existing hardware investments. Thus, driving the FPGA in Telecom Sector market revenue.

FPGA in Telecom Sector Market Segment Insights

FPGA in Telecom Sector Technology Insights

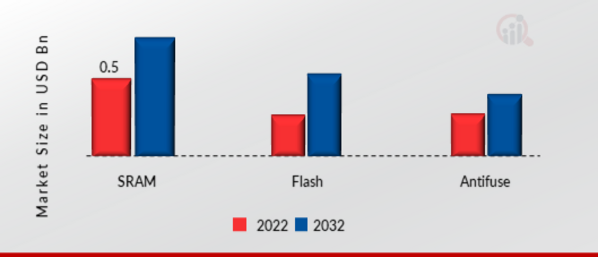

The FPGA in Telecom Sector market segmentation, based on technology includes SRAM, flash, antifuse. The SRAM segment dominated the market, accounting for 43.52% of market revenue. SRAM's capacity to handle complicated jobs, high performance, and flexibility are well suited to the changing demands of the telecom industry.

Figure 1: FPGA in Telecom Sector Market, by Technology, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

FPGA in Telecom Sector Configuration Insights

The FPGA in Telecom Sector market segmentation, based on configuration, includes low-end FPGA, mid-range FPGA, high-end FPGA. The mid-range FPGA segment dominated the market, accounting for 47.65% of market revenue. Mid-range FPGAs are ideally suited for a variety of telecom applications because they find a compromise between price and performance.

FPGA in Telecom Sector Node size Insights

The FPGA in Telecom Sector market segmentation, based on node size, includes less than 28 nm, 28–90 nm, more than 90 nm. The Less than 28 nm segment dominated the market, accounting for 51.25% of market revenue. Compared to bigger node sizes, nodes less than 28 nm provide advantages including higher performance and lower power consumption. As more transistors can be crammed into a smaller space because to these lower nodes, logic capacity and operating frequencies are enhanced.

FPGA in Telecom Sector Application Insights

The FPGA in Telecom Sector market segmentation, based on application, includes 4G, 3G, WiMax and LTE. The 4G segment dominated the market, accounting for 52.46% of market revenue. High-speed data transfer, effective signal processing, and overall LTE network performance are all made possible by the infrastructure that 4G provides.

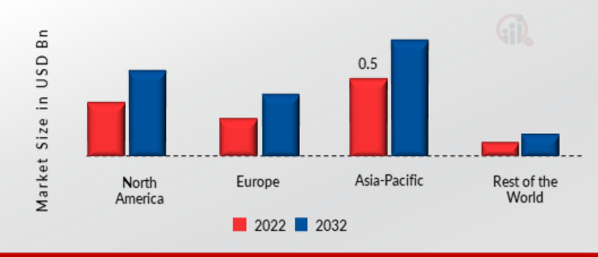

FPGA in Telecom Sector Regional Insights

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. The Asia-Pacific FPGA in Telecom Sector Market dominated this market in 2022 (45.80%). The need for FPGAs in base stations, optical networking, edge computing, and other telecom applications has increased as a result of the region's concentration on 5G network installations and improvements in mobile communication technology. Further, China’s FPGA in Telecom Sector market held the largest market share, and the Indian FPGA in Telecom Sector market was the fastest growing market in the Asia-Pacific region.

Figure 2: FPGA IN TELECOM SECTOR MARKET SHARE BY REGION 2022 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

North America FPGA in Telecom Sector market accounts for the second-largest market share. This is due to the presence of top telecom businesses, an established telecom infrastructure, and a keen interest in technical advancements. Further, the U.S. FPGA in Telecom Sector market held the largest market share, and the Canada Armor Materials market was the fastest growing market in the North America region.

Further, the major countries studied in the market report are The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

The Europe FPGA in Telecom Sector Market is expected to grow at the fastest CAGR from 2023 to 2032. The need for FPGAs in base stations, network infrastructure, and data centres has increased as a result of the region's focus on cutting-edge communication technologies like 5G and network virtualization. Moreover, , the German FPGA in Telecom Sector market held the largest market share, and the UK FPGA in Telecom Sector market was the fastest growing market in the European region.

FPGA in Telecom Sector Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the FPGA in Telecom Sector market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, FPGA in Telecom Sector industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the FPGA in Telecom Sector industry to benefit clients and increase the market sector. In recent years, the FPGA in Telecom Sector industry has offered some of the most significant advantages to medicine. Major players in the FPGA in Telecom Sector market, including Cypress Semiconductor and Achromic Semiconductor Corporation (US), S2C Inc. (US), Atmel Corporations (US),Texas Instruments (US) Intel Corporations (US) and others, are attempting to increase market demand by investing in research and development operations.

Cypress Semiconductor, a US-based semiconductor company, has made significant contributions to the FPGA market in the telecom sector. A variety of programmable system-on-chip (PSoC) solutions are available from Cypress that combine FPGA fabric with microcontrollers and other parts. Their solutions for telecom applications, such as baseband processing, wireless infrastructure, and network hardware, are adaptable and effective. The FPGAs made by Cypress Semiconductor are renowned for their excellent performance capabilities, low power requirements, and simplicity of integration. Cypress has made a name for itself as a trustworthy supplier of FPGA solutions for the telecom industry thanks to their significant experience in the semiconductor industry. Another company competing in the FPGA market that focuses on telecom applications is Achromic Semiconductor Corporation, which is likewise situated in the US. The design and development of FPGA solutions specifically suited for telecom infrastructure, including 4G and 5G networks, is a specialty of Achromic Semiconductor. In the telecom industry, high-speed data processing, low latency, and sophisticated signal processing are demanding requirements that their FPGAs are made to satisfy.

Texas Instruments (TI), a renowned US-based semiconductor company, has a significant presence in the FPGA market within the telecom sector. FPGAs are just one of the many programmable logic products that TI provides to meet the stringent demands of telecom applications. Their FPGAs are made to take care of the requirements for flexible telecom infrastructure, low latency, and high-speed data processing. The advanced features found in TI's FPGAs, such as embedded processors, high-speed transceivers, and DSP blocks, allow for effective protocol handling and signal processing. Base stations, wireless access points, routers, switches, and other telecom equipment all frequently use these solutions. The FPGA products offered by TI strike a compromise between usability, power efficiency, and performance, making them appropriate for a range of telecom applications. Texas Instruments continues to be a dependable supplier of FPGA solutions that support the development and effectiveness of telecom networks ly because to their significant knowledge and presence.

Key Companies in the FPGA in Telecom Sector market include

-

Cypress Semiconductor and Achromic Semiconductor Corporation (US)

-

-

Atmel Corporations (US)

-

-

FPGA in Telecom Sector Industry Developments

August 2020: By developing a flexible radio platform, Intel Corporation and Analogue Devices addressed the difficulties and limitations with the 5G network. The platform offers new tools for optimisation by utilising cutting-edge technology and Intel's FPGA. Using FPGA technology, network problems can be effectively fixed.

FPGA in Telecom Sector Market Segmentation

FPGA in Telecom Sector Technology Outlook

FPGA in Telecom Sector Configuration Outlook

-

Low-End FPGA

-

Mid-range FPGA

-

High-end FPGA

FPGA in Telecom Sector node size Outlook

-

Less than 28 nm

-

28–90 nm

-

More than 90 nm

FPGA in Telecom Sector Application Outlook

FPGA in Telecom Sector Regional Outlook

o U.S.

o Canada

o Germany

o France

o UK

o Italy

o Spain

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America

| Report Attribute/Metric |

Details |

| Market Size 2022 |

USD 1.1 Billion |

| Market Size 2023 |

USD 1.15 Billion |

| Market Size 2032 |

USD 1.75 Billion |

| Compound Annual Growth Rate (CAGR) |

5.30% (2023-2032) |

| Base Year |

2022 |

| Market Forecast Period |

2023-2032 |

| Historical Data |

2018- 2022 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Technology, Configuration, node size, Application, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered |

The U.S., Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Cypress Semiconductor and Achromic Semiconductor Corporation (US), S2C Inc. (US), Atmel Corporations (US),Texas Instruments (US) Intel Corporations (US) |

| Key Market Opportunities |

Network modernization, network upgrades, and network function virtualization |

| Key Market Dynamics |

Rising Data and Bandwidth Demand, Technological Advances, and Standards Evolution |

Frequently Asked Questions (FAQ) :

The FPGA in Telecom Sector market size was valued at USD 1.1 Billion in 2022.

The market is projected to grow at a CAGR of 5.30% during the forecast period, 2023-2032.

Asia-Pacific had the largest share in the market

The key players in the market are Cypress Semiconductor and Achromic Semiconductor Corporation (US), S2C Inc. (US), Atmel Corporations (US),Texas Instruments (US) Intel Corporations (US).

The SRAM category dominated the market in 2022.

The Mid-range FPGA had the largest share in the market.