Global Blood Culture Test Market Overview

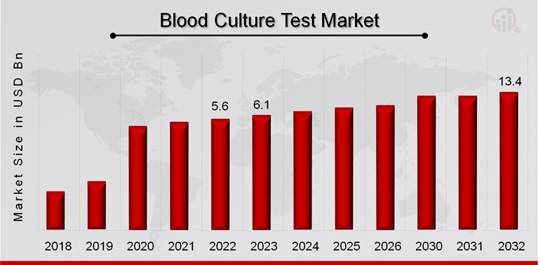

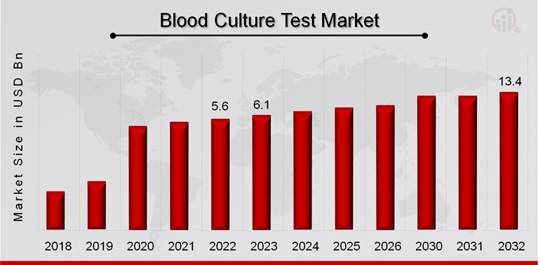

Blood Culture Test Market Size was valued at USD 5.6 Billion in 2022. The Blood Culture Test market industry is projected to grow from USD 6.1 Billion in 2023 to USD 13.4 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 10.20% during the forecast period (2024 - 2032). Increased prevalence of bloodstream infections and growing awareness and initiatives for infection control are the key market drivers enhancing the market growth.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Blood Culture Test Market Trends

- Technological advancements in Blood Culture Testing are driving the market growth.

The Blood Culture Test market showcases a significant focus on technological advancements. Continuous innovation in Blood Culture Testing methods, including the incorporation of advanced automation, molecular techniques, and rapid diagnostic technologies, has enhanced the efficiency and accuracy of detecting infectious agents in blood samples. These advancements not only contribute to faster and more reliable results but also support healthcare professionals in making informed decisions regarding patient treatment plans, leading to improved outcomes and reduced healthcare costs. This factor drives the Market CAGR.

Additionally, a notable trend in the Blood Culture Test market is the growing demand for point-of-care testing solutions. Point-of-care Blood Culture Testing allows for rapid diagnosis at or near the patient's location, reducing the turnaround time for results. This trend is particularly beneficial in emergency departments, critical care settings, and ambulatory care, where quick and accurate detection of bloodstream infections is crucial. The shift towards point-of-care testing aligns with the broader healthcare trend of decentralizing diagnostics and improving accessibility to timely and actionable information for healthcare providers.

Molecular diagnostic techniques play a key role in shaping the trends in the Blood Culture Test market. The increasing adoption of molecular methods, such as polymerase chain reaction (PCR) and nucleic acid amplification, allows for the rapid identification of specific pathogens and their resistance patterns. This molecular-level precision contributes to effective antibiotic stewardship by enabling healthcare professionals to tailor antimicrobial therapy to the specific characteristics of the detected pathogens. With the rising global concern over antibiotic resistance, these trends reflect a strategic approach toward optimizing treatment strategies and preserving the effectiveness of available antimicrobial agents.

For instance, in October 2022, the NRH Medical Lab received a state-of-the-art blood culture machine worth USD 43,740 from the Australia High Commission. Thus, driving the Blood Culture Test market revenue.

Blood Culture Test Market Segment Insights

-

Blood Culture Test Method Insights

The Blood Culture Test market segmentation, based on Method, includes Conventional and automated. The dominating method category is automated, holding a significant market share due to the efficiency, accuracy, and faster turnaround time offered by automated blood culture systems. Conversely, the fastest-growing method category is conventional, which is experiencing rapid expansion as there is a renewed focus on enhancing traditional blood culture techniques.

-

Blood Culture Test Product Insights

The Blood Culture Test market segmentation, based on Product, includes Consumables and instruments. The dominating product category is consumables, which hold a significant market share due to the consistent demand for consumable items like culture media, blood culture bottles, and other disposable components essential for conducting accurate Blood Culture Tests. Conversely, the fastest-growing product category is Instruments, which is experiencing rapid expansion as technological advancements drive innovation in Blood Culture Testing equipment.

-

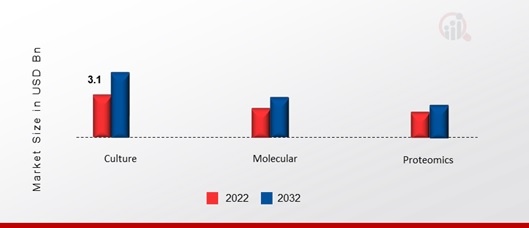

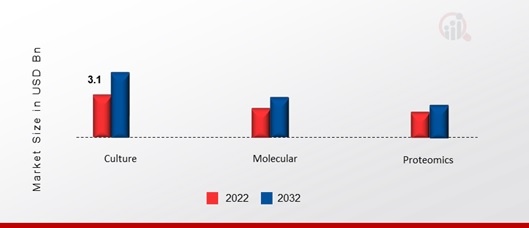

Blood Culture Test Technology Insights

The Blood Culture Test market segmentation, based on Technology, includes Culture, Molecular, and Proteomics. The dominating technology category is culture, which holds a significant market share due to its longstanding use and reliability in identifying microbial pathogens through traditional culturing methods. Conversely, the fastest-growing technology category is Molecular, experiencing rapid expansion as advancements in molecular diagnostic techniques, such as polymerase chain reaction (PCR) and nucleic acid amplification, provide faster and more accurate detection of pathogens.

Figure 1: Blood Culture Test Market, by Technology, 2023 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Blood Culture Test Application Insights

The Blood Culture Test market segmentation, based on Technology, includes Culture, Molecular, and Proteomics. The dominating application category is bacteremia, which holds a significant market share due to the widespread prevalence of bacterial infections and the routine use of blood cultures for diagnosing bacterial bloodstream infections. Conversely, the fastest-growing application category is fungemia, which is experiencing rapid expansion as the recognition of fungal infections and the demand for accurate fungal pathogen identification continue to rise.

Blood Culture Test End User Insights

The Blood Culture Test market segmentation, based on End Users, includes Hospitals and reference Labs. The dominating end-user category is hospitals, which hold a significant market share due to the high volume of Blood Culture Tests conducted within hospital settings for diagnosing various infections. Conversely, the fastest-growing end-user category is Reference Labs, which is experiencing rapid expansion as there is a growing trend toward outsourcing specialized and high-complexity testing services.

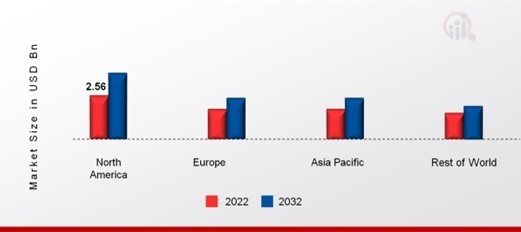

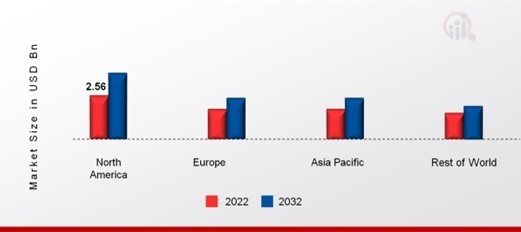

Blood Culture Test Regional Insights

By region, the study provides the market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American Blood Culture Test market area will dominate this market, owing to advanced healthcare infrastructure and a high level of awareness among healthcare professionals, which will boost market growth in this region.

Further, the major countries studied in the market report are the US, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: BLOOD CULTURE TEST MARKET SHARE BY REGION 2023 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe's Blood Culture Test market accounts for the second-largest market share due to the healthcare system and a proactive approach to infectious disease management. Further, the German Blood Culture Test market held the largest market share, and the UK Blood Culture Test market was the fastest-growing market in the European region.

The Asia-Pacific Blood Culture Test Market is expected to grow at the fastest CAGR from 2023 to 2032. This is due to rapid urbanization, population growth, and increasing healthcare awareness. Moreover, China’s Blood Culture Test market held the largest market share, and the Indian Blood Culture Test market was the fastest-growing market in the Asia-Pacific region.

Blood Culture Test Key Market Players& Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Blood Culture Test market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the Blood Culture Test industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Blood Culture Test industry to benefit clients and increase the market sector. In recent years, the Blood Culture Test industry has offered some of the most significant advantages. Major players in the Blood Culture Test market include BD (U.S.), Abbott Laboratories (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), Novartis AG (Switzerland), Eli Lilly and Company (U.S.), Terumo Corporation (Japan), Bruker Corporation (U.S.), bioMérieux SA (France), Bayer AG (Germany), and Merck & Co., Inc. (U.S.).

T2 Biosystems, Inc. is a company specializing in the development of innovative diagnostic products aimed at improving patient outcomes through rapid and accurate detection of various diseases. Founded in 2006 and headquartered in Lexington, Massachusetts, T2 Biosystems focuses on creating diagnostic solutions that leverage its proprietary T2MR technology, enabling direct detection of pathogens and other biomarkers in whole blood. The company's portfolio includes diagnostics for sepsis, hemostasis, and Lyme disease. In March 2023, T2 Biosystems, Inc. announced its plan to add Candida Auris detection technology to its existing T2Candida panel. The company has already received FDA and CE approval for its T2Candida panel.

Bruker Corporation is a leading global provider of scientific instruments and solutions for a variety of industries, including life sciences, analytical chemistry, diagnostics, and materials research. Founded in 1960 and headquartered in Billerica, Massachusetts, Bruker is known for its innovative technologies that enable advancements in areas such as structural and molecular biology, mass spectrometry, magnetic resonance, and X-ray analysis. In April 2023, Bruker Corporation introduced MALDI Biotyper IVD Software. The new software provides a high sample throughput for microbial identification. The software is used in a variety of clinical settings, including hospitals, clinics, and reference laboratories.

Key Companies in the Blood Culture Test market include

- BD (U.S.)

- Abbott Laboratories (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Novartis AG (Switzerland)

- Eli Lilly and Company (U.S.)

- Terumo Corporation (Japan)

- Bruker Corporation (U.S.)

- bioMérieux SA (France)

- Bayer AG (Germany)

- Merck & Co., Inc. (U.S.)

Blood Culture Test Industry Developments

May 2021: F. Hoffmann-La Roche Ltd acquired GenMark Diagnostics to expand its molecular diagnostics portfolio with GenMark's expertise in syndromic testing. GenMark's ePlex systems enhance Roche's work in managing infectious diseases and antibiotic resistance.

October 2021: Becton, Dickinson and Company launched the BD BACTEC FX blood culture system, which features advanced technology to detect a wide range of microorganisms.

Blood Culture Test Market Segmentation

Blood Culture Test Method Outlook

Blood Culture Test Product Outlook

Blood Culture Test Technology Outlook

- Culture

- Molecular

- Proteomics

Blood Culture Test Application Outlook

Blood Culture Test End User Outlook

Blood Culture Test Regional Outlook

- North America

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America

|

Report Attribute/Metric

|

Details

|

|

Market Size2022

|

USD 5.6 Billion

|

|

Market Size 2023

|

USD 6.1 Billion

|

|

Market Size2032

|

USD 13.4 Billion

|

|

Compound Annual Growth Rate (CAGR)

|

10.20% (2024-2032)

|

|

Base Year

|

2023

|

|

Market Forecast Period

|

2024-2032

|

|

Historical Data

|

2018- 2022

|

|

Market Forecast Units

|

Value (USD Billion)

|

|

Report Coverage

|

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends

|

|

Segments Covered

|

Method, Product, Technology, Application, End User, and Region

|

|

Geographies Covered

|

North America, Europe, AsiaPacific, and the Rest of the World

|

|

Countries Covered

|

The US, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil

|

|

Key Companies Profiled

|

BD (U.S.), Abbott Laboratories (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), Novartis AG (Switzerland), Eli Lilly and Company (U.S.), Terumo Corporation (Japan), Bruker Corporation (U.S.), bioMérieux SA (France), Bayer AG (Germany), and Merck & Co., Inc. (U.S.)

|

|

Key Market Opportunities

|

· Increased prevalence of bloodstream infections

|

|

Key Market Dynamics

|

· Growing awareness and initiatives for infection control

|

Frequently Asked Questions (FAQ) :

The Blood Culture Test market size was valued at USD 5.6 Billion in 2022.

The global market is projected to grow at a CAGR of 10.20% during the forecast period, 2024-2032.

North America had the largest share in the global market

The key players in the market are BD (U.S.), Abbott Laboratories (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), Novartis AG (Switzerland), Eli Lilly and Company (U.S.), Terumo Corporation (Japan), Bruker Corporation (U.S.), bioMérieux SA (France), Bayer AG (Germany), and Merck & Co., Inc. (U.S.).

The Conventional category dominated the market in 2022.

The Consumables had the largest share in the global market.