B2B Cybersecurity Market Overview

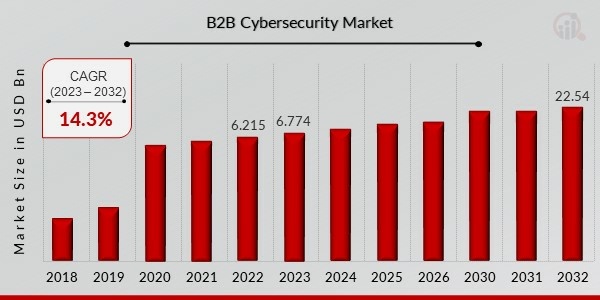

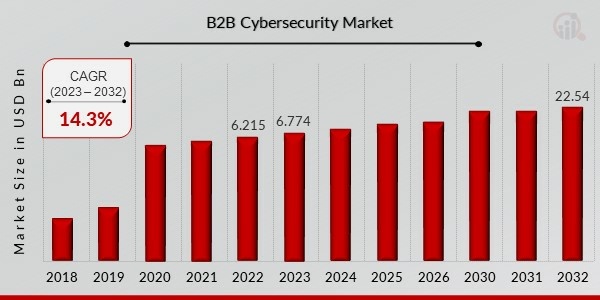

The B2B Cybersecurity market size is projected to grow from USD 6,774.4 Million in 2023 to USD 22,543.2 million by 2032, exhibiting a compound annual growth rate (CAGR) of 14.3% during the forecast period (2023 - 2032). Additionally, the market size for B2B Cybersecurity was valued at USD 6,215.0 million in 2022. B2B Cybersecurity, increasing frequency of cyberattacks on businesses and stringent regulatory requirements for data protection compliance are the key market drivers boosting the growth of the B2B Cybersecurity market. Furthermore, the convergence of Cybersecurity with adjacent domains such as cloud computing, IoT, AI, and blockchain presents immense opportunities for vendors and service providers to develop integrated, holistic solutions that offer enhanced visibility, automation, and threat detection capabilities. Moreover, the growing adoption of hybrid and multi-cloud environments, remote work models, and IoT devices will continue to fuel demand for cloud-native security solutions, identity-centric access controls, and IoT security platforms.

As per Analyst at MRFR, “Looking ahead, the B2B Cybersecurity market is poised for robust growth driven by the increasing frequency and sophistication of cyber threats, digital transformation initiatives, and regulatory pressures. The advent of 5G networks, edge computing, quantum computing, and AI-powered cyberattacks is expected to further complicate the threat landscape, necessitating proactive Cybersecurity measures and investments in next-generation technologies.”

FIGURE 1: B2B CYBERSECURITY MARKET SIZE 2019-2032 (USD MILLION)

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

B2B Cybersecurity Market Driver

The growing adoption of cloud computing and IoT technologies is expected to drive market growth.

Cloud computing has revolutionized how businesses manage and store data, enabling them to access computing resources and applications on-demand over the internet. Instead of relying solely on physical hardware and on-premises infrastructure, companies can now leverage cloud platforms to streamline operations and drive agility. This shift towards cloud services has empowered businesses to scale dynamically, reduce capital expenditures, and accelerate time-to-market for products and services.

Simultaneously, the proliferation of IoT devices has reshaped various industries, embedding connectivity and intelligence into everyday objects. From smart thermostats and wearable devices to industrial sensors and autonomous vehicles, IoT technology has unlocked new realms of data collection, analysis, and automation. Businesses harness IoT to optimize processes, enhance customer experiences, and gain real-time insights into operational efficiency and consumer behavior.

However, the rapid expansion of cloud computing and IoT ecosystems has expanded the attack surface for cyber threats. Each connected device and cloud service presents a potential entry point for malicious actors seeking to infiltrate networks, steal sensitive information, or disrupt critical operations. Consequently, B2B organizations face heightened risks of data breaches, ransomware attacks, and system vulnerabilities in this interconnected landscape.

One of the primary concerns associated with cloud computing is data security and privacy. While cloud providers implement robust security measures to protect customer data, businesses must also ensure compliance with industry regulations and safeguard sensitive information from unauthorized access. The shared responsibility model in cloud environments necessitates a collaborative approach between cloud service providers and their customers to address security gaps and mitigate risks effectively.

Similarly, the proliferation of IoT devices introduces unique Cybersecurity challenges due to the diverse nature of connected endpoints and the lack of standardized security protocols. Many IoT devices possess limited processing power and memory, making them vulnerable to exploitation by cybercriminals. Weak authentication mechanisms, unencrypted communication channels, and insecure firmware updates further compound the security risks associated with IoT deployments.

Moreover, the complexity of IoT ecosystems amplifies the difficulty of monitoring and managing connected devices across diverse environments. Businesses must contend with the sheer volume of data generated by IoT sensors and devices, requiring advanced analytics and threat intelligence to detect anomalies and potential security incidents in real-time. Without comprehensive visibility and control over their IoT infrastructure, organizations remain susceptible to cyber attacks and operational disruptions.

In response to these challenges, B2B Cybersecurity vendors are developing innovative solutions tailored to the evolving threat landscape of cloud computing and IoT environments. These solutions encompass a range of technologies such as network segmentation, encryption, identity and access management (IAM), and behavioral analytics to fortify defenses and mitigate cyber risks effectively.

For cloud security, B2B organizations are adopting cloud-native security solutions that integrate seamlessly with popular cloud platforms and services. These solutions offer centralized management and policy enforcement capabilities to monitor and protect cloud workloads, data storage, and networking configurations. Additionally, cloud access security brokers (CASBs) enable businesses to enforce data loss prevention (DLP) policies, control user access permissions, and detect unauthorized activity across cloud applications and services.

Similarly, B2B Cybersecurity vendors are developing specialized solutions to address the unique security requirements of IoT deployments. These solutions encompass device authentication, encryption, and integrity checking mechanisms to safeguard IoT communication channels and prevent unauthorized access. Security frameworks such as Trusted Platform Module (TPM) and blockchain technology are also being leveraged to establish trust and integrity in IoT ecosystems, ensuring the secure exchange of data between interconnected devices.

B2B Cybersecurity Market Platform Segment Insights

B2B Cybersecurity Offering Insights

Based on offering, the B2B Cybersecurity Market segmentation includes Solution {Identity, Access Management, Compliance & Policy Management, Firewall, Unified Threat Management (UTM), Encryption & Tokenization, and Antiware & Malware}, and Services). The Service held the majority share in 2022, contributing around ~57% to the market revenue. Services are predicted to dominate the market over the forecast period. A significant portion of the market might be attributed to the rising need for expert services such as physical security testing, business risk assessment, and penetration testing. The lack of skilled cybersecurity workers is a major factor driving the segment's growth. Furthermore, end-user companies choose the advice and expertise of expert service providers to lower corporate security risks by implementing reasonably priced security solutions.

B2B Cybersecurity Security Type Insights

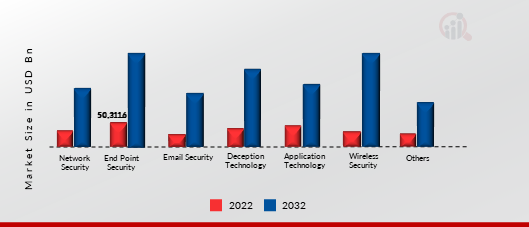

Based on the security type, the B2B Cybersecurity Market segmentation is Security Type, Network Security, End Point Security, Email Security, Deception Technology, Application Technology, Wireless Security, and Others). End Point Security dominated the market in 2022. Endpoint security is the process of defending against harmful threats and cyberattacks on devices such as workstations, servers, and others that can accept a security client. Businesses can defend servers located on a network or in the cloud, or devices used by employees for work, from online attacks by implementing endpoint security software.

The endpoint security solution allows businesses to swiftly detect malware and other typical security threats. Additionally, it can offer endpoint monitoring, detection, and response, which helps the company identify increasingly sophisticated threats including zero-day assaults, polymorphic attacks, and fileless malware. This more advanced technique provides increased visibility and a wider selection of response options when presented with a security concern.

FIGURE 2: B2B CYBERSECURITY MARKET, BY SECURITY TYPE, 2022 VS 2032 (USD MILLION)

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

B2B Cybersecurity Deployment Type Insights

Based on deployment type, the B2B Cybersecurity Market segmentation includes On-Cloud and On-Premises. The On-Premises owners held the majority share in 2022. On-premises B2B cybersecurity, while extremely safe and customized, is losing market share due to a rising demand for low-cost cloud-based solutions. Significant investments in software licenses, IT perssonnel, hardware, and continuing costs are necessary to maintain on-premises security. Small and medium-sized organizations (SMEs) are increasingly opting for cloud-based security due to its cost-effectiveness. Enterprise usage of on-premises security is declining, even if it conceals internal systems. SMEs are discouraged by their high installation costs, while some in the BFSI industry place a higher priority on security than costs. Their market share will probably rise as more reasonably priced cloud-based solutions become available. On-premises solutions have high deployment costs, sluggish software updates, a lack of agility in rearchitecting, and no real-time behavioral analysis. The on-premises B2B cybersecurity market's growth will be constrained by these issues

B2B Cybersecurity Organization Size Insights

Based on organization size, the B2B Cybersecurity Market segmentation includes Freelancers or Micro-Organizations (Upto 5 Users), SME's (5 to 200 Users), and Large Organizations (More than 200 Users). The Large Organizations (More than 200 Users) owners held the majority share in 2022. The large enterprise category is likely to dominate the market over the forecast period. Large companies frequently have broad and complicated IT infrastructures that include data centers, many offices or locations, and a diverse set of devices and applications. Because of this complexity, comprehensive security solutions are needed. These companies also frequently handle sensitive company and customer data, which makes data breaches and cyberattacks a security risk as well as a big legal and reputational worry. It necessitates increased investment in cybersecurity solutions to protect against potential threats.

Furthermore, major corporations are subject to strict regulatory compliance obligations that necessitate robust cybersecurity processes. High penalties for noncompliance further incline large businesses to make significant investments in cybersecurity. The industry is growing as a result of a number of factors, including high-value assets, complicated network environments, regulatory pressure, and a higher danger of sophisticated threats.

B2B Cybersecurity Industry Vertical Insights

Based on industry vertical, the B2B Cybersecurity Market segmentation includes BFSI, Manufacturing, Healthcare, Retail, IT & Telecommunications, Aerospace & Defense, Government, and Others. The IT & Telecommunications owners held the majority share in 2022. The IT and telecom sectors' increasing inclination for cyber security services and solutions is driving market participants to expand their product lines and clientele. The telecom industry has seen tremendous transformation as a result of the current digitalization trend. The telecom industry is investing in cutting-edge technologies like cloud, IoT, and 5G, which is anticipated to create a lot of chances for the telecom and IT cybersecurity market. Furthermore, it is anticipated that the necessity of Bring-Your-Own-PC (BYOPC) would increase the importance of content migration and device administration due to remote management.

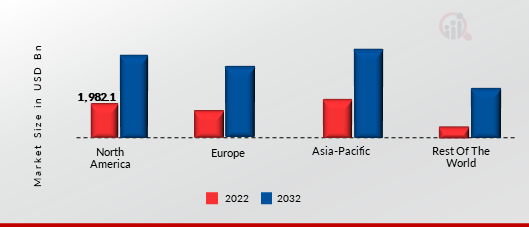

B2B Cybersecurity Regional Insights

By Region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North America B2B Cybersecurity market accounted for ~32% in 2022. It is expected to exhibit a significant CAGR growth during the study period. In North America region the B2B Cybersecurity Market, both, business and public organizations are experiencing incremental growth in cyberattacks; hence, the large investment in security fortification have led to the significant share of this region in the global market. Additionally, the market is growing in this region due to other factors like rising cyberterrorism, malware and phishing threats, adoption of IoT, privacy concerns, and the emergence of disruptive digital technologies.

FIGURE 3: B2B CYBERSECURITY MARKET SIZE BY REGION 2022 VS 2032

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Further, the major countries studied in the market report are the U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Asia Pacific market accounts for the second-largest market share. The Asia-Pacific cybersecurity business is anticipated to grow even more as the severity of these attacks increases and government regulations tighten. The increasing use of cybersecurity solutions is a result of rising internet usage in both developed and developing nations. Furthermore, cybersecurity has become an essential part of any organization due to increasing data vulnerability brought on by the proliferation of the wireless network for mobile devices.

A growing number of developing nations, including China, India, Singapore, and Japan, are dealing with cybersecurity-related problems. In terms of DNS hijacks, India comes in third place, suggesting a significant increase in the registration of cybercrime. Furthermore, Asia was the most attacked region in the globe in 2021, accounting for 26% of all attacks worldwide, according to the IBM X-Force Threat Intelligence Index 2022. Asia's most attacked country ranking is headed by India. The cybersecurity industry may triple in size over the next ten years, according to recent analysis from the Australian Cyber Security Growth Network.

The Europe B2B Cybersecurity Market is expected to grow at the fastest CAGR between 2022 and 2032. The growing demand for cybersecurity solutions in Europe to safeguard businesses and governments from hostile cyber-attacks is driven by increased digitization. The development of online and data-driven organizations in the post-pandemic era raised the need for cyber security majors in corporations and government agencies across the globe, spurring the use of B2B cybersecurity solutions.

According to a European DIGITAL SME Alliance report published in October 2023, there was a significant increase in ransomware assaults, followed by phishing activities carried out over the same period each year, mostly targeting France, Germany, Italy, and Spain. The first quarter of 2023 witnessed a steady peak in attacks across all four quarters, with 7,772 new Common Vulnerabilities and Exposures being published. This underscores the dynamic and ever-changing nature of cyber vulnerability.

B2B Cybersecurity Key Market Players & Competitive Insights

With a strong presence across different verticals and geographies, the B2B Cybersecurity market is highly competitive and dominated by established, pure-play vendors. Over 30 vendors cater to this market, and they continually innovate their solutions to meet the evolving needs of businesses by adopting new technologies. These vendors have a robust geographic footprint and partner ecosystem to cater to diverse customer segments. The B2B Cybersecurity market is highly competitive, with many vendors offering similar products and services.

The major players in the market include Palo Alto Networks, Fortinet, Check Point Software Technologies, CrowdStrike Holdings Inc.and others. Palo Alto Networks focuses on expanding its Cybersecurity offerings through innovation and strategic acquisitions. The company aims to enhance its portfolio with advanced threat detection and prevention capabilities, including cloud security, endpoint protection, and network security solutions. Additionally, Palo Alto Networks emphasizes partnerships with industry leaders and investing in research and development to address evolving cyber threats and meet the needs of organizations seeking robust Cybersecurity solutions.

Fortinet's key growth strategy in Cybersecurity centers on providing integrated and automated security solutions to address evolving threats. The company emphasizes innovation, continuously enhancing its Security Fabric platform to deliver comprehensive protection across networks, endpoints, applications, and the cloud. Fortinet also focuses on expanding its global presence, strengthening partnerships, and investing in research and development to stay ahead of emerging cyber threats and maintain its position as a leader in the Cybersecurity industry.

The B2B Cybersecurity Market is consolidated, increasing competition, acquisitions, mergers, and other strategic market developments and decisions to improve operational effectiveness.

Key Companies in the B2B Cybersecurity market include

- Palo Alto Networks

- Fortinet

- Check Point Software Technologies

- CrowdStrike Holdings Inc.

- Trend Micro Inc.

- Zscaler

- Cloudflare Inc.

- Rapid7

- Darktrace PLC

- CyberArk Software Inc.

- SentinelOne Inc.

B2B Cybersecurity Industry Developments

- In December 2023, Palo Alto Networks, the global Cybersecurity leader, today announced it has completed its acquisition of Dig Security, an innovative provider of Data Security Posture Management (DSPM).

- In November 2023, Palo Alto Networks reached an agreement to acquire secure web browser provider Talon Cyber Security.

B2B Cybersecurity Market Segmentation

B2B Cybersecurity Offering

-

Solution

- Identity Access Management

- Compliance & Policy Management

- Firewall

- Unified Threat Management (UTM)

- Encryption & Tokenization

- Antiware & Malware

-

Services

B2B Cybersecurity Security Type

- Network Security

- End Point Security

- Email Security

- Deception Technology

- Application Technology

- Wireless Security

- Others

B2B Cybersecurity Deployment

B2B Cybersecurity Organization Size

- Freelancers or Micro-Organizations (Upto 5 Users)

- SME's (5 to 200 Users)

- Large Organizations (More than 200 Users)

B2B Cybersecurity Industry Vertical

- BFSI

- Manufacturing

- Healthcare

- Retail

- IT & Telecommunications

- Aerospace & Defense

- Government

- Others

B2B Cybersecurity Regional Outlook

-

North America

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

-

Rest of the World

- Middle East

- Africa

- Latin America

| Report Attribute/Metric |

Details |

| Market Size 2022 |

USD 6,215.0 million |

| Market Size 2023 |

USD 6,774.4 million |

| Market Size 2032 |

USD 22,543.2 million |

| Compound Annual Growth Rate (CAGR) |

14.3% (2023-2032) |

| Base Year |

2022 |

| Market Forecast Period |

2023-2032 |

| Historical Data |

2019- 2022 |

| Market Forecast Units |

Value (USD Million) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Offering, Security Type, Deployment, Organization Size, Industry Vertical, and Region |

| Geographies Covered |

Europe, North America, Asia-Pacific, and the Rest of the World |

| Countries Covered |

The U.S, Germany, Canada, U.K., Italy, France, Spain, Japan, China, Australia, India, South Korea, and Brazil |

| Key Companies Profiled |

Palo Alto Networks, Fortinet, Check Point Software Technologies, CrowdStrike Holdings Inc., Trend Micro Inc., Zscaler, Cloudflare Inc., Rapid7, Darktrace PLC, CyberArk Software Inc., SentinelOne Inc. |

| Key Market Opportunities |

· Integration Of Ai Enhances Threat Detection Capabilities |

| Key Market Dynamics |

· Increasing frequency of cyber attacks on businesses · Stringent regulatory requirements for data protection compliance |

Frequently Asked Questions (FAQ) :

The B2B Cybersecurity Market size is expected to be valued at USD 6,215.0 Million in 2022.

The global market is projected to grow at a CAGR of 14.3% during the forecast period, 2023-2032.

Europe had the largest share of the global market.

The key players in the market are Palo Alto Networks, Fortinet, Check Point Software Technologies, CrowdStrike Holdings Inc., Trend Micro Inc., Zscaler, Cloudflare Inc., Rapid7, Darktrace PLC, CyberArk Software Inc., SentinelOne Inc.