Global Human Insulin Market Overview

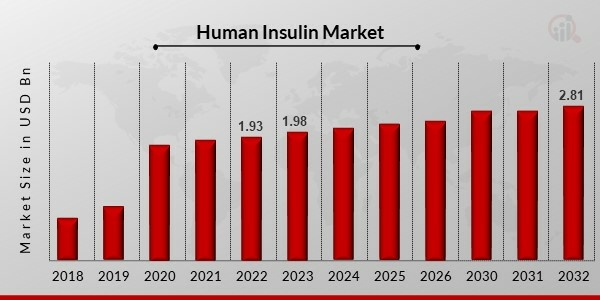

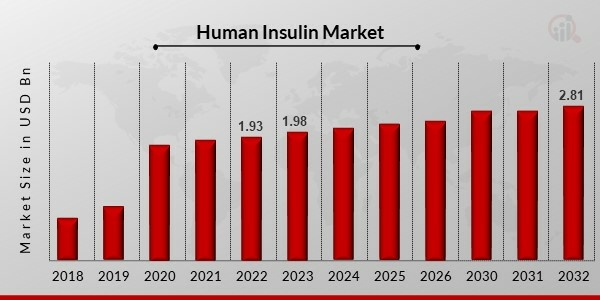

The Human Insulin Market Size was valued at USD 1.93 billion in 2022 and is projected to grow from USD 1.98 Billion in 2023 to USD 2.81 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 4.9% during the forecast period (2024 - 2032). Improvements in formulation and the increased prevalence of diabetes are the main market drivers boosting market expansion.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Human Insulin Market Trends

- Growing Use of Insulin Analogues to boost market growth

With the introduction of insulin analogs, replacement methods that more nearly resemble the physiology of the average person have been proposed. Furthermore, many studies show that, compared to conventional human insulin, insulin analogs have faster offset and onset of insulin impact due to their closer-to-normal pharmacodynamic and pharmacokinetic profiles. Additionally, basal insulin analogs (such as long-acting insulin detemir and insulin glargine) have reportedly been shown to have sound effects on weight, reduced hypoglycemia, and less fluctuation. As a result, these considerations encourage the use of analog insulin products worldwide.

The leading causes of the rise in diabetes worldwide are obesity and a sedentary lifestyle. In the previous decades, the prevalence of diabetes has increased dramatically, and it is predicted that this trend will continue in the decades to come. The number of people with diabetes will increase in the following years, according to the "IDF Diabetes Atlas Tenth edition 2021." It is anticipated to grow to 643.0 million in 2030 and 783.0 million in 2045. A sizable portion of the population also has type 1 diabetes. For people with type 1 diabetes, insulin is necessary for daily glycemic management.

A study published in Diabetologia, the journal of the European Association for the Study of Diabetes (EASD), projected that over 9.0 million persons worldwide have type-1 diabetes. Additionally, the International Diabetes Federation estimates that around 10.0% of all people with diabetes have type 1 diabetes. This aspect, which has increased demand for human insulin globally, will drive the market's expansion throughout the forecast period. Therefore, such factors related to the insulin has enhanced the market CAGR of Human Insulin across the globe in the recent years.

However, formulation advancements are another crucial is another factor driving the growth of the Human Insulin market revenue.

Human Insulin Market Segment Insights

Human Insulin Type Insights

The Market segments of Human Insulin, based on type, includes analog and traditional human insulin. The analog insulin segment held the majority share in 2022, contributing to around ~65-67% of the Human Insulin Market revenue. Due to the growing benefits analog insulin offers over conventional human insulin. Analog insulin has superior adherence to therapy and glycemic control, according to several articles and whitepapers that have been published. In addition, compared to conventional products, it does not carry as significant a risk of hypoglycemia. Analogue insulins also have a quick and consistent rate of action, according to Diabetes.co.uk.

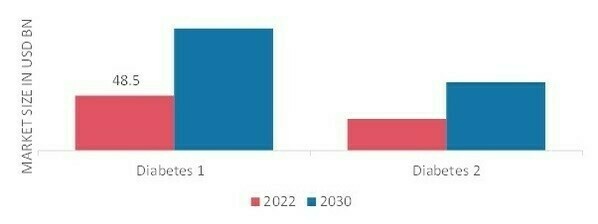

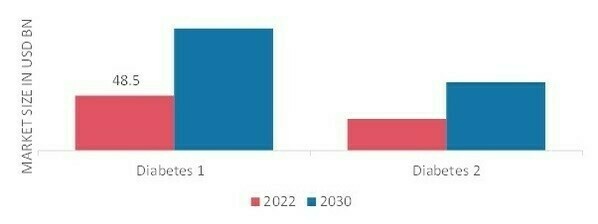

Human Insulin Diabetes Type Insights

The Human Insulin Market data has been bifurcated by Diabetes Type into Diabetes 1 and Diabetes 2. The Diabetes 1 segment dominated the market in 2022 and is projected to be the faster-growing segment during the forecast period, 2022-2030. This is because rising of the prevalence of diabetes and patients with type 1 diabetes, daily require insulin injections to manage blood glucose levels. For persons with type 1 diabetes, insulin is the most crucial medication, according to the International Diabetes Federation (IDF). These elements should propel this market segment.

Figure 2: Human Insulin Market, by Diabetes Type, 2022 & 2030 (USD billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Diabetes 2 was the fastest-growing segment. Because individuals with type 2 diabetes have a variety of additional treatment options. Patients with

type 2 diabetes have only been provided human insulin when other treatments have failed to control their condition.

Human Insulin Distribution Channel Insights

Based on Distribution Channels, the Human Insulin Market segmentation has been segmented into Hospital Pharmacy, Retail & Online Pharmacies, and others. Retail & Online Pharmacy held the most significant segment share in 2022; The retail & online pharmacies market sector is expected to grow as a result of the entry of major corporations like Amazon & Walmart into the industry and the release of cost-effective insulin products. For instance, Walmart introduced the analo insulin brand ReilOn in June 2021. Both vials and pens are available. This medication costs between 58.0% and 75.0% less than the cost of comparable branded insulin products.

The fastest-growing segment in the Human Insulin industry is Hospital Pharmacy. Due to the expansion of hospital facilities worldwide.

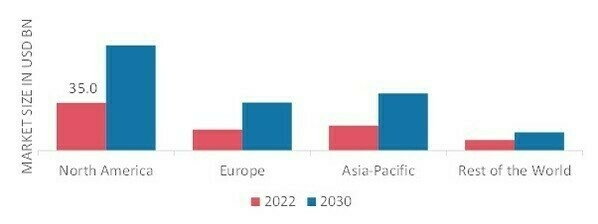

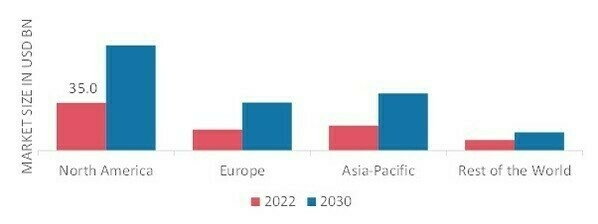

Human Insulin Regional Insights

By Region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North America Human Insulin market is expected to exhibit a significant CAGR growth during the study period. The insulin drug market in North America is driven by several factors, including the considerable presence of the major insulin makers, fierce competition among businesses, and the rising prevalence of type 1 diabetes. For instance, the American Diabetes Association (ADA) estimates that 1.6 million Americans, including 187,000 children and teenagers, have type-1 diabetes. American market to capture a sizable piece of the global market.

Further, the significant countries studied in the market report are The U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: HUMAN INSULIN MARKET SHARE BY REGION 2022 (%)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe, Human Insulin market accounts for the second-largest market share. The expansion of essential players in this area is responsible for its growth. Further, the Germany market of Human Insulin held the largest market share, and the UK market of Human Insulin was the fastest-growing market in the European region.

Asia-Pacific Human Insulin Market is expected to grow at the fastest CAGR from 2022 to 2030. due to various variables, including an increase in the target and geriatric populations, the number of partnerships for the development of biosimilars, the geographic growth of essential companies, and the active involvement of charitable and governmental organizations in the market. Moreover, China's market of Human Insulin held the largest market share, and the India market of Human Insulin was the fastest-growing market in the Asia-Pacific region.

Human Insulin Key Market Players & Competitive Insights

Major market companies are investing significant money in R&D to expand their product portfolios, which will fuel further market growth for human insulin. In addition, market participants are launching key developments, entering into contracts, acquiring companies, increasing investments, and working with other organizations, among other significant market changes, to expand their global footprint. To grow and thrive in a more cutthroat and competitive market climate, competitors in the human insulin industry must provide affordable products.

Making products locally to cut operational costs is one of the leading business methods producers use in the market of Human Insulin to benefit customers and grow the market sector. In recent years, Human Insulin industry has provided medicine with some of the most significant benefits. The Human Insulin market major player such as Biocon, Eli Lilly, and others are working to expand the market demand by investing in research and development activities.

Bangalore-based Biocon Limited is a biopharmaceutical firm run by Indians. In 1978, Kiran Mazumdar-Shaw started it. The business produces generic active medicinal ingredients distributed to about 120 nations, including the US and Europe. In April 2022, With the award of a three-year, $90.0 million contract from the Malaysian Ministry of Health to sell recombinant human insulin known as Insugen, Biocon expanded its presence in a rising market like Malaysia.

Also, With operations throughout 18 nations, Eli Lilly and Company is an American pharmaceutical company with its main office in Indianapolis, Indiana. Approximately 125 countries sell their products. The business was established in 1876 and is named after Colonel Eli Lilly, a pharmacist, and American Civil War soldier. In September 2021, Eli Lilly & Company decreased the cost of the Lispro injectable in the United States, enabling patients to pay less out-of-pocket and making it more widely accessible.

Key Companies in the market of Human Insulin includes

- Adocia

- Merck & Co.Inc

- Julphar

- Pfizer Inc.

- Bristol-Myers Squibb Company

- GlaxoSmithKline Plc

- Sanofi

- Oramed

- Novo Nordisk India Pvt. Ltd.

- Eli Lilly and Company

- Biocon

- Tonghua Dongbao Pharmaceutical Co., Ltd., among others

Human Insulin Industry Developments

November 2023: Biocon Biologics wins $90 million contract from Malaysian government to supply human insulin. Biocon Biologics, a subsidiary of Biocon, has won a $90 million contract from the Malaysian government to supply human insulin. The contract is for a period of five years and will start in 2024. This is the largest contract that Biocon Biologics has won for its human insulin products.

October 2023: Eli Lilly launches new human insulin analog in China. Eli Lilly has launched a new human insulin analog, Lyumjev, in China. Lyumjev is a rapid-acting insulin that is designed to start working faster than other insulins, making it ideal for people with diabetes who need to manage their blood sugar levels after meals.

September 2023: Novo Nordisk announces price cuts for human insulin in low- and middle-income countries. Novo Nordisk has announced that it will cut the prices of its human insulin products by up to 50% in low- and middle-income countries. This move is part of Novo Nordisk's commitment to making insulin more affordable for people with diabetes in all parts of the world.

August 2023: Sanofi launches new human insulin formulation in India. Sanofi has launched a new formulation of its human insulin product, Lantus, in India. The new formulation is designed to be more stable and easier to administer.

July 2023: WHO adds human insulin to list of essential medicines. The World Health Organization (WHO) has added human insulin to its list of essential medicines. This means that human insulin is now considered to be an essential medicine for the treatment of diabetes.

Human Insulin Market Segmentation

Human Insulin Type Outlook

- Analogue Insulin

- Traditional Human Insulin

Human Insulin Diabetes Type Outlook

Human Insulin Distribution Channel Outlook

- Hospital Pharmacy

- Retail & Online Pharmacy

Human Insulin Regional Outlook

- North America

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America

| Report Attribute/Metric |

Details |

| Market Size 2022 |

USD 1.93 billion |

| Market Size 2023 |

USD 1.98 billion |

| Market Size 2032 |

USD 2.81 billion |

| Compound Annual Growth Rate (CAGR) |

4.9% (2024-2032) |

| Base Year |

2023 |

| Market Forecast Period |

2024-2032 |

| Historical Data |

2019 - 2022 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Type, Diabetes Type, Distribution Channel, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the World |

| Countries Covered |

The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

ADOCIA, MERCK & CO., INC., Julphar, Pfizer Inc., Bristol-Myers Squibb Company, GLAXOSMITHKLINE PLC, SANOFI, Oramed, Novo Nordisk India Pvt. Ltd, Eli Lilly and Company, BIOCON, and Tonghua Dongbao Pharmaceutical Co., Ltd. |

| Key Market Opportunities |

· Increasing affordability of human insulin |

| Key Market Dynamics |

· Increasing diabetes prevalence · escalating obesity epidemic · rise in the number of elderly individuals |

Human Insulin Market Highlights:

Frequently Asked Questions (FAQ) :

The Human Insulin Market size was valued at USD 1.93 Billion in 2022.

The global market is projected to grow at a CAGR of 4.9% during the forecast period, 2023-2032.

North America had the largest share in the global market for Human Insulin

The key players in the market are SANOFI, Oramed, Novo Nordisk India Pvt. Ltd, Eli Lilly and Company, Biocon,

The Analogue Insulin category dominated the market in 2022.

The Diabetes 1 had the largest share in the Human Insulin Market.