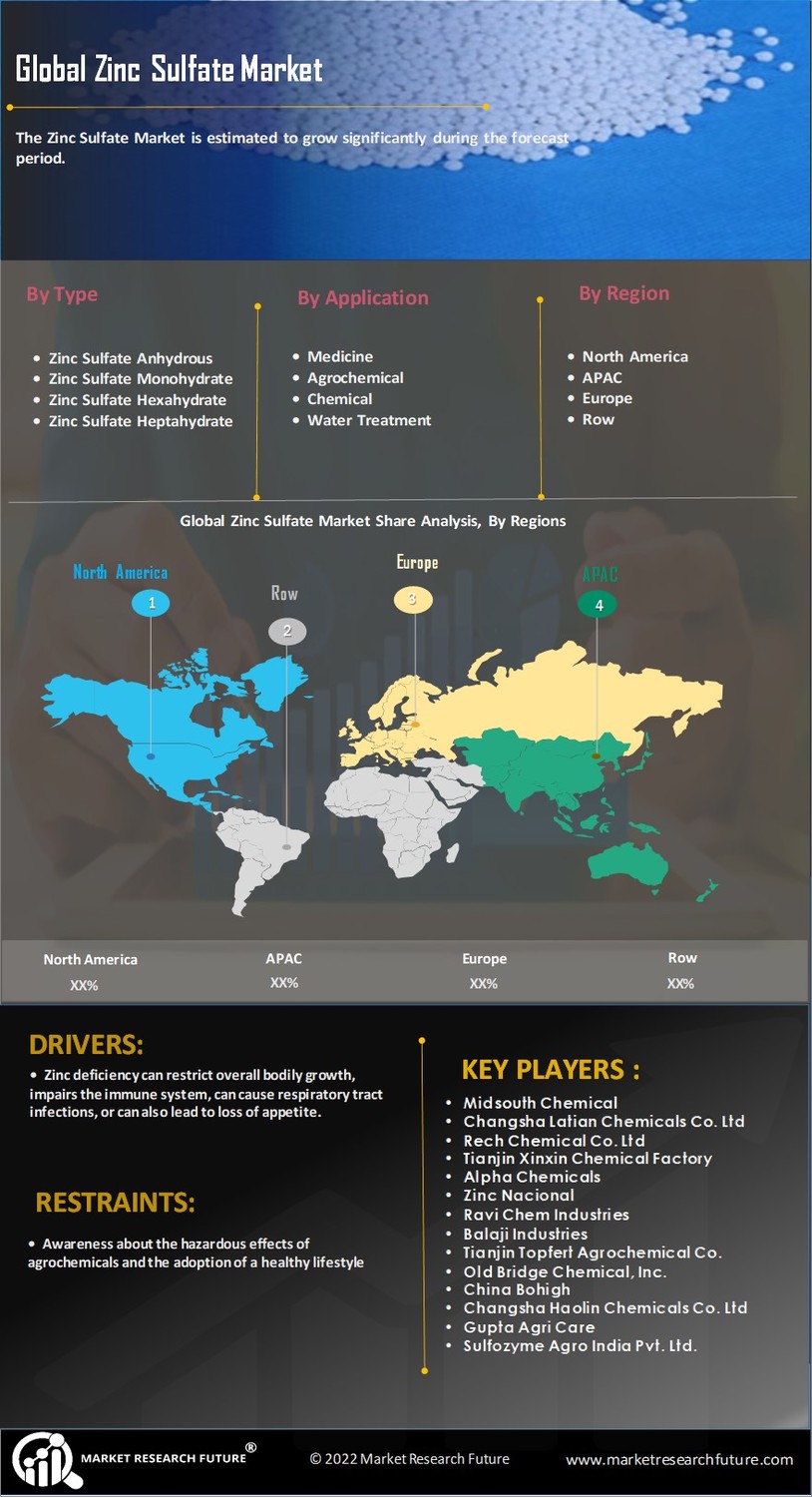

Global Zinc Sulfate Market Overview

Zinc Sulfate Market Size was valued at USD 1.7 Billion in 2022. The Zinc Sulfate industry is projected to grow from USD 1.8 Billion in 2023 to USD 3.1 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 6.80% during the forecast period (2024 - 2032). The increasing demand for zinc sulfate in the agricultural industry and surge in usage in zinc sulfate in industrial applications, are the key market drivers enhancing the market growth.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Zinc Sulfate Market Trends

-

The increasing demand for zinc sulfate in the agricultural industry is driving the market growth

The increased demand for zinc sulphate in the agriculture industry is the main factor fueling the market's rise. Zinc sulphate is a crucial element of the agricultural industry. In the agricultural industry, it is typically used as an addition to fertiliser to prevent and treat zinc deficiency in crops. It is the most often used source of zinc in granular fertilisers due to its high solubility in water and low production cost. Therefore, it is projected that increased demand for fertiliser additives during the projection period will drive zinc sulphate use. In agriculture, the use of pesticides, insecticides, and fertilisers is rising. The massive expansion of the agriculture sector is being driven by the rising need for food in densely populated countries like China and India. As a result, it is predicted that the growth of the agriculture industry will spur market expansion over the projection period.

The rise in demand for zinc sulphate in the textile sector is a recent market trend. Fabrics are made with zinc sulphate in the textile industry. It is blended with a number of chemicals to provide a variety of hues for textiles. It also functions as a precursor for lithopone, a desired pigment in the textile industry. As a result, during the course of the projected period, rising use of this chemical will also be linked to growth in the worldwide textile industry. It is also used to make synthetic fiber and is a raw material in the manufacture of textiles and fibre in the synthetic fibre industry. Zinc sulphate is a dietary supplement that is used to treat human zinc insufficiency. It is also used as a fertiliser and in agricultural sprays to treat crops deficient in zinc and to raise the soil's nutrient value. It can be used as an electrolyte for plating zinc, a coagulant when making rayon (synthetic fibre), a clarifier when making glue, and a mordant when colouring. Businesses in the zinc chemicals market have used techniques such as agreements and contracts in order to grow their current customer base.

Zinc sulphate is commonly used in cosmetic and personal care products because of its anti-microbial and anti-bacterial characteristics. It serves as an astringent, a product for oral hygiene, and a cosmetic biocide. It can be used to clean the skin and deodorise by preventing bacterial growth, among other things, in cosmetic goods. These elements, together with the rising use of cosmetics by millennials, are fueling market revenue growth. Zinc sulphate is becoming more and more widely used in a variety of agrochemicals and industrial chemicals, as well as in other crucial applications like corrosion inhibitors in water-treatment systems, processing herbicides, flotation agents in the mining industry, production of pigments and adhesives, manufacturing of detergent, deodorants, and various cosmetics. Thus, driving the Zinc Sulfate market revenue.

Zinc Sulfate Market Segment Insights

Zinc Sulfate Type Insights

The Zinc Sulfate market segmentation, based on Type, includes Zinc Sulfate Anhydrous, Zinc Sulfate Hexahydrate, Zinc Sulfate Monohydrate, and Zinc Sulfate Heptahydrate. Zinc sulfate anhydrous segment dominated the market in 2022. Zinc sulphate is a transparent, anhydrous solid crystal that is frequently used as an ingredient in the production of rayon, fertiliser, and animal feed. When used in chemical processing, zinc sulphate dissolves in water and exists as an anhydrous solid that can be mixed and stored.

Zinc Sulfate Application Insights

The Zinc Sulfate market segmentation, based on Application, includes Drugs and Medicine, Agrochemical, Chemical, Synthetic Fibers, and Water Treatment. Drugs and medicine segment dominated the market in 2022. For men and women between the ages of 0 and 18, the recommended daily intake of zinc is between 2 and 11 mg, depending on age and body weight. The permitted limits of zinc intake for both adults and children are governed by a number of guidelines. Thus, zinc supplements are used to alleviate issues brought on by a zinc deficit.

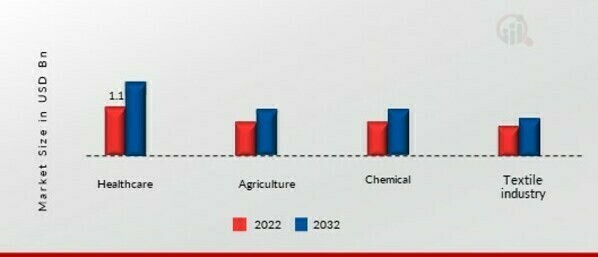

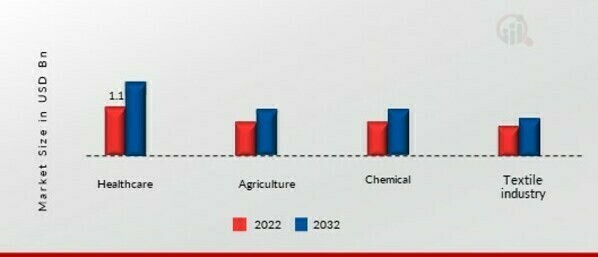

Zinc Sulfate End User Insights

The Zinc Sulfate market segmentation, based on End User, includes Healthcare, Agriculture, Chemical, and Textile industry. Healthcare segment dominated the Zinc Sulfate market in 2022. Supplemental zinc boosts the immune system and helps prevent colds, flu, recurring ear infections, and respiratory infections. It is also listed on the World Health Organization's list of essential medicines.

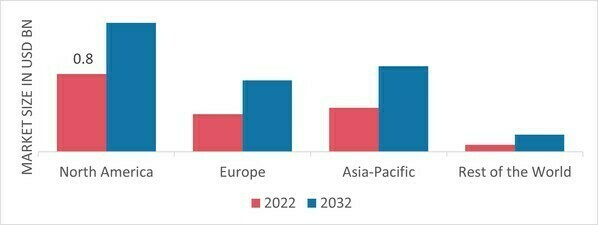

Figure 1: Zinc Sulfate Market, by End User, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

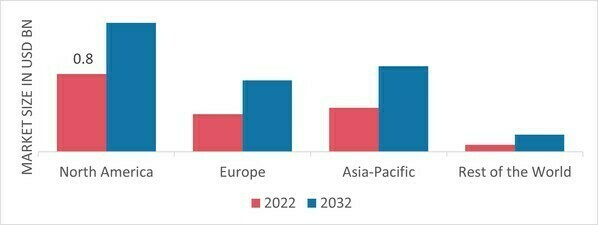

Zinc Sulfate Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North America Zinc Sulfate Market dominated this market in 2022 (45.80%). The meal with the highest zinc content per serving is oysters, but since beef is so widely consumed, it accounts for 20% of Americans' daily zinc intake. Zinc is a key component of the usual mineral-fortified American breakfast cereal. Enriched and fortified foods provide 12.1% to 18.4% of the daily zinc intake for children and adolescents in the United States, which is accelerating the market's expansion in terms of revenue. Further, the U.S. Zinc Sulfate market held the largest market share, and the Canada Zinc Sulfate market was the fastest growing market in the North America region.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: ZINC SULFATE MARKET SHARE BY REGION 2022 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe Zinc Sulfate market accounted for a healthy market share in 2022. This is due to the increased use of zinc sulphate in the production of medications. By lowering general mortality rates, preventing diarrhoea and respiratory infections in children, lowering the risk of premature delivery, and promoting weight gain and development in infants and young children, zinc supplements can be beneficial for health. Further, the German Zinc Sulfate market held the largest market share, and the U.K Zinc Sulfate market was the fastest growing market in the European region

The Asia Pacific Zinc Sulfate market is expected to register significant growth from 2023 to 2032. This is due to the growth of the agricultural industry and the swift adoption of zinc in industrial applications. There have been reports of severe micronutrient shortages in soils and crops all around the world, but especially in Bangladesh, China, and India. This has led to significant output losses and a drop in nutritional quality. Moreover, China’s Zinc Sulfate market held the largest market share and the Indian Zinc Sulfate market was the fastest growing market in the Asia-Pacific region.

Zinc Sulfate Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Zinc Sulfate market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Zinc Sulfate industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Zinc Sulfate industry to benefit clients and increase the market sector. In recent years, the Zinc Sulfate industry has offered some of the most significant advantages to medicine. Major players in the Zinc Sulfate market, including Midsouth Chemical, Changsha Latian Chemicals Co. Ltd, Rech Chemical Co. Ltd, Tianjin Xinxin Chemical Factory, Alpha Chemicals, Zinc Nacional, Ravi Chem Industries, Balaji Industries, Tianjin Topfert Agrochemical Co., Old Bridge Chemical, Inc., China Bohigh, Changsha Haolin Chemicals Co. Ltd, Gupta Agri Care, Sulfozyme Agro India Pvt. Ltd., and Sigma-Aldrich, Inc., are attempting to increase market demand by investing in research and development Types.

EverZinc is a manufacturer of specialised chemicals based on zinc with its headquarters in Loncin, Belgium. The company specialises in three product lines: fine zinc powders, zinc oxide, and zinc for batteries. These goods are offered for sale to customers all over the world for use in a variety of goods, such as sunscreens, ceramics and glass, anti-corrosion paints, tyres, pharmaceutical compounds, and other goods. G.H. Chemicals Ltd. and Microzinc Inc., generally known as "GHC," were acquired by EverZinc in January 2019. The acquisition will enable Quebec's top-notch facilities to assist grow the product and market.

Piramal Enterprises Ltd (PEL), originally Piramal Healthcare Ltd, is a provider of drugs and services for financing healthcare. The company offers a range of OTC drugs as well as products for anesthesia, orthopedic drugs, Phytomedicines, consumer care, and Halothane, Isoflurane, and Sevoflurane. Additionally, it offers contract manufacturing and development services, pharma solutions, critical care solutions, imaging services, fund management services, and other services including structured investments. The company offers services to the financial services, healthcare, real estate, and life sciences sectors. It operates in various countries, including Canada, the United States, Germany, Italy, the United Kingdom, and France. Mumbai, Maharashtra, India serves as the headquarters for the PEL organisation. Piramal Pharma's Critical Care division, a market leader in challenging hospital generics, launched Zinc Sulphate Injection as a first-to-market generic in the US in August 2022. The U.S. Food and Drug Administration approved this medication using the Competitive Generic Therapy (CGT) designation, a path to approval designed to increase market competition for pharmaceuticals with a single source of supply.

Key Companies in the Zinc Sulfate market include

- Midsouth Chemical

- Changsha Latian Chemicals Co. Ltd

- Rech Chemical Co. Ltd

- Tianjin Xinxin Chemical Factory

- Alpha Chemicals

- Zinc Nacional

- Ravi Chem Industries

- Balaji Industries

- Tianjin Topfert Agrochemical Co.

- Old Bridge Chemical, Inc.

- China Bohigh

- Changsha Haolin Chemicals Co. Ltd

- Gupta Agri Care

- Sulfozyme Agro India Pvt. Ltd.

- Sigma-Aldrich, Inc.

Zinc Sulfate Industry Developments

November 2021: In the fiscal year 2020–21, Wata Chemical Limited, an Indian producer and supplier of different acids, saw a 24 percent decline in profits.In February 2023: Nevada Zinc announced that its pilot plant project has produced high-grade zinc sulfate monohydrate. The company is developing the Lone Mountain zinc carbonate-oxide deposit in Nevada.

Zinc Sulfate Market Segmentation

Zinc Sulfate Type Outlook

- Zinc Sulfate Anhydrous

- Zinc Sulfate Hexahydrate

- Zinc Sulfate Monohydrate

- Zinc Sulfate Heptahydrate

Zinc Sulfate Application Outlook

- Drugs and Medicine

- Agrochemical

- Chemical

- Synthetic Fibers

- Water Treatment

Zinc Sulfate End User Outlook

- Healthcare

- Agriculture

- Chemical

- Textile industry

Zinc Sulfate Regional Outlook

- North America

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America

| Report Attribute/Metric |

Details |

| Market Size 2022 |

USD 1.7 Billion |

| Market Size 2023 |

USD 1.8 Billion |

| Market Size 2032 |

USD 3.1 Billion |

| Compound Annual Growth Rate (CAGR) |

6.80% (2024-2032) |

| Base Year |

2022 |

| Market Forecast Period |

2024-2032 |

| Historical Data |

2018- 2022 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Type, Application, End User, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered |

The U.S., Canada, German, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Midsouth Chemical, Changsha Latian Chemicals Co. Ltd, Rech Chemical Co. Ltd, Tianjin Xinxin Chemical Factory, Alpha Chemicals, Zinc Nacional, Ravi Chem Industries, Balaji Industries, Tianjin Topfert Agrochemical Co., Old Bridge Chemical, Inc., China Bohigh, Changsha Haolin Chemicals Co. Ltd, Gupta Agri Care, Sulfozyme Agro India Pvt. Ltd., and Sigma-Aldrich, Inc. |

| Key Market Opportunities |

New product launches |

| Key Market Dynamics |

The increasing demand for zinc sulfate in the agricultural industry and surge in usage in zinc sulfate in industrial applications |

Zinc Sulphate Market Highlights:

Frequently Asked Questions (FAQ) :

The Zinc Sulfate market size was valued at USD 1.7 Billion in 2022.

The Zinc Sulfate market is projected to grow at a CAGR of 6.80% during the forecast period, 2024-2032.

North America had the largest share in the Zinc Sulfate market

The key players in the Zinc Sulfate market are Midsouth Chemical, Changsha Latian Chemicals Co. Ltd, Rech Chemical Co. Ltd, Tianjin Xinxin Chemical Factory, Alpha Chemicals, Zinc Nacional, Ravi Chem Industries, Balaji Industries, Tianjin Topfert Agrochemical Co., Old Bridge Chemical, Inc., China Bohigh, Changsha Haolin Chemicals Co. Ltd, Gupta Agri Care, Sulfozyme Agro India Pvt. Ltd., and Sigma-Aldrich, Inc.

The Zinc Sulfate Anhydrous Type dominated the Zinc Sulfate market in 2022.

The Drugs and Medicine Application had the largest share in the Zinc Sulfate market.