Top Industry Leaders in the Wireless Network Infrastructure Ecosystem Market

Competitive Landscape of the Wireless Network Infrastructure Ecosystem Market

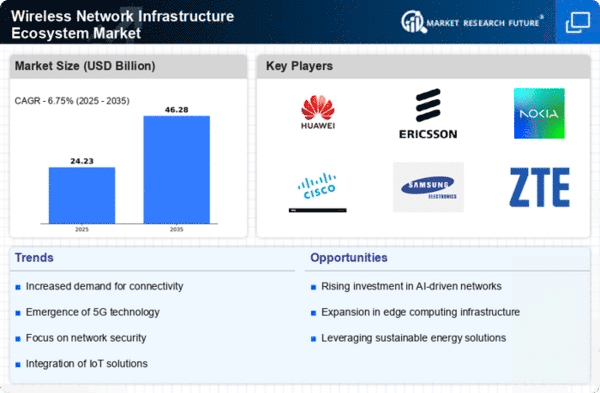

The wireless network infrastructure ecosystem market is a dynamic and fast-growing space, driven by the increasing demand for data and the adoption of new technologies like 5G. This creates a competitive landscape where established players and emerging companies vie for Wireless network infrastructure ecosystem market share.

Key Players:

- Cisco Systems Inc. (US)

- Fujitsu (Japan)

- Huawei Technologies Co. Ltd (China)

- Nokia (Finland)

- Ericsson AB (Sweden)

- IBM Corporation (US)

- Wipro Limited (India)

- Oracle Corporation (US)

- Samsung (Korea)

- ZTE Corporation (China)

Strategies Adopted:

- Established players: Leveraging their existing market share, established players focus on research and development of advanced technologies like 5G, network slicing, and edge computing. They also emphasize expanding their service offerings to include managed services, network automation, and security solutions.

- Emerging players: Emerging players often focus on specific niche markets or technologies, offering competitive pricing and innovative solutions. They also prioritize partnerships and collaborations with established players to gain access to resources and market share.

Market Share Analysis Factors:

- Financial performance: Revenue, profitability, and market capitalization are key indicators of financial strength and market position.

- Product portfolio: Breadth and depth of product offerings across different technology segments, including 5G radio access networks, core networks, and backhaul solutions.

- Customer base: Number and type of customers served, including mobile network operators, enterprises, and government entities.

- Geographical reach: Global presence and market share in different regions.

- Technological innovation: Investment in research and development, patents held, and new product launches.

New and Emerging Companies:

- Airspan Networks: Focuses on open-source RAN solutions for rural and remote areas.

- CommScope: Offers a wide range of network infrastructure solutions, including fiber optic cables, antennas, and wireless backhaul systems.

- Cambium Networks: Provides wireless broadband solutions for enterprise and industrial applications.

- JMA Wireless: Specializes in tower and site solutions for wireless networks.

- Siklu Communication: Offers high-capacity millimeter wave technology for wireless backhaul applications.

Current Company Investment Trends:

- Increased focus on 5G: Companies are investing heavily in 5G research and development, both for hardware and software solutions.

- Network automation and virtualization: Companies are developing new solutions for automating network operations and virtualizing network functions to improve efficiency and reduce costs.

- Security and privacy: Companies are investing in security solutions to protect wireless networks from cyberattacks and comply with data privacy regulations.

- Open RAN: Companies are increasingly embracing open RAN solutions to promote interoperability and reduce vendor lock-in.

- Edge computing: Companies are developing edge computing solutions to bring processing power closer to the edge of the network, enabling real-time applications and reduced latency.

Latest Company Updates:

To speed up the monetization of operators' transport networks in the 5G future, NEC Corporation, and its ecosystem partners A10 Networks, Adtran (previously ADVA), Fortinet, and Juniper Networks introduced the Value Added xHaul Solution Suite in 2023. With the help of the new solution package, traditional IP and optical transport networking will be able to provide more value thanks to improved features including datacenter networks, network security, and automation that will increase operator profitability.

The 'Ericsson Reduced Capability (RedCap)' Radio Access Network (RAN) solution was introduced on Monday by Swedish telecom equipment manufacturer Ericsson in 2023. Its goal is to enable new 5G use cases for devices like wearables, industrial sensors, and smartwatches by increasing battery life and lowering complexity.

The Pi Network testnet now offers in-app notifications on the newest ecosystem items in 2023. In order to give users more detailed information about the most recent projects to launch on the chain, Pi Network (PI) has introduced a new feature to its ecosystem dashboard. Which third-party apps have been confirmed by Pi Network's core team and which have not yet been confirmed will be indicated by the update.

At the Mobile World Congress 2023, which will take place in Barcelona from February 27 to March 2, 2023, Astella Technologies Limited (Astella) will present a live demonstration of recently released commercial-grade 5G infrastructure software products, such as the 5G core network and 5G integrated small cells for both sub-6 and mmWave frequency bands.