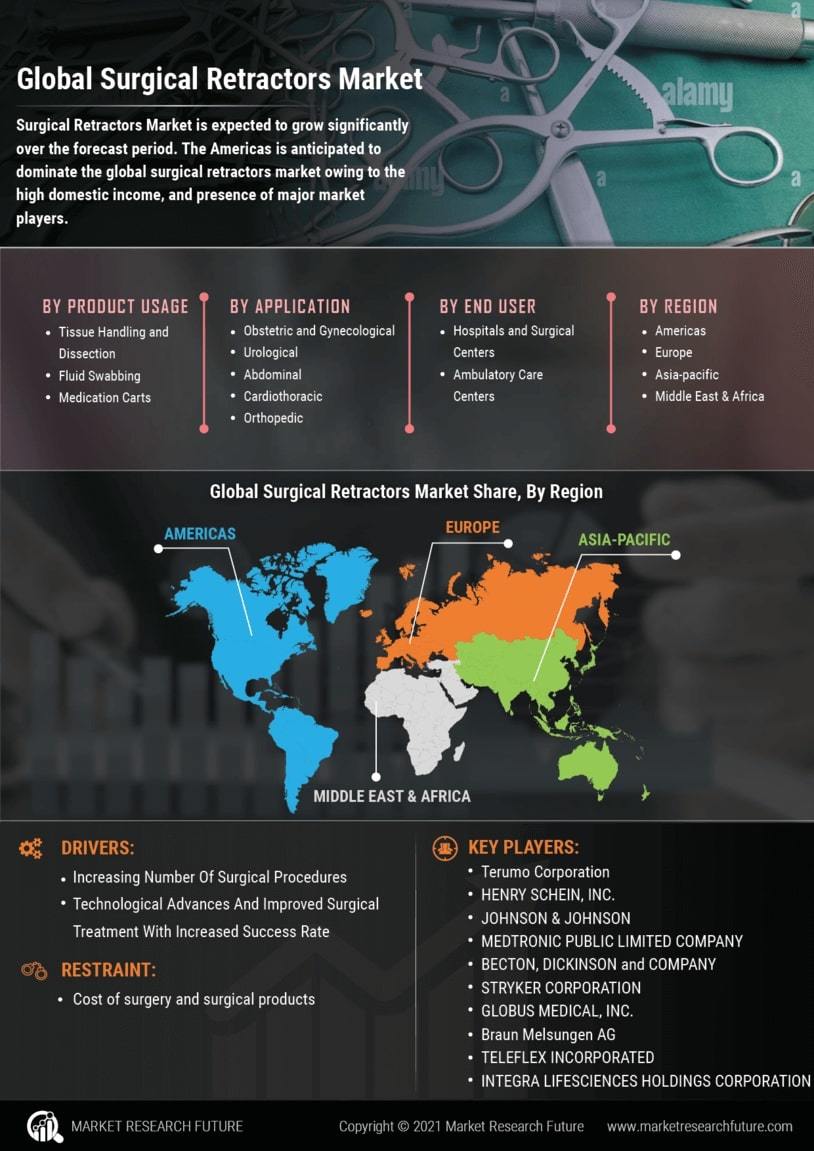

Global Surgical Retractors Market Overview

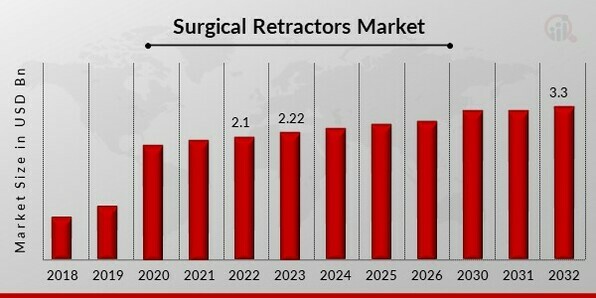

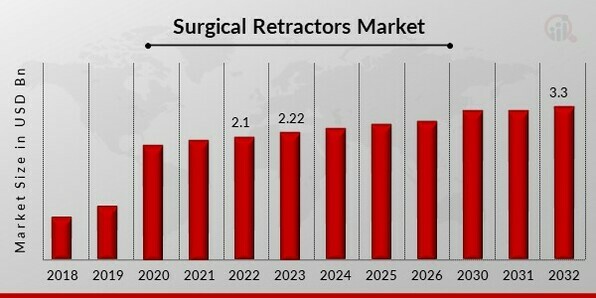

Surgical Retractors Market Size was valued at USD 2.1 billion in 2022. The Surgical Retractors market industry is projected to grow from USD 2.22 Billion in 2023 to USD 3.3 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 6.1% during the forecast period (2023 – 2032). The increasing number of surgical procedures and improved surgical treatment with an increased success rate of chronic diseasesare the major market drivers enhancing the market growth.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Surgical Retractors Market Trends

- Increasing Number Of Surgical Procedures to Fuel Market Growth

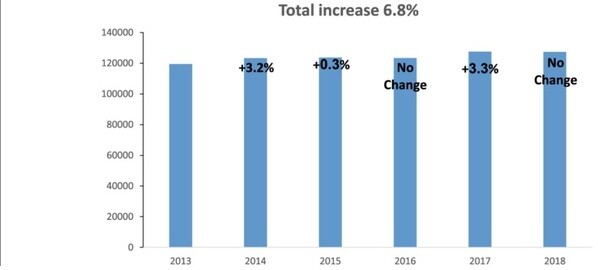

An increase in surgical procedures is expected to support market growth during the forecast period. A surgical procedure is a medical procedure that involves instrumental incisions, usually performed in an operating room, and usually includes anesthesia and respiratory support. Different surgical interventions include cesarean section, cataract surgery, breast biopsy, bariatric surgery, etc. Hence, the increasing prevalence of cancer in the population is expected to increase the number of surgeries performed, which is expected to boost the market CAGR during the forecast period.

Additionally, the number of surgeries due to chronic conditions such as trauma, hip and knee replacements, and cardiovascular diseases requiring surgery is also increasing. This is the major growth factor for the surgical retractor market. A study published in June 2021 in the Journal of Thoracic and Cardiovascular Surgery found that 92,809 surgeries were classically classified as cardiac surgeries, of which 29,444 were isolated coronary artery bypass graft surgeries and 35,469 were isolated coronary artery bypass graft surgeries. The case was isolated heart valve surgery. The number of isolated heart transplants increased by 2% to 340 in 2020. Therefore, the high number of cardiac interventions and surgeries performed is expected to spur the growth of the surgical retractors market revenue over the forecast period.

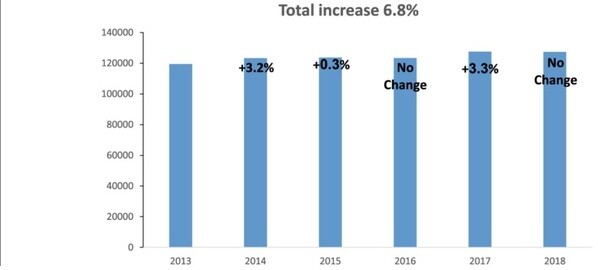

Figure 1: Number of surgical procedures in private hospitals, 2013-2018

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Several research teams have focused on using 3D printing for manufacturing surgical retractors successfully. This will enable deployed medical staff to create a wide range of medical devices on demand, regardless of location. For instance, in August 2021, the first trial laparotomy was performed using the new TITAN CSR. It is a lightweight titanium surgical retractor for trauma and emergency procedures. It offers the speed of traditional self-retaining retractors and the exposure of a table-mounted system that does not require a post or table component.

Surgical Retractors Market Segment Insights

Surgical Retractors Product Types Insights

Based on product types, the surgical retractors market includes hand retractors and self-retaining retractors. The hand retractors segment dominated the market in 2022 and is projected to be the faster-growing segment during the forecast period, 2023-2030. Hand retractors help maintain a desired position in a specific tissue area. Holding tissue during surgery requires the help of a surgeon or other medical professional and limits the free use of the surgeon's hands. Different types of retractors are available depending on the type of surgical procedure. Common retractors include abdominal, digital, neurological, orthopedic, rectal, thoracic, and ribbon retractors. Hence, rising design options for Surgical Retractors positively impact the market growth.

Surgical Retractors Design Insights

The surgical retractors market data based on the design includes fixed or flat frame retractors. The fixed or flat frame retractors surgical retractors segments held the majority share in 2022 with respect to the surgical retractors market revenue. This is due to blade-elevated tip retractors' improved traction and strong grip.

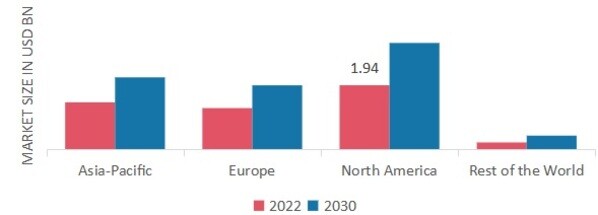

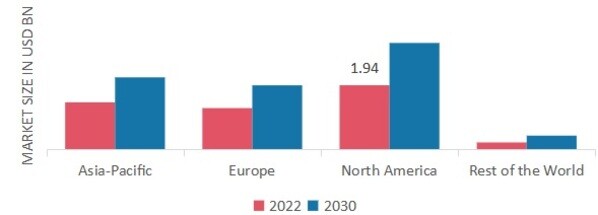

Surgical Retractors Product Usage Insights

Based on product usage, the surgical retractors market segmentation includes tissue handling and dissection. The tissue-handling Surgical Retractors segment held the majority share in 2022 with respect to the Surgical Retractors market revenue. This is attributed to the increased handling of tissues, organs, and ligaments around the surgical area with the increasing number of surgical procedures globally.

Figure 2: Surgical Retractors Market, by Usage, 2022 & 2030 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

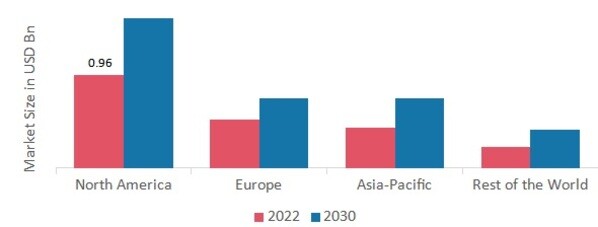

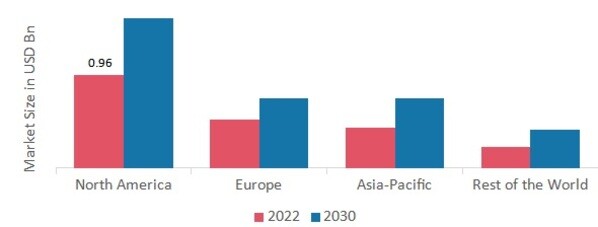

Surgical Retractors Regional Insights

By region, the study offers market insights into Asia-Pacific, Europe, North America, and Rest of the World. The North America Surgical Retractors market accounted for USD 0.96 billion in 2022 and is anticipated to exhibit a substantial CAGR growth during the study period. An increasing geriatric population, an increasing patient population, and an increasing number of various surgical procedures. A rising number of surgeries, such as gynecological, abdominal, cardiothoracic, and orthopedic surgeries, are expected to boost the demand for surgical retractors during the forecast period. Further, the United States Surgical Retractors market held the largest market share, and the Canada Surgical Retractors market was the fastest-growing market in the North American region.

Further, the key countries studied in the market report are: The U.S, Canada, UK, Italy, Germany, France, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: SURGICAL RETRACTORS MARKET SHARE BY REGION 2022 (%)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe's Surgical Retractors market accounts for the second-largest market share because of the increased prevalence of chronic diseases, increased adoption of advanced devices, increased reimbursement for surgical procedures, etc. For instance, every year across Europe, 3.9 million and over 1.8 million in the European Union die from cardiovascular disease (CVD). CVD accounts for 45% of all deaths in Europe and 37% in the European Union. Additionally, major stainless steel retractor manufacturing leaders in the region are expected to drive market revenue growth. Further, the Germany Surgical Retractors market held the largest market share, and the United Kingdom Surgical Retractors market was the fastest growing market in the European region

The Asia-Pacific Surgical Retractors Market is anticipated to develop at the fastest CAGR from 2023 to 2030. This is due to the region's strong healthcare infrastructure, increasing medical surgeries, and cooperation between government initiatives and market leaders to create innovative products. For instance, in March 2022, India planned to build medical devices in cooperation with Japan under her US$42 billion investment and financial plan over five years agreed by the two prime ministers. The Asia-Pacific region is expected to drive market revenue growth throughout the forecast period. Further, the China Surgical Retractors market held the largest market share, and the India atrial fibrillation market was the fastest growing market in the region

Surgical Retractors Key Market Players & Competitive Insights

Key market players are spending a large portion of money on research & development to increase their Product Type lines, which will help the Surgical Retractors market grow even more. Market players are also taking several strategic initiatives to increase their worldwide footprint, with key market developments such as mergers and acquisitions, contractual agreements, increased investments, new Product Type launches, and collaboration with other organizations. Competitors in the Surgical Retractors industry must expand their business footprint to survive in an increasingly competitive and rising market environment.

One of the manufacturers primary business strategies in the Surgical Retractors industry is to help clients and increase the market sector by increasing investment in R&D to enhance solutions and services. In recent years, the Surgical Retractors industry has provided transparency and reduced disruptions in the supply chain. The Surgical Retractors' major market players, such as JOHNSON & JOHNSON, HENRY SCHEIN INC., MEDTRONIC PUBLIC LIMITED COMPANY, TERUMO CORPORATION, BECTON, DICKINSON and COMPANY, STRYKER CORPORATION, JUNE MEDICAL, GLOBUS MEDICAL and others, are working on expanding the market demand by investing in research and development activities.

Medtronic is a US-based medical device company that sells and manufactures device-based medical therapies to hospitals, physicians, clinicians, and patients worldwide. For instance, In April 2021, Medtronic PLC has partnered with Medtronic's StealthStation S8 surgical navigation system to connect Surgical Theater's SyncAR augmented reality (AR) technology. This collaboration will enable neurosurgeons to use real-time AR technology to improve visualization during complex cranial surgery and improve placement of retractors and other surgical instruments during surgery.

JUNE MEDICAL is a UK-based privately-owned provider of medical devices for pelvic floor solutions. In October 2020, JUNE MEDICAL partnered with Vivo Surgical to launch the Galaxy II LUX self-retaining ring retractor with light. The device is manufactured by combining both the features of JUNE MEDICAL’s Galaxy II retractor with Vivo Surgical’s KLARO light that is mounted on the retractor via a purpose-designed clip

Key Companies in the Surgical Retractors market include

Surgical Retractors Industry Developments

August 2022:Spineology Inc. launched OptiLIF Endo, an innovative, ultra-MIS system that requires only one tubular retractor to seamlessly integrate endoscopes and endoscopic equipment into lumbar interbody fusion procedures.

May 2021:OBP Medical Corporation launched a new spin-off company called OBP Surgical Corporation, which will continue reinventing the everyday tools surgeons use.

In 2019:Thompson Surgical has developed a table-mounted hip retraction system. A flexible tether is used to secure the retractor blade in place, reducing the personnel required to hold the retractor.

Surgical Retractors Market Segmentation

Surgical Retractors Product Types Outlook

Surgical Retractors Design Outlook

Surgical Retractors Product Usage Outlook

Surgical Retractors Regional Outlook

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Rest of Europe

-

Asia-Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Australia

-

Rest of Asia-Pacific

-

Rest of the World

-

Middle East

-

Africa

-

Latin America

| Report Attribute/Metric |

Details |

| Market Size 2022 |

USD 2.1 billion |

| Market Size 2023 |

USD 2.22 billion |

| Market Size 2032 |

USD 3.3 billion |

| Compound Annual Growth Rate (CAGR) |

6.1% (2023-2032) |

| Base Year |

2022 |

| Market Forecast Period |

2023-2032 |

| Historical Data |

2018 & 2021 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Portability, Product Types, Type, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the World |

| Countries Covered |

The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

HENRY SCHEIN INC., JOHNSON & JOHNSON, TERUMO CORPORATION, MEDTRONIC PUBLIC LIMITED COMPANY, BECTON, DICKINSON and COMPANY, JUNE MEDICAL, STRYKER CORPORATION, and GLOBUS MEDICAL |

| Key Market Opportunities |

Technology advancement in surgical retractors |

| Key Market Dynamics |

An increasing number of surgical procedures to Fuel Market Growth |

Surgical Retractors Market Highlights:

Frequently Asked Questions (FAQ) :

The market size of surgical retractors market was valued at USD 3.3 billion in 2032.

The market is projected to grow at a CAGR of 6.1% during the forecast period, 2023-2032.

North America had the leading share of the market

The major players in the market are HENRY SCHEIN INC., TERUMO CORPORATION, JOHNSON & JOHNSON, MEDTRONIC PUBLIC LIMITED COMPANY, JUNE MEDICAL, BECTON, DICKINSON and COMPANY, STRYKER CORPORATION, GLOBUS MEDICAL, and others.

The hand retractors surgical retractors category dominated the market in 2022.

Tissue handling had the largest share of the market.