Global Smart Factory Market Overview:

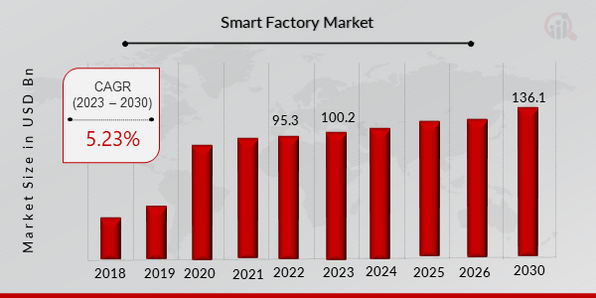

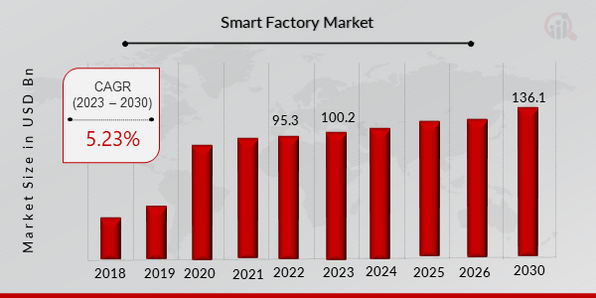

Smart Factory Market Size was prized at USD 95.3 billion in 2022. The smart factory market industry is projected to grow from USD 100.2 Billion in 2023 to USD 136.1 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 5.23% during the forecast period (2023 - 2030). The growing interest in energy efficiency, resource optimization, and cost reduction in manufacturing operations, growing demand for industrial robots, and fiscal policies to keep manufacturing facilities afloat in the face of the COVID-19 crisis are just a few of the trends that are driving up industrial IoT and AI demand are the key market drivers enhancing the market growth. Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Smart Factory Market Trends

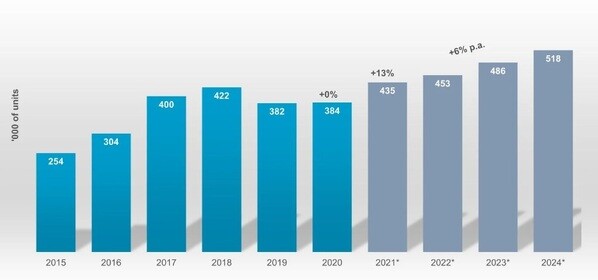

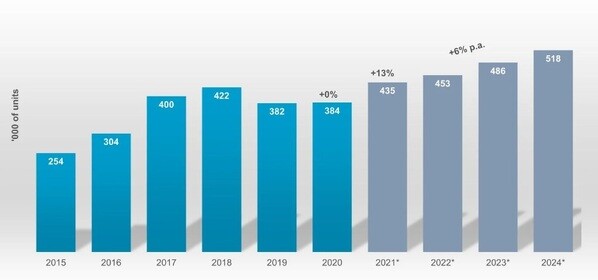

The rising demand for industrial robots will drive the future market expansion of the "smart factory." A smart factory employs tools like information and smart sensor technologies, robots, the internet of things, or artificial intelligence to optimize and industrially automate its resources. According to International Federation of Robotics, a nonprofit organization headquartered in Germany, sales of new robots increased somewhat in 2021 by 0.5%, while robot installations are predicted to rebound rapidly and increase by 13%. Therefore, the rising sales of robots are the major factor driving the growth of the smart factory market revenue.

Figure 1: Global prediction of installation of industrial robots in a million units from 2014 to 2024  Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Owners of smart factories will be able to employ cellular technologies more securely and customize them for certain use cases thanks to 5G technology. They can collect data off the production networks without connecting to the machines by installing sensors on equipment connected to 5G networks, enabling seamless real-time optimization. During July and September 2022, around 110 million new subscriptions to 5G were added globally, bringing the total to approximately 870 million. Wired communication is no longer necessary thanks to installing 5G networks in factories, which allows for high-speed manufacturing with high flexibility and minimal downtime. The development of the 5G network will provide factories with a one-stop shop for solutions and open up huge prospects for smart manufacturing. Thus, the ease of availability of the 5G network has enhanced the smart factory market CAGR across the globe in recent years.

Smart Factory Market Segment Insights:

Smart Factory Connectivity Insights

The Smart Factory Market segmentation, based on connectivity, includes wired connectivity and wireless connectivity. In 2022, wireless connectivity dominated the market with respect to the Smart Factory Market revenue. This trend will likely continue as the shift to virtual work highlights the need for dependable, secure, scalable, and flexible off-premises technology services. Additionally, wired connectivity experienced significant market growth due to the important benefits of automated manufacturing processes, such as effortless monitoring, waste minimization, and output speed.

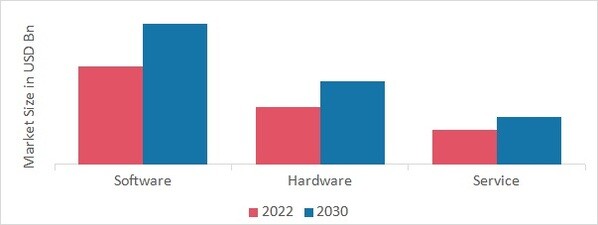

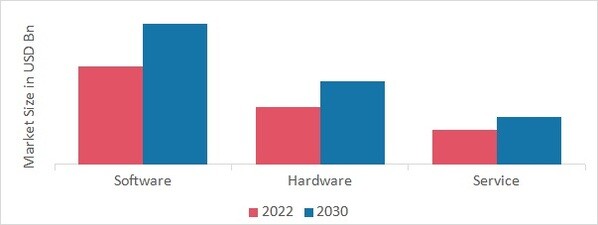

Smart Factory Component Insights

The Smart Factory Market data has been bifurcated by components into software, hardware, and service. Software is expected to rule the market throughout the forecast period. Robots, drones, and other machinery will be operated by cutting-edge software, decreasing the possibility of any errors.

Figure 2: Smart Factory Market, by Component, 2022 & 2030 (USD Billion) Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

The second fastest-growing segment in the smart factory industry is the hardware segment. High-level and compatible hardware is needed to operate the sophisticated software. Production facilities use equipment that uses less energy, is agile, and can operate without human intervention. Hence, rising applications of hardware for smart factory positively impact market growth.

Smart Factory Industry Vertical Insights

Based on industry vertical, the global smart factory industry has been segmented into electronics and semiconductors, aerospace & defense, automotive, oil & gas, chemicals, healthcare & pharmaceuticals and others. In 2022, the automotive sector dominated the market. Many automakers are making pitiful profits, so they are turning to smart manufacturing to cut waste, save costs, and boost margins. The market also assists automakers in keeping a high level of product homogeneity.

July 2022: Audi's Production Lab, or P-Lab for short, is used to identify new and innovative technologies and incorporate them reliably into production sequences. P-Lab director Henning Löser and his team assess the suitability of leading innovative technologies for serial production in Gaimersheim, just a few minutes drives from the Ingolstadt facility. This approval has further broadened the growth opportunity for the smart factory industry.

Furthermore, the aerospace and defense industry segment is anticipated to grow significantly. Several flights are required for testing in space exploration, and this can only be done by building rockets quickly and intelligently. The defense sector invests large industrial automation investments in developing cutting-edge defensive strategies to counter emerging threats.

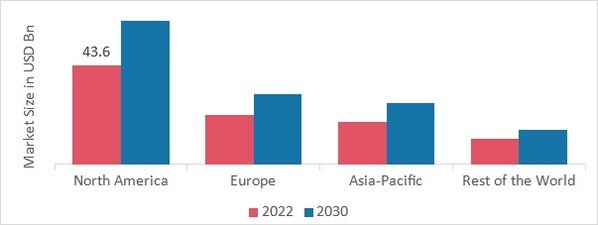

Smart Factory Regional Insights

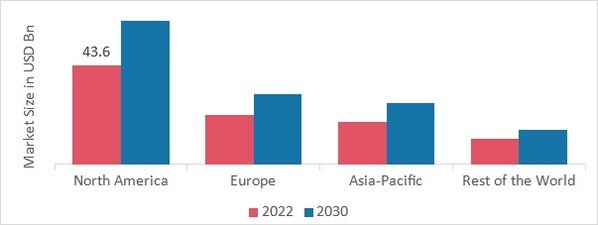

By region, the study provides market insights into North America, Europe, Asia-Pacific and Rest of the World. The North American smart factory market accounted for USD 43.6 billion in 2022 and is expected to exhibit a significant CAGR growth during the study period. The aerospace and defense, manufacturing, automotive, and North American health sectors are undergoing several regional investment programs that are expected to lead to significant future growth. Around 13,000 Community Health Workers will receive training thanks to $225 million in American Rescue Plan funding from the Biden-Harris administration (CHWs). American Rescue Plan made historic investments in response to the urgent need to increase the healthcare workforce and combat pandemic-related burnout.

Further, the major countries studied in the market report are Canada, U.S, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: Smart Factory Market SHARE BY REGION 2022 (%) Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe's smart factory market accounts for the second-largest market share. The creation of smart technologies and solutions that allow the European manufacturing sector to capitalize on digital potential fully has received strong support from the research and innovation (R&I) initiatives of the European Union. The "Factories of the Future Public-Private Partnership," which intends to assist EU manufacturing enterprises and SMEs in meeting global competitiveness by creating the necessary core enabling technologies across various end-user industries, provides funding for several projects. Further, the German smart factory market held the largest market share, and the UK smart factory market was the fastest-growing market in the European region.

The Asia-Pacific Smart Factory Market is expected to grow at the fastest CAGR from 2022 to 2030 due to the vibrant ecosystem in nations like Japan, India, and Australia. SMEs are anticipated to lead the adoption of smart manufacturing solutions. The push for cloud adoption across the region is driven by the growing acceptance of disruptive technologies like Industrial 4.0, AI, AR, IoT, and others. In China, 8.8 billion linked devices are anticipated to exist by 2021. Moreover, China's smart factory market held the largest market share, and the Indian smart factory market was the fastest-growing market in the Asia-Pacific region.

Smart Factory Key Market Players & Competitive Insights

Major market players are investing huge amounts of money in R&D to expand their product portfolios, which will spur further market growth for smart factories. With significant market developments like introducing new products, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations, market participants are also undertaking various strategic initiatives to expand their global footprint. Cost-effective products are a need for competitors in the smart factory industry if they want to grow and thrive in a market that is becoming more and more competitive.

Manufacturing locally to cut operational costs is one of the main business methods manufacturers use in the global smart factory industry to benefit customers and develop the market sector. Some of the biggest advantages to medicine in recent years have come from the smart factory industry. The smart factory market major player, including Emerson Electric Co., Rockwell Automation, ABB Ltd, FANUC Corporation, and others, are attempting to increase market demand by funding R&D initiatives.

Teledyne Technologies Incorporated is a multinational industrial company based in the United States. Teledyne Technologies Inc sells industrial technologies. Contracts with the US government account for roughly one-fourth of Teledyne's revenue. The company's business is divided into four divisions: instrumentation, digital imaging, aerospace and defense electronics, and engineered systems. In September 2021, Teledyne FLIR introduced the latest Blackfly S GigE camera line additions, the BFS-PGE-50S4M-C and BFS-PGE-50S4C-C. With a weight of 53 grams and a high pixel density excellent for integration with compact, low-cost lenses, these 5MP models are especially well suited for incorporation into small handheld devices.

Also, DataMetrex AI Ltd is an information technology firm situated in Canada. It employs machine learning and artificial intelligence to collect, analyze, and present organized and unstructured data. Business segments are AI & technology and Health Security. It has two geographic segments: Canada and South Korea. In September 2022, Datametrex AI Ltd. announced the release of Smart Factory AI technology based on artificial intelligence, big data, and server automation operating system technologies. Furthermore, the company claimed to receive purchase orders totaling approximately CAD 200,000 from several global corporations, including Lotte Data Communication Co., Ltd., Kolon Benit, and Woongjin Co. Ltd.

Key Companies in the smart factory market include

-

Mitsubishi Electric Corporation

-

FANUC Corporation

-

Siemens AG

-

Honeywell International Inc.

-

Schneider Electric

-

Yokogawa Electric Corporation

-

ABB Ltd

-

Johnson Controls International PLC

-

Robert Bosch GmbH

-

Emerson Electric Co.

-

Cognex Corporation

-

Atos SE

-

General Electric Company (GE)

-

Ubisense

-

Rockwell Automation

Recent Industry News:

July 2023- It is with great pleasure that Singapore Finance and Huayuan Food Group jointly announce the building of the first edible fungus smart factory in the United States. The joint venture, which is based in Houston, Texas, will result in daily production of about 50 tons of American Enoki mushrooms, reducing the country's long-term reliance on imported mushrooms as the demand for wholesome edible fungus rises along with better eating patterns. The intelligent factory will employ cutting-edge technological processes for the ecologically benign, chemical-free, and soilless cultivation of edible fungi.

One of the biggest Chinese brand operators in the U.S. Asian food industry is Huayuan Food Group, which is a subsidiary of the Shanghai Finc Biotechnology Co., LTD. The partnership for this Houston-based smart factory displays support for the mushroom industry's rapid growth and an open mind to extending production abroad. One year following the start of construction, the factory is expected to be fully operational.

Along with the smart factory, the company will work to increase the influence of its Freshmore brand and develop a strategy for brand globalization. High-quality Chinese-grown mushrooms called Freshmore are sold in 57 different countries and are the nation's top industrial producer of edible fungus.

Finc is regarded as the innovator of white jade mushroom and crab mushroom industrial cultivation in China after 20 years of development. More than 190 utility and inventive patent applications have been submitted by the business. The white jade as well as crab mushrooms made by Finc are among the most popular fresh mushrooms within China, & its global brand Freshmore has enjoyed more than ten years of international recognition. Finc intends to continue its international growth by fostering closer relationships between businesses, academic institutions, and research labs, as well as through supporting the worldwide edible fungal market.

July 2023- Monday marked the formal start of the smart factory development initiative between Samsung Vietnam and the Ministry of Industry & Trade (MoIT), which aims to assist Vietnamese businesses in joining global supply chains.

Accordingly, 12 firms from Bắc Ninh, Hà Nam, Hà Nội, Hưng Yên & Vĩnh Phúc will take part in a three-week training course to learn about smart factories & nine-week practice during the project's first phase. Vietnamese consultants and Samsung experts will assess the companies' operations and aid in the establishment of smart factories.

Then, specialists would keep helping the businesses develop their operational and managerial processes and make improvements.

The ceremony's keynote speaker, Thng Hi, the deputy minister of industry and trade, said: Vietnamese manufacturing enterprises are facing many challenges in the context of a highly competitive market, with a self-screening and selection mechanism, having to race with large organizations not only in international markets but also in domestic markets. As a result, Vietnamese manufacturing companies will inevitably follow the trend of constructing smart factories.

In 2022, the ministry collaborated with Samsung Vietnam to implement the MoU on cooperation project on the development of smart factories between the MoIT and Samsung Vietnam. The ministry trained 51 smart factory consultants and supported consulting and improvement for 26 enterprises using smart factories in both the North & the South.

The project has contributed a great deal of thorough knowledge to assist improving the capacity of production operations based on enterprises' information technology and support improving the competence of domestic consultants. The ministry will continue executing the project in 2023 and the years after that based on the reaction and active engagement from the business sector.

Samsung Vietnam has been working to help the growth of Viet Nam's support sector through various support operations since 2008, when the company first made an official investment in the country.

Smart Factory Market Segmentation:

Smart Factory Connectivity Outlook

-

Wireless Connectivity

-

Wired Connectivity

Smart Factory Component Outlook

-

Software

-

Hardware

-

Service

Smart Factory Industry Vertical Outlook

Smart Factory Regional Outlook

-

North America

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Rest of Europe

-

Asia-Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Australia

-

Rest of Asia-Pacific

-

Rest of the World

-

Middle East

-

Africa

-

Latin America

Smart Factory Industry Developments

March 2022: Emerson Electric Co. introduced MT Connect, an industrial control platform driver that allows the simple integration of computer numerical control (CNC) machines into modern data analysis automation environments. This enables previously unavailable data from machines, robots, equipment, and gadgets to be collected and evaluated on a single platform.

November 2021: Mitsubishi Electric Corporation and the National Institute of Advanced Industrial Science and Technology (AIST) launched the Maisart AI technology, which predicts changes during automated manufacturing processes and then causes real-time adjustments in industrial automation equipment.

| Report Attribute/Metric |

Details |

| Market Size 2022 |

USD 95.3 billion |

| Market Size 2023 |

USD 100.2 billion |

| Market Size 2030 |

USD 136.1 billion |

| Compound Annual Growth Rate (CAGR) |

5.23% (2023-2030) |

| Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Historical Data |

2019 - 2021 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Market Competitive Landscape, Revenue Forecast, Growth Factors, and Trends |

| Segments Covered |

Connectivity, Component, and Industry Verticals |

| Geographies Covered |

Europe, Asia Pacific, North America, and Rest of the World |

| Countries Covered |

Canada, U.S, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Emerson Electric Co., Rockwell Automation, ABB Ltd, and FANUC Corporation. |

| Key Market Opportunities |

The emergence of 5G technology |

| Key Market Dynamics |

Growing emphasis on energy efficiency, resource optimization, and cost reduction in production operations. Increasing demand for industrial robots. |

Frequently Asked Questions (FAQ) :

The Smart Factory Market size was prized at USD 95.3 Billion in 2022.

The global market is projected to grow at a CAGR of 5.23% during the forecast period 2022-2030.

North America had the major share of the global market

The key players in the market are Emerson Electric Co., Rockwell Automation, ABB Ltd, and FANUC Corporation.

The software category dominated the market in 2022.

The automotive sector had the largest share of the global market.