Global Polypropylene Market Overview

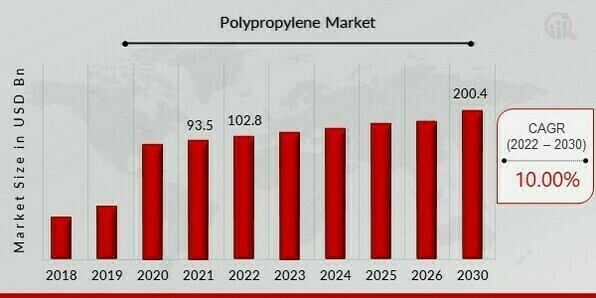

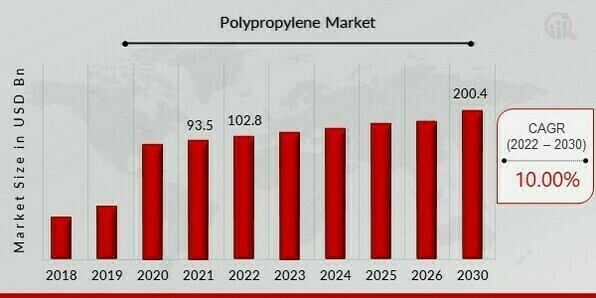

Polypropylene Market Size was valued at USD 93.5 billion in 2021. The polypropylene industry is projected to grow from USD 102.8 Billion in 2022 to USD 200.4 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 10.00% during the forecast period (2024 - 2030). Growing demand from packaging and automotive sector are the key market drivers enhancing the market growth.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Polypropylene Market Trends

-

Growing use in Packaging and Automotive Industry to boost market growth

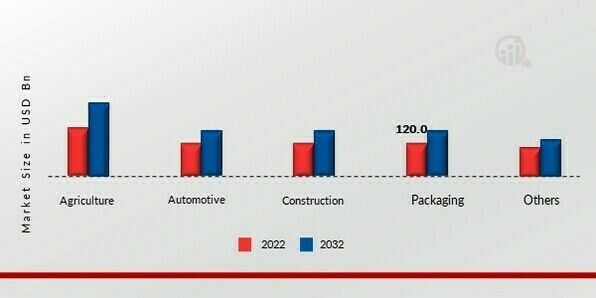

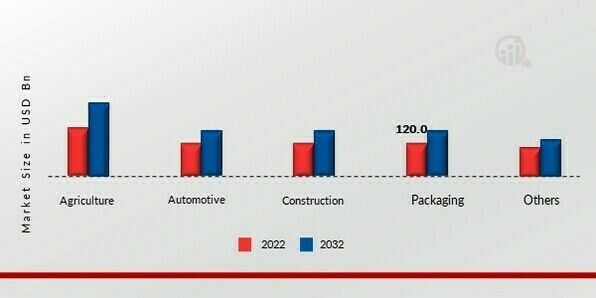

Polypropylene provides resistance against chemicals and extreme temperatures moreover they are stiffer and stronger in comparison of copolymer which makes it more suitable for packaging. Packaging industry is leading segment and accounted more than 45% of the share of total polypropylene (PP) demand in 2021. Automotive industries are accountable to produce more than 30% of revenue for this market.

The market for polypropylene was dominated by the packaging sector, and it is anticipated that this trend would continue during the projected period. The most popular plastic for packaging is polypropylene. It is mostly utilised in applications for food packaging that come into direct contact with food or drinks. As well as, Polypropylene is used to make a variety of items, including automobile components, fashion garments, profiles, and healthcare equipment. Increasing demand for these components in a variety of end-use sectors, the introduction of new technologies, and customer preferences for lightweight electronic devices are all offering profitable prospects to drive market expansion.

The automotive sector is the second largest end use industry of polypropylene. The main driving factor for polypropylene in the automotive industry is the increasing demand for electric and hybrid electric vehicles , polypropylene can be used as an insulating material for material for high voltage carrying cables as well as in the interior of the vehicles.

Additionally, there is a massive growth in the number of working-class people, if we look at a few years ago the no. Of working women was quite low as compared to today which led to increase in growth of packaged food usage, as it is less time-consuming. Also most of working-class individuals like to travel through their own vehicles to reduce time used to reach their workplace. As per the statics in the year 2019 the employment rate was 35.3% which is now at 46.3%. In conclusion, the increase in employment played a significant role in the enhancement of the Polypropylene market CAGR across the globe in recent years.

However, there are many more sectors like- agriculture, construction, electronic, and others that are increasingly using polypropylene, thus driving the growth of the polypropylene market revenue.

Polypropylene Market Segment Insights

Polypropylene Application Insights

The Polypropylene Market segmentation, based on application, includes agriculture, automotive, packaging, construction, electrical, electronics , and others. The packaging industries sector dominates the market due to the superior polypropylene features such as high flexibility and the ability to withstand in harsh environments. Moreover, the packaging segment held the majority share polypropylene market in the year 2018-2022. Contributed more than 45% in respect to the Polypropylene Market revenue. Many companies have shifted from other materials to polypropylene because of its stiffness and low cost . The market for polypropylene has expanded as a result of the increasing need for thermoplastic products. Thermoplastic materials can be recycled and remoulded without losing their physical characteristics thanks to their special chemical characteristics. Thermoplastic materials are so far more beneficial for a variety of applications, such as apparel, packaging, food, and drinks. In addition, they are employed in demanding fields like the aerospace, military, and medical ones.

Figure 2: Polypropylene Market, by Surgery, 2021& 2030 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

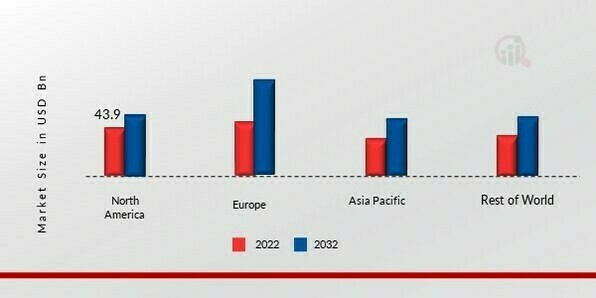

Polypropylene Regional Insights

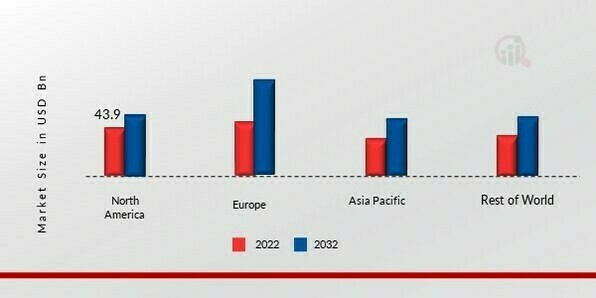

By Region, the study provides market insights into North America, Europe, Asia-Pacific and Rest of the World. Further, the Asia Pacific is expected to be one of the fastest-growing markets ly over the forecast period. This is attributed to the ascending demand for polypropylene from key industries including automotive, electrical & electronics, building & construction, medical, and packaging in emerging economies such as China and India, as studied in the market report.

Figure 3: POLYPROPYLENE MARKET SHARE BY REGION 2021 (%)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe Polypropylene market accounts for the second-largest market share in the year 2021. due to the increased use of electric vehicles in the area. The European Environment Agency (EEA) reports that in 2020, the adoption of electric cars and vans in Europe rose dramatically. Nearly 1,325,000 electric vehicles were registered in this region in 2019, an increase from 550,000 the year before. New car registrations rose from 3.5% to 11% in just one year. Registrations for electric vans increased as well, from 1.4% in 2019 to 2.2% in 2020. Further, the Germany Polypropylene market held the largest market share, and the UK Polypropylene market was the fastest growing market in the European region

The North America polypropylene market stood at USD billion in 2020. North America is expected to grow at a high rate of CAGR from 2022 to 2030. China, Japan and India are key countries contributing to the market growth in the region owing to the increasing application of PP in food and beverages, packaging, and automobile industries in these countries. Moreover, China polypropylene market held the largest market share, and the India polypropylene market was the fastest growing market in the Asia-Pacific region

For instance, in India polypropylene market Homopolymer polypropylene segment held the largest Indian Polypropylene Market share in 2021, with a share of over 62%. Homopolymer polypropylene is a widely-used general-purpose grade of polypropylene, Singapore is ranked at 2nd position, Japan at 3rd, India at 10th, South Korea at 14th, and china’s PP capacity is scheduled to increase by further 12%on a year-on-year basis to around 39m tons per year following a 13% increase in2021. Hence, Asia-Pacific is anticipated to register the highest growth rate over the forecast period from 2022–2030.

Polypropylene Key Market Players & Competitive Insights

Major market players are spending a lot of money on R&D to increase their product lines, which will help the Polypropylene market grow even more. Market participants are also taking a range of strategic initiatives to grow their worldwide footprint, with key market developments such as new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Competitors in the Polypropylene industry must offer cost-effective items to expand and survive in an increasingly competitive and rising market environment.

One of the primary business strategies adopted by manufacturers in the polypropylene industry to benefit clients and expand the market sector is to manufacture locally to reduce operating costs. In recent years, the polypropylene industry has provided materials with some of the most significant benefits. The polypropylene markets major player such as SABIC (Saudi Arab), LG Chem (South Korea), BASF SE(Germany), and many others.

SABIC (Saudi Arab) is a Saudi manufacturing firm for chemicals. Saudi Aramco is the owner of 70% of SABIC's shares. Petrochemicals, chemicals, industrial polymers, fertilisers, and metals are among its active applications. According to its Tadawul listing, it is the second-largest public business in the Middle East and Saudi Arabia. SABIC was ranked fourth ly among chemical firms by Fortune 500. SABIC ranked as the 281st-largest corporation in the world by the year's conclusion. In April 2021, SABIC, a leader in the chemical industry, announced that Beiersdorf will innovate the packaging of its world-leading ‘NIVEA Naturally Good’ range of face creams using SABIC’s certified renewable polymers. SABIC’s bio-based polypropylene (PP) resin, part of its TRUCIRCLE™ portfolio, will be used for producing the jars of Beiersdorf’s NIVEA Naturally Good day and night face creams. The new product is playing into Beiersdorf’s ambitious Sustainable Packaging Targets 2025 to reduce fossil-based, virgin plastic for its cosmetic packaging products by 50 percent.

A worldwide chemical corporation with offices in London, the UK and Houston, Texas, LyondellBasell Industries N.V. was founded in the Netherlands. In terms of polyethylene and polypropylene technologies, the firm is the largest licensee. Additionally, it makes oxyfuels, polyolefins, ethylene, and propylene. In December 2020, Lyondell Basell introduced Beon3D, a cutting-edge PP product line that will offer a distinctive design and enable the production of intricate, high-quality 3D-printed objects in a single step. This product was created by fusing additive manufacturing and polymer technologies. The transportation, industrial, building & construction, and consumer goods sectors will all benefit from this product line.

Key Companies in the Polypropylene market include

- The Dow Chemical Company(US)

-

LG Chem (South Korea)

- Eni S.P.A.(Italy)

- Chevron Philips Chemical Company(US)

- Lyondel lBasell(US)

- LANXESS(Germany)

- SABIC(Saudi Arabia)

- BASF SE(Germany)

-

Exxon Mobil Corporation (US)

- INEOS(Switzerland)

Polypropylene Industry Developments

In October 2021, At the upcoming INDEX Expo in Geneva, Switzerland, SABIC, a leader in the chemical industry, will present its extensive portfolio of SABIC PURECARES polypropylene (PP) and polyethylene (PE) polymers for high-purity nonwovens and hygiene films. This segment of its Petrochemicals business was recently established.

In June 2022 Products from LG Chem's LETZero Eco-Friendly Materials Brand are included in a product book that has been produced. LETZero is a master brand that incorporates environmentally friendly materials like PCR made of recycled waste plastics, biomaterials composed of bio-based renewable resources, and biodegradable materials made of glucose and leftover glycerol taken from maize. Through the Product Book, we introduce LG Chem's array of environmentally friendly products for a sustainable environment and future.

In June 2021, LyondellBasell, one of the world’s major plastics, chemicals, and refinery firms based in the Netherlands, acquired Poly Pacific Polymers The growth of LyondellBasell's polypropylene division is aided by this acquisition. A Malaysian company called Poly Pacific Polymers Sdn Bhd makes modified polypropylene olefin compounds.

Polypropylene Market Segmentation

Polypropylene Application Outlook

- Agriculture

- Automotive

- Packaging

- Construction

- Electrical

- Electronics

Polypropylene Regional Outlook

- North America

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America

| Report Attribute/Metric |

Details |

| Market Size 2021 |

USD 93.5 billion |

| Market Size 2022 |

USD 102.85 billion |

| Market Size 2030 |

USD 200.4 billion |

| Compound Annual Growth Rate (CAGR) |

10.00% (2024-2030) |

| Base Year |

2021 |

| Market Forecast Period |

2024-2030 |

| Historical Data |

2018 & 2020 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Application, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the World |

| Countries Covered |

The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

LG Chem (South Korea), SABIC(Saudi Arabia), BASF SE(Germany), LANXESS(Germany), and others |

| Key Market Opportunities |

Boost in demand due to new appliances and technology. |

| Key Market Dynamics |

Rising demand for packing material from packaging industry. Need of thermosetting plastic in automotive industries and others. |

Frequently Asked Questions (FAQ) :

The Polypropylene Market size was valued at USD 93.5 Billion in 2021.

The Polypropylene market is projected to grow at a CAGR of 10.00% during the forecast period, 2024-2030.

Asia pacific had the largest share in the Polypropylene market

The key players in the Polypropylene market are SABIC(Saudi Arabia), LANXESS(Germany), BASF SE(Germany), LG Chem (South Korea) and others

The packaging industry dominated the Polypropylene market in 2021.