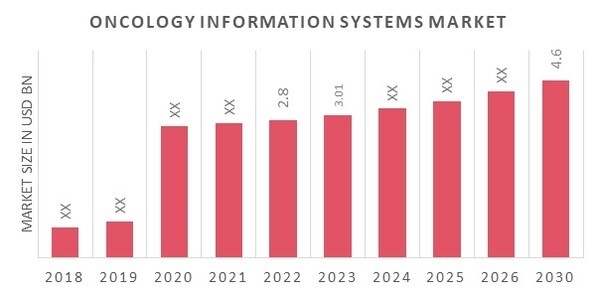

Global Oncology Information Systems Market Overview

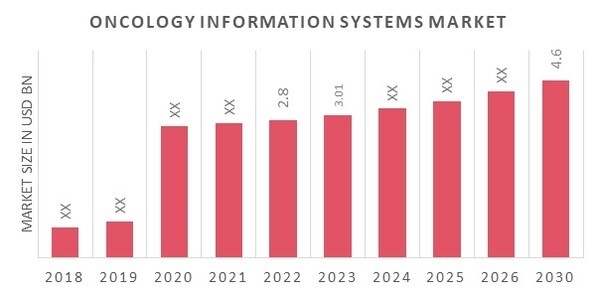

The Oncology Information Systems Market Size was valued at USD 2.8 billion in 2022 and is projected to grow from USD 3.01 Billion in 2023 to USD 4.81 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 7.9% during the forecast period (2023 - 2030). The rise in cancer cases and the variety of treatments being used are the main market drivers for the expansion of oncology information systems. These factors have forced healthcare providers to adopt a comprehensive data management system for maintaining huge data sets, including patient records and treatment regimens.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

An integrated information and image management tool called an oncology information system makes it easier to manage and improve cancer patients' therapy and patient profiles. To manage patient portfolios, OIS software is used in healthcare facilities like hospitals, physician offices, and research labs. The OIS helps healthcare organizations like hospitals, clinics, and academic labs manage and improve cancer care services and share patient data across organizations to improve patient safety, personalized care for each patient, and optimize therapy. The market's growth is fueled by governments increasing their outlay in oncology-related studies and development. The need for healthcare IT services is expected to rise during the forecast time frame due to factors like how well oncology information systems are replacing traditional data handling methods and validations, which reduces manual labor and automates the process.

Additionally, this software is utilized to share patient data on cancer patients between healthcare organizations and forecast treatment outcomes. The prevalence of cancer cases and the wide range of treatment options have forced healthcare providers to start using an effective data management system to manage large data sets, including medical records and treatment practices, which is a major driver of the expanding scope of the oncology information systems market. Electronic health record and medical record maintenance, patient treatment pattern maintenance, and treatment prediction are all goals of these data management systems, often known as OIS. These advantages raise the patient-centered safety and effectiveness of cancer treatment. OIS aids medical professionals in making the best treatment decisions to increase survival rates.

News

The cancer information system RayCare may now link to Varian TrueBeam linear accelerators, according to RaySearch Laboratories AB. This is the outcome of the signed interoperability contract with Varian Medical Systems. An important feature of an oncology information system is the capability to organize radiation treatments and monitor therapy progress. Data transfer among the OIS and the treatment delivery system, in the present instance, the Varian TrueBeam linear accelerators (linacs), is required to allow an integrated workflow.

Oncology Information Systems Market Trends

- Growing incidence of cancer to propel market growth

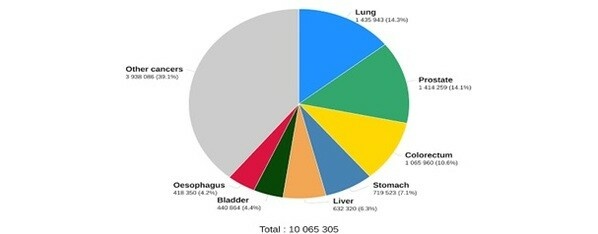

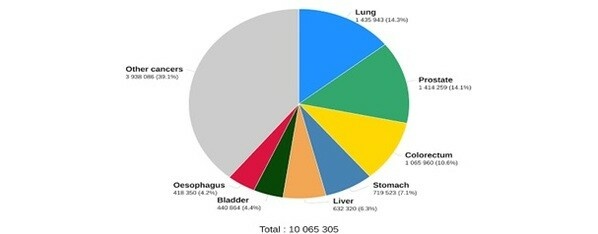

The global increase in cancer cases is one of the main factors driving the market for oncology information systems. Globally, there were 19.29 million new cases of cancer in 2020, and GLOBOCAN 2020 predicts that number would rise to 28.4 million by 2040 (an increase of 47%). It is projected that 50.6 million individuals worldwide have cancer (5-year prevalence, or the total number of people living with cancer from the last 5 years). In a similar vein, the American Cancer Society reports that in 2021, there were over 1.9 million new instances of cancer diagnosed in the United States alone. The development of a wide range of revolutionary technologies has the ability to totally change the treatment plan. As a result of the rising incidence of cancer, there will be a demand for OIS to streamline patient information and data management, which would ultimately propel the market of oncology information systems. A few other reasons, such as the growing demand to reduce the cost of cancer treatment and the rising popularity of electronic health records (EHR) and other oncology information systems, are also playing significant roles in propelling the market for oncology information systems forward. Thus, this factor is driving the market CAGR for oncology information systems.

Figure 1: Estimated number of new cases in 2020, worldwide

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Furthermore, the market's expansion is driven by the availability of numerous OIS with increased features. OIS has gradually taken the place of paper and manual medical records because of digitalization. These systems are made to make it simple to handle patient treatment plans, timetables, delivery, summaries, and test results. These systems' built-in software streamlines and simplifies the labour process, which helps in providing patients with high-quality care. Personal and medical histories, clinical diagnoses, actual and anticipated treatment plans, and post-therapy outcomes are all fully and accurately described by OIS. These programmes keep track of numerous patient oncology treatment regimens.

However, there is an increasing need for various forms of OIS software as a result of the increased demand for OIS to streamline patient information and data management. Market expansion is anticipated to be fueled by increased corporate expenditure in cancer research. Businesses are increasingly investing in the creation of cutting-edge items because the market is anticipated to grow greatly in the upcoming years. Thus, it is anticipated that this aspect will accelerate oncology information systems market revenue globally.

Oncology Information Systems Market Segment Insights

Oncology Information Systems Product and Service Type Insights

The Market segments of Oncology Information Systems, based on product and service type, includes Software and Professional Services. The software segment held the majority share in 2022 in the Market data of Oncology Information Systems. This is a result of better radiological information management techniques being used by healthcare providers more frequently. The segment has developed as a result of the software, which facilitates the gathering of cancer patient-reported outcomes and permits direct communication between medical professionals and patients.

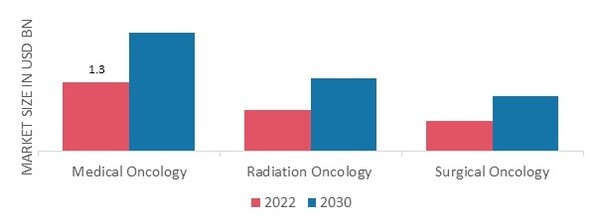

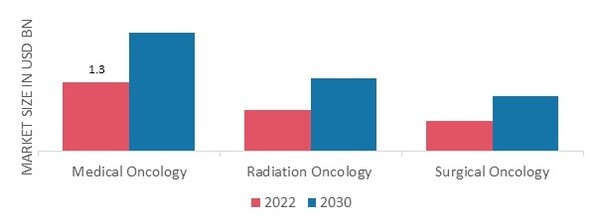

Oncology Information Systems Application Insights

The Oncology Information Systems Market segmentation, based on application, includes Medical Oncology, Radiation Oncology and Surgical Oncology. The medical oncology segment dominated the market growth for oncology information systems in 2022 and is projected to be the faster-growing segment during the forecast period, 2022-2030 due to quick developments in immunotherapy, targeted therapy, and hormone therapy for effectively treating various malignancies. Additionally, major firms are conducting a number of cancer research initiatives, which has a significant impact on the segment's growth. Major players are also undertaking a number of efforts related to cancer research, which is further boosting the market's expansion.

Figure 2: Oncology Information Systems Market, by Application, 2022 & 2030 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Oncology Information Systems End-User Insights

The Oncology Information Systems Market data, based on end-user, includes Hospitals & Oncology Clinics, Government Institutes and Research Centers. The hospitals & oncology clinics segment dominated the market revenue for oncology information systems in 2022 and is projected to be the faster-growing segment during the forecast period, 2022-2030. The variables can be ascribed to an increase in cancer cases and the increased adoption of technologically improved cancer treatment methods in hospitals around the world.

News

RaySearch Laboratories has received a purchase order for its RayCare oncology information system from the Australian Bragg Centre for Proton Therapy and Research. RayCare can be used alongside the RayStation treatment planning software to have access to its treatment planning features. RayCare was created to enable comprehensive cancer care. The system enables treatment scheduling control and distributes machines appropriately based on treatment specifications, patient preferences, and personnel schedules. The system offers task management for each step in the planning and quality control workflow to enhance the treatment planning process. RayCare wants to connect to every therapy delivery equipment in use at contemporary oncology facilities around the globe utilizing the RayTreat control application.

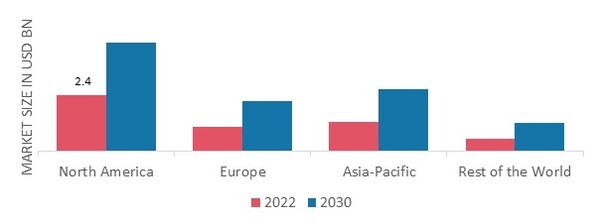

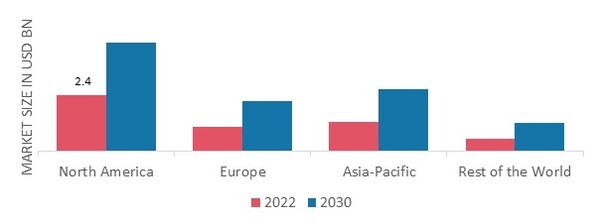

Oncology Information Systems Regional Insights

By region, the study provides the market insights for oncology information systems into North America, Europe, Asia-Pacific and Rest of the World. North America oncology information systems market accounted for USD 2.4 billion in 2022 with a share of around 45.80% and is expected to exhibit a significant CAGR growth during the study period due to the region's access to cutting-edge healthcare facilities and growing expertise in patient data management. In addition, the market is influenced by factors such as the growing usage of these systems to monitor and record the treatment outcomes of cancer patients as well as the use of electronic medical records (EMR) in improving healthcare choices.

Further, the major countries studied in the market report for oncology information systems are: The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: ONCOLOGY INFORMATION SYSTEMS MARKET SHARE BY REGION 2022 (%)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Asia Pacific oncology information systems market accounts for the second-largest market share due to favorable government programmes and increased public awareness of the OIS's advantages. In order to establish a grip in these lucrative areas, the firms vying for a sizable piece of this market must develop distinctive pricing policies as well as marketing plans specifically suited to this sector. Moreover, China market of oncology information systems held the largest market share, and the India market of oncology information systems was the fastest growing market in the region.

Europe oncology information systems market is expected to grow at the fastest CAGR from 2022 to 2030. The region's sophisticated healthcare infrastructure and growing understanding of patient information management are two important drivers of this progress. The demand for OIS in this region is also anticipated to rise because to the increasing requirement for dose management, treatment planning, and management of treatment schedules. Further, the UK market of oncology information systems held the largest market share, and the Germany market of oncology information systems was the fastest growing market in the region.

Oncology Information Systems Key Market Players & Competitive Insights

Major market players are spending a lot of money on R&D to increase their product lines, which will help the market of oncology information systems grow even more. Market participants are also taking a range of strategic initiatives to grow their worldwide footprint, with key market developments such as new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Competitors in the oncology information systems industry must offer cost-effective items to expand and survive in an increasingly competitive and rising market environment.

One of the primary business strategies adopted by manufacturers in the global oncology information systems industry to benefit clients and expand the market sector is to manufacture locally to reduce operating costs. In recent years, oncology information systems industry has provided medicine with some of the most significant benefits. The market of oncology information systems major player such as Altos Solutions, Elekta AB, Varian Medical Systems, Flatiron Health, RaySearch Laboratories, Epic Systems Corporation and Bogardus Medical Systems.

The Swedish business Elekta is a global leader in the development and manufacture of clinical management, radiation therapy, and radiosurgery-related equipment for the treatment of cancer and brain disorders. With more than 40 locations worldwide and about 4,700 workers, Elekta has a presence in more than 120 countries. In June 2021, to improve complete and individualised cancer care through precision oncology technologies, Elekta and Philips inked a contract to deepen their already successful strategic alliance.

American radiation oncology software and treatment provider Varian Medical Systems is situated in Palo Alto, California. Its medical equipment includes linear accelerators and software for radiation, radio-surgery, proton therapy, and brachytherapy in the treatment of cancer and other diseases. In September 2019, to hasten the creation of software tools that would enable precision medicine in radiation oncology, Varian established a cooperation with the privately held digital health business Oncora Medical.

Key Companies in the market of oncology information systems includes

- Altos Solutions

- Elekta AB

- Varian Medical Systems

- Flatiron Health

- RaySearch Laboratories

- Epic Systems Corporation

- Bogardus Medical Systems

Oncology Information Systems Industry Developments

Nov 2023: Elekta announces that it has acquired Carestream Health's oncology information systems (OIS) business for $1.6 billion. The acquisition gives Elekta a stronger position in the OIS market and allows it to offer a wider range of products and services to cancer centers.Varian Medical Systems announces that it has partnered with IBM to develop a new cloud-based OIS. The partnership will combine Varian's expertise in OIS with IBM's expertise in cloud computing to develop a new OIS that is more scalable, secure, and cost-effective than existing OIS.Siemens Healthineers announces that it has launched a new OIS called Syngo Velocity AI. Syngo Velocity AI is an AI-powered OIS that can help clinicians to make faster and more accurate diagnoses and treatment decisions.May 2022: To create a new radiation therapy simulation and treatment planning workflow solution that will make it easier to focus radiation to reduce a tumour, GE Healthcare has partnered with RaySearch Labs AB, a producer of radiation oncology software.

Oncology Information Systems Market Segmentation

Oncology Information Systems Product & Service Type Outlook (USD Billion, 2019-2030)

- Software

- Professional Services

Oncology Information Systems Application Outlook (USD Billion, 2019-2030)

- Medical Oncology

- Radiation Oncology

- Surgical Oncology

Oncology Information Systems End-User Outlook (USD Billion, 2019-2030)

- Hospitals & Oncology Clinics

- Government Institutes

- Research Centers

Oncology Information Systems Regional Outlook (USD Billion, 2019-2030)

-

North America

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

-

Rest of the World

- Middle East

- Africa

- Latin America

| Report Attribute/Metric |

Details |

| Market Size 2022 |

USD 2.8 billion |

| Market Size 2023 |

USD 3.01 billion |

| Market Size 2030 |

USD 4.81 billion |

| Compound Annual Growth Rate (CAGR) |

7.9% (2023-2030) |

| Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Historical Data |

2018 - 2021 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Product and Service Type, Application, End-User and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the World |

| Countries Covered |

The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Altos Solutions, Elekta AB, Varian Medical Systems, Flatiron Health, RaySearch Laboratories, Epic Systems Corporation and Bogardus Medical Systems |

| Key Market Opportunities |

High costs associated with OIS services |

| Key Market Dynamics |

Increasing prevalence of cancer Rising geriatric population |

Oncology Information Systems Market Highlights:

Frequently Asked Questions (FAQ) :

The Oncology Information Systems Market size was valued at USD 2.8 Billion in 2022.

The Oncology Information Systems Market is projected to grow at a CAGR of 7.9% during the forecast period, 2023-2030.

North America had the largest share in the global market for oncology information systems.

The key players in the market for oncology information systems are Altos Solutions, Elekta AB, Varian Medical Systems, Flatiron Health, RaySearch Laboratories, Epic Systems Corporation and Bogardus Medical Systems.

The medical oncology dominated the oncology information systems market in 2022.

The hospitals & oncology clinics had the largest share in the Oncology Information Systems Market.