Global Honey Market Overview

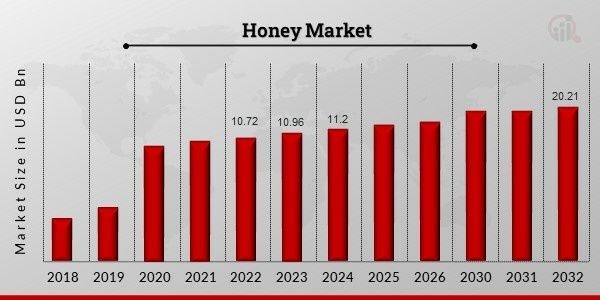

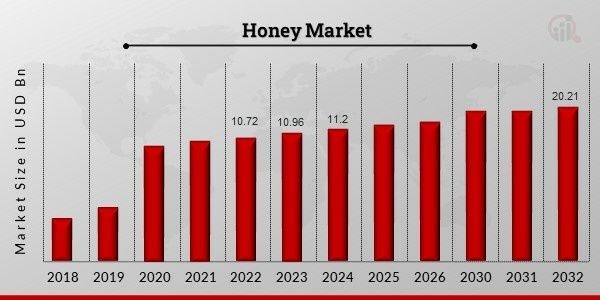

Honey Market Size was valued at USD 10.5 billion in 2021. The honey market industry is projected to grow from USD 11.2 billion in 2024 to USD 17.80 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 6.85% during the forecast period (2024 - 2030). A rise in the use of honey in cosmetics and pharmaceuticals is the key market driver enhancing market growth.

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Honey Market Trends

-

Consumers' preference for healthy and natural alternatives to artificial sweeteners to propel the market growth

Artificial sweeteners increase the risk of obesity, high cholesterol, mineral loss, tooth decay, hypertension, and cardiovascular disorders. Along with Type 2 diabetes, metabolic syndrome, and many malignancies and tumors, they are also to blame for their development. On the other hand, natural honey has a lower glycemic index (GI), which indicates that it does not immediately boost blood sugar levels and is also rich in antioxidants that significantly impact human health.

They can be found in functional foods, cosmetics, and other items and have a number of health advantages. Bees produce it from the nectar of flowers, is an unadulterated, unfiltered, and unpasteurized sweetener that is prized for its extraordinary nutritional and medicinal properties. Consumers are becoming more concerned about consuming food products that boost their immunity levels, according to the most recent trends in food consumption, especially in light of the pandemic's rapid expansion. As a result, it is projected that this element would draw new customers to the market CAGR. Additionally, natural honey has been promoted by governments and international organizations as a crucial food component and a helpful meditational substance. For instance, the World Health Organization (WHO) has suggested it as a successful natural therapy for people with chronic cough and cough in young infants. Regarding clean labeling, the market is expanding in North America and Europe. Honey is consumed in America by about 50% of the population. Thus, the increased customer preference for natural alternatives to artificial sweeteners is a major factor driving the predicted growth of the market to 2.4 million tonnes.

Furthermore, there has been a noticeable rise in demand for organic goods in recent years, particularly in developed economies like Japan, Europe, and the US. The demand for natural products is high among people who care about their health and the environment and is driven by the high profits associated with organic items. One of the most well-liked market trends in numerous economies is using the product above in creative health beverages and supplements. For instance, a Singapore-based company announced the release of a honey Exir in September 2021. The item is advertised as a cholesterol-free health supplement. Sales of organic products are also expected to be supported by growing support for organic agriculture from organizations like the National Beekeepers Association and the National Organic Value Chain Association.

However, to engage more consumers, product producers are developing unique launches. For instance, Dabur introduced honey-infused syrups in July 2021, a new line of syrups and spreads. The product is a healthier alternative to the popular strawberry syrups and sweet chocolates on the market because it contains no added sugar. Consumers are encouraged to incorporate natural sweeteners into their diets and use less white sugar due to growing health consciousness. The product's long shelf life and high affordability are two other significant elements that favorably influence honey market revenue.

Honey Market Segment Insights

Honey Type Insights

The honey market data has been segmented by type into alfalfa, wildflower, buckwheat, acacia and clover. The buckwheat segment dominated the market in 2021 and is projected to be the faster-growing segment during the forecast period, 2022-2030. The buckwheat honey category is anticipated to increase at the quickest rate. Due to its medicinal qualities, it is widely used in pharmaceutical products. It is low in sweetness, high in antioxidants, and has a distinct flavor.

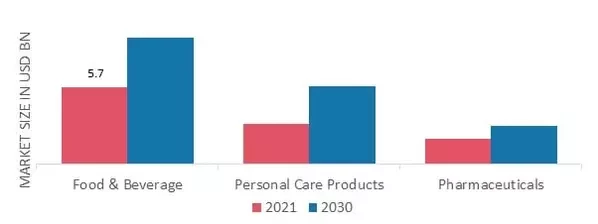

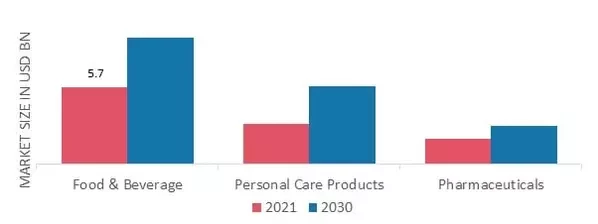

Honey Application Insights

The honey market segmentation is based on application, food & beverage, personal care products and pharmaceuticals. The food & beverage segment dominated the market in 2021 and is projected to be the faster-growing segment during the forecast period, 2022-2030. The increased market share of this sector can be attributed to the rising usage of honey in place of sugar in various items, including baked goods, beverages, and confectionery. Additionally, it is directly consumed, increasing the need for honey in this market. Hence, this would have a positive impact on market growth.

Figure 2: Honey Market by Application, 2021 & 2030 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Honey Packaging Insights

The honey market segmentation, based on packaging, includes bottle, jar, tube and tub. The bottle category held the majority share in 2021 regarding the honey market revenue. The popularity of bottles is due to their adaptability to various sizes and forms and their portability due to their low weight and shatter resistance.

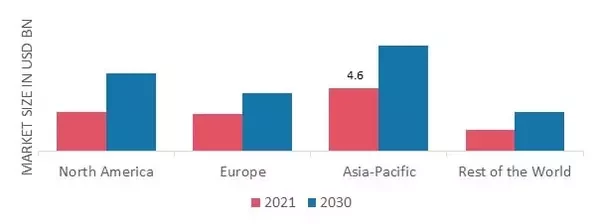

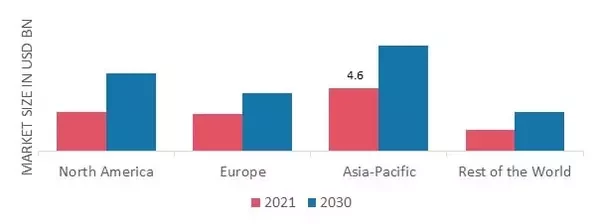

Honey Regional Insights

By region, the study provides the market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The Asia Pacific honey market accounted for USD 4.6 billion in 2021 and is expected to exhibit a 43.90% CAGR during the study period due to the presence of established competitors in the area, strong production rates, and a sizable consumer market that uses it for skin care, baking, medication, and other household purposes. Various corporate growth tactics are becoming increasingly important to manufacturers in this area. For example, Amul, a prominent dairy company in India, stated in September 2020 that it would introduce its honey brand and enter the country's market.

Further, the major countries studied in the market report are: The U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: HONEY MARKET SHARE BY REGION 2021 (%)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

European honey market accounts for the second-largest market share. It is increasingly being used as a healthier sugar substitute, consumers are becoming more health-conscious, and knowledge of its therapeutic, anti-inflammatory, and anti-microbial properties is growing rapidly. These factors have contributed significantly to the market's expansion in this region. Further, the Germany honey market held the largest market share, and the Uk honey market was the fastest-growing market in the European region

North American honey market is expected to grow at a substantial CAGR from 2022 to 2030. The region is expected to expand due to rising demand from the United States, Canada, and Mexico due to consumers' increased health consciousness and preference for natural sweeteners in the region. Moreover, US honey market held the largest market share, and the Canada honey market was the fastest-growing market in this region.

Honey Key Market Players & Competitive Insights

Major market players are spending a lot on R&D to increase their product lines, which will help the honey industry grow even more. Market participants are also taking various strategic initiatives to grow their worldwide footprint, including new product launches, contractual agreements, mergers and acquisitions, increased investments, market developments and collaboration with other organizations. Competitors in the industry must offer cost-effective items to expand and survive in an increasingly competitive and rising market industry.

One of the primary business strategies manufacturers adopt in the honey industry to benefit clients and expand the sector is manufacturing locally to reduce operating costs. In recent years, honey industry has provided medicine with some of the most significant benefits. The honey market major player such as Dabur India Ltd., Comvita Ltd., Barkman Honey Llc, Bee Maid Honey Limited and Billy Bee Honey Products.

S.K. Burman founded the Indian consumer goods corporation Dabur Ltd, which has its headquarters in Ghaziabad. One of India's biggest producers of fast-moving consumer goods, it also produces natural consumer goods and Ayurvedic medicines. In July 2021, Dabur introduced "Dabur Honey Tasties" to signal its entry into the syrups and spreads market. There are two kinds of this new product available at launch: strawberry and chocolate.

Also, Comvita is dedicated to providing you with the greatest quality Manuka Honey, with the most rigorous certifications and openness. Comvita has industry-leading standards thanks to its over 50 years of beekeeping expertise and top-notch internal lab. In September 2020, the first MGO-certified, multi-floral Manuka honey was released by Comvita. With this release, the business hopes to reach a wider audience of consumers who are looking for natural sweeteners that are both economical and palatable.

Key Companies in the honey market includes

- Dabur India Ltd.

- Comvita Ltd.

- Barkman Honey Llc

- Bee Maid Honey Limited

- Billy Bee Honey Products

Honey Industry Developments

January 2022: One of the top producers of honey and other natural sweeteners, Sweet Harvest Foods Inc., has bought Nature Nate's Honey Co. of McKinney. Nature Nate provides consumers with 100% pure, raw, and unfiltered honey through retail stores across the country.

March 2021: The retail market for Manuka honey has grown throughout the US and Canada. The introduction of honey as a natural sweetener coincided with expanding markets in the surrounding area and contributed to a little increase in the company's earnings.

June 2020: Low Glycemic Index (GI) honey is a brand-new product from Capilano Honey Limited. The product is said to be of tremendous importance for consumers trying to cut back on their sugar intake and those following low GI diets.

April 2020: Despite the coronavirus epidemic halting operations at its car assembly plants, the British luxury car firm Rolls Royce claimed a surge in honey output. To support the preservation of the British bee population, the company collects honey at its bee farm, Goodwood Apiary.

Honey Market Segmentation

Honey Type Outlook

- Alfalfa

- Wildflower

- Buckwheat

- Acacia

- Clover

Honey Application Outlook

- Food & Beverage

- Personal Care Products

- Pharmaceuticals

Honey Packaging Outlook

Honey Regional Outlook

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America

| Report Attribute/Metric |

Details |

| Market Size 2021 |

USD 10.5 Billion |

| Market Size 2024 |

USD 11.2 Billion |

| Market Size 2030 |

USD 17.8 Billion |

| Compound Annual Growth Rate (CAGR) |

6.85% (2024-2030) |

| Base Year |

2021 |

| Forecast Period |

2024-2030 |

| Historical Data |

2018 & 2020 |

| Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Type, Application, Packaging and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the World |

| Countries Covered |

The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Dabur India Ltd., Comvita Ltd., Barkman Honey Llc, Bee Maid Honey Limited and Billy Bee Honey Products |

| Key Market Opportunities |

Rise in the use of honey in cosmetics and pharmaceuticals Rise in demand for organic goods, particularly in developed economies |

| Key Market Dynamics |

Increased customer preference for natural alternatives to artificial sweeteners |

Frequently Asked Questions (FAQ) :

The honey market size was expected to be USD 10.5 billion in 2021.

The market for honey is expected to register a CAGR of ~6.85% over the next ten years.

Asia Pacific held the largest market share in the honey market.

Dabur India Ltd., Comvita Ltd., Barkman Honey Llc, Bee Maid Honey Limited and Billy Bee Honey Products are the key players in the honey industry.

The food & beverage category led the application segment in the market.

Bottle category had the largest market share in the market for honey.

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review