Global Cell Therapy Market Overview

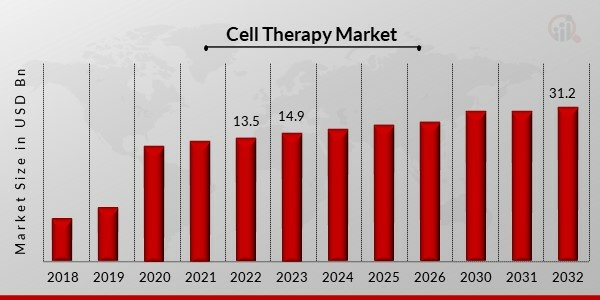

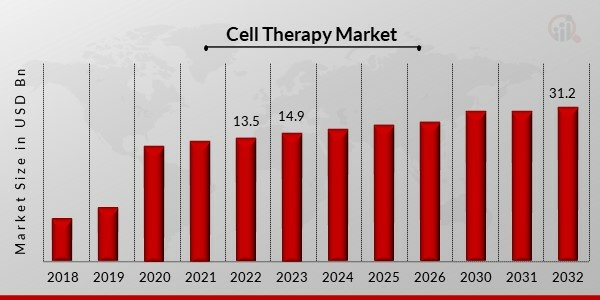

Cell Therapy Market Size was valued at USD 13.5 Billion in 2022. The Cell Therapy market industry is projected to grow from USD 14.8 Billion in 2023 to USD 31.2 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 9.1% during the forecast period (2023 - 2032). The expansion of financing for cell therapy clinical research, the adoption of practical manufacturing methods, and the commercial success of innovative products, are the key market drivers enhancing the market growth.

Source Secondary Research, Primary Research, MRFR Database and Analyst Review

Cell Therapy Market Trends

- The rise in funding for cell therapy clinical studies is driving the market growth

The market for cell treatment is constantly seeing the introduction of new cell types, creating enormous opportunity for companies to strengthen their market positions. As a result, during the past several years, there has been a sharp rise in the number of companies developing cell treatments. The increase in funding for cell therapy clinical research, the adoption of useful standards for cell therapy production, and the success of innovative products are some of the major factors influencing the growth in the number of businesses in the market. A decrease in the price of stem cell treatments has also increased consumer interest. The creation of cell banking facilities and the subsequent expansion of cell production, storage, and characterization have improved the market's capacity to deal with significant volumes on a basis. The market's improved income generation over the preceding few years has been directly attributed to this.

The existence of both public and private financing organisations, which routinely grant approvals to projects to assist across all stages of clinical trials, can be ascribed to a rise in the number of clinical studies. Most late-stage projects in Europe receive funding from grants from the EU. For instance, Achilles Therapeutics announced in July 2022 that it had received a USD 4.2 million grant dubbed "Horizon Europe." It is the main funding programme for research and innovation in the EU. The production of personalised therapies will advance thanks to this support. Due to its uses in treating autoimmune and metabolic illnesses, stem cell treatment is also gaining popularity. It is crucial for a person to build their immunity so they can fight off different metabolic problems. For instance, in May 2022, Sernova and Evotec agreed to work together to develop cell therapies based on induced pluripotent stem cells (iPSCs) for the treatment of insulin-dependent diabetes.

The major technologies anticipated to have a favourable impact on the market growth for adult and cord blood cells are automation in adult stem cell processing and storage as well as cord blood storage. Additionally, major players in the market are working together to convert newborn stem cells from tissue and umbilical cord blood into induced pluripotent stem cells (iPSCs). Over the course of the projected period, these advancements are anticipated to fuel market expansion.

The primary drivers driving growth of the cell therapy market are an increase in the use of human cells for research in cell therapeutics, technological developments in the field of cell therapy, and an increase in the prevalence of diseases like cancer and cardiac abnormalities. Furthermore, it is projected that the installation of strong government rules regulating the use of cell therapy will limit market expansion. On the other hand, the market for cell treatment is anticipated to benefit from an increase in the number of rules promoting stem cell therapy and an increase in research funding in emerging nations. Thus, driving the Cell Therapy market revenue.

Cell Therapy Market Segment Insights

Cell Therapy Cell Type Insights

The Cell Therapy market segmentation, based on cell type, includes stem cell and non-stem cell. Stem cell segment dominated the market in 2022. This is a result of the rising need for new, improved medications to treat cardiovascular, neurological, and immunological diseases. Cell regeneration treatment is another name for stem cell therapy. However, the category with the quickest rate of growth over the anticipated period is non-stem cells. Non-stem cell therapy can increase the production of collagen and the creation of new, healthy skin tissue.

Cell Therapy Therapy Type Insights

The Cell Therapy market segmentation, based on therapy type, includes autologous and allogeneic. The autologous segment dominated the market in 2022. Additionally, it is anticipated that during the forecast period, this segment will increase more quickly. Due to the widespread use of CAR-T treatments and their successful outcomes in the treatment of various malignancies and genetic abnormalities, the market is expected to rise.

Cell Therapy Therapeutic Area Insights

The Cell Therapy market segmentation, based on therapeutic area, includes malignancies, musculoskeletal disorders, autoimmune disorders, dermatology, and others. Malignancies segment dominated the cell therapy market in 2022. Patients with acute lymphocytic leukaemia (ALL) have allegedly seen high percentages of full and long-lasting remissions thanks to CAR T-cells that target CD19. Additionally, the sector for cell therapies is anticipated to increase as the FDA continues to approve more new therapies.

Cell Therapy End User Insights

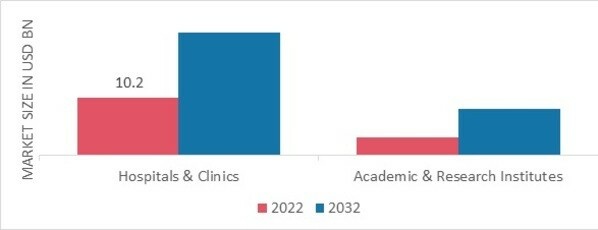

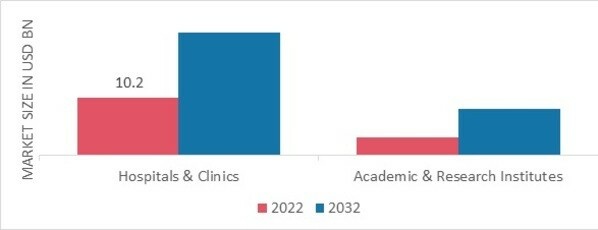

The Cell Therapy market segmentation, based on end user, includes hospitals & clinics and academic & research institutes. The hospital & clinics segment dominated the cell therapy market in 2022. This is as a result of the anticipated period's rising need for gene and cell therapy. However, the category with the fastest growth is academic and research institutions. The major purpose of the stem cells is for research, which has resulted in a sizeable revenue share for the research usage.

Figure 1 Cell Therapy Market, by End User, 2022 & 2032 (USD Billion)

Source Secondary Research, Primary Research, MRFR Database and Analyst Review

Cell Therapy Regional Insights

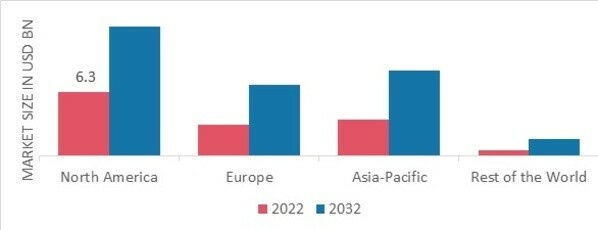

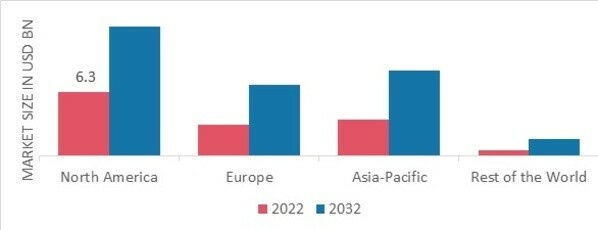

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. The North America Cell Therapy Market dominated this market in 2022 (45.80%). This is a result of regional pharmaceutical industry titans and academic institutes collaborating on research projects. Through several partnerships, there are new developments in the area. Further, the U.S. Cell Therapy market held the largest market share, and the Canada Cell Therapy market was the fastest growing market in the North America region.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2 CELL THERAPY MARKET SHARE BY REGION 2022 (USD Billion)

Source Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe Cell Therapy market accounted for the healthy market share in 2022. The market in Europe is anticipated to grow as a result of increased market participants' spending in the development and use of cell-based therapies in the United States. Further, the German Cell Therapy market held the largest market share, and the U.K Cell Therapy market was the fastest growing market in the European region

The Asia Pacific Cell Therapy market is expected to register significant growth from 2023 to 2032. This is a result of the region's rising need for cell treatment. During the projection period, it is projected that a number of variables, including rising investments, rising investments in novel medicines, and anticipated favourable government regulations, will boost market expansion. Moreover, China’s Cell Therapy market held the largest market share and the Indian Cell Therapy market was the fastest growing market in the Asia-Pacific region.

Cell Therapy Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Cell Therapy market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Cell Therapy industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Cell Therapy industry to benefit clients and increase the market sector. In recent years, the Cell Therapy industry has offered some of the most significant advantages to medicine. Major players in the Cell Therapy market, including Kolon TissueGene Inc., AlloSource, Holostem Terapie Avanzate S.R.L., AlloSource, Holostem Terapie Avanzate S.R.L., Castle Creek Biosciences Inc., Anterogen Co. Ltd, Celgene Corporation, and Tameika Cell Technologies Inc., are attempting to increase market demand by investing in research and development Products.

A biotechnology business is Immunocore Holdings Plc (Immunocore). It focuses on the creation of immunotherapeutic medicines for the management of autoimmune, infectious, and cancerous disorders. The business uses its own T cell receptor (TCR) technology to create its medications. It is currently working on the IMC-C103C, IMC-F106C, IMC-I109V, IMC-M113V, and IMCgp100 products. To develop its therapeutic candidates for the treatment of metastatic cutaneous melanoma, cancer, and other indications, the company collaborates with a number of pharmaceutical firms. It is present in the US, Australia, New Zealand, Asia, and Europe in addition to the UK. The U.K. county of Oxfordshire serves as the home base for Immunocore. The Food and Drug Administration granted Immunocore approval for KIMMTRAK (tebentafusp-tebn) in January 2022 to treat unresectable or metastatic uveal melanoma.

The goal of Novadip Biosciences is to increase access to tissue regeneration treatments through the development of cell-based regeneration medicines. With the help of the company's therapies, clinicians and patients can achieve better clinical outcomes and long-term quality of life. These therapies help heal bone disorders and deformities as well as hard and soft tissue restoration using autologous adipose stem cells. For the treatment of a rare paediatric bone condition, Novadip Biosciences' regenerating bone medicine NVD-003 got FDA approval as an investigational new drug (IND) in March 2021.

Key Companies in the Cell Therapy market include

Cell Therapy Industry Developments

April 2023, Bristol Myers Squibb collaborated with Novartis to strengthen cell therapy capabilities by introducing a U.S. manufacturing facility for viral vector production of CAR T cell therapies.

March 2023, Arsenal Biosciences, Inc. and Thermo Fisher Scientific collaborated on the manufacturing processes for new cancer treatments. ArsenalBio has developed a robust manufacturing process for their next-generation, programmable autologous T cells for cancer treatment as a result of this research and process development collaboration.

March 2023, Danaher has formed a strategic partnership with the University of Pennsylvania to address manufacturing challenges affecting cell therapy uptake.

March 2022, Novartis Kymriah® CAR-T cell therapy has been approved by the FDA for patients with relapsed or refractory follicular lymphoma. Kymriah is now FDA approved for three indications and is the only CAR-T cell therapy that is approved for both adults and children.

December 2022, Kite, a Gilead Company, has formed a strategic alliance with Arcellx, Inc. to develop and commercialise CART-ddBCMA for the treatment of relapsed multiple myeloma. IN December 2022, the parties agreed to collaborate on the development and marketing of a CART-ddBCMA candidate for relapsed or refractory multiple myeloma.

December 2022, Kite acquired Tmunity Therapeutics in order to develop next-generation CAR T-cell therapies for cancer treatment. As a result of the acquisition, Kite will gain access to pre-clinical and clinical projects, as well as a 'armoured' CAR T technology platform that can be applied to a variety of CAR Ts to improve anti-tumor efficacy and speed up production procedures.

Lifileucel, the first cell-based treatment for a solid tumor in the US, may receive its first regulatory approval from Iovance Biotherapeutics in a few months. As a one-time, customized treatment for people with advanced melanoma, the FDA has formally begun an immediate examination of the tumor-infiltrating lymphocyte (TIL) therapy with an effective date of 25th November. Additionally, the FDA has no plans to convene an advisory committee. The encouraging results of CAR-Ts in treating blood cancers could inspire Iovance, which is attempting to pave the way for cell therapies in solid tumors.

The first patient dosed in Phase 1 clinical trial of A2B530, according to A2 Biotherapeutics, Inc. (A2 Bio), a clinical-stage cell treatment business developing first-in-class logic-gated cell therapies for tumors that are solid. Patients with colorectal, pancreatic, and lung cancers that are not small cells will be enrolled in the multi-center Phase 1 dose escalation study known as EVEREST-1 (NCT05736731). The safety of A2B530 will be assessed, and the optimal dosage will be determined by EVEREST-1. The initial autologous cell therapy created using the exclusive Tmod platform of A2 Bio is called A2B530. Utilizing a dual-receptor architecture, the Tmod platform targets tumor cells with an activator and shields normal cells with a blocker. The ability to target and kill tumor cells specifically is the fundamental problem with solid tumor cancer treatments.

Two presentations showcasing clinical data from the company's autologous CD30 were announced today by Tessa Therapeutics Ltd. (Tessa), a clinical-stage cell therapy business developing next-generation cancer therapies for hematological malignancies and solid tumors. Off-the-shelf CD30 CAR EBVST treatment (TT11X) and CAR-T therapy (TT11). Tessa's autologous CD30 is TT11.In a Phase 1B (ACTION) study aimed at patients with R/R traditional Hodgkin Lymphoma (cHL), CAR-T therapy is currently being investigated with Nivolumab.

Cell Therapy Market Segmentation

Cell Therapy Cell Type Outlook

Cell Therapy Therapy Type Outlook

Cell Therapy Therapeutic Area Outlook

- Malignancies

- Musculoskeletal Disorders

- Autoimmune Disorders

- Dermatology

- Others

Cell Therapy End User Outlook

- Hospitals & Clinics

- Academic & Research Institutes

Cell Therapy Regional Outlook

-

North America

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

-

Rest of the World

- Middle East

- Africa

- Latin America

Cell Therapy Report Scope

| Report Attribute/Metric |

Details |

| Market Size 2022 |

USD 13.5 Billion |

| Market Size 2023 |

USD 14.8 Billion |

| Market Size 2032 |

USD 31.2 Billion |

| Compound Annual Growth Rate (CAGR) |

9.1% (2023-2032) |

| Base Year |

2022 |

| Market Forecast Period |

2023-2032 |

| Historical Data |

2018- 2022 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Cell Type, Therapy Type, Therapeutic Area, End User, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered |

The U.S., Canada, German, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Kolon TissueGene Inc., AlloSource, Holostem Terapie Avanzate S.R.L., AlloSource, Holostem Terapie Avanzate S.R.L., Castle Creek Biosciences Inc., Anterogen Co. Ltd, Celgene Corporation, and Tameika Cell Technologies Inc. |

| Key Market Opportunities |

Entering developing economies |

| Key Market Dynamics |

The rise in funding for cell therapy clinical studies, the adoption of useful guidelines for cell therapy manufacturing, and the success of novel products |

Cell Therapy Market Highlights:

Frequently Asked Questions (FAQ) :

The Cell Therapy market size was valued at USD 13.5 Billion in 2022.

The market is projected to grow at a CAGR of 9.1% during the forecast period, 2023-2032.

North America had the largest share in the market

The key players in the market are Kolon TissueGene Inc., AlloSource, Holostem Terapie Avanzate S.R.L., AlloSource, Holostem Terapie Avanzate S.R.L., Castle Creek Biosciences Inc., Anterogen Co. Ltd, Celgene Corporation, and Tameika Cell Technologies Inc.

The Stem Cell Type dominated the market in 2022.

The Autologous Therapy Type had the largest share in the market.