Global Bioinformatics Market Overview

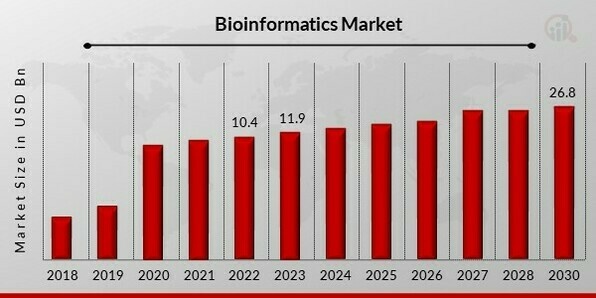

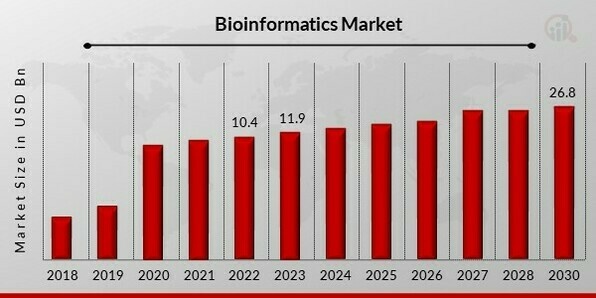

Bioinformatics Market Size was valued at USD 10.4 billion in 2022 and is projected to grow from USD 11.9 Billion in 2023 to USD 26.8 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 14.50% during the forecast period (2023 - 2030). The market driver for the worldwide bioinformatics market is due to the rise in demand for integrated data, the rise in demand for nucleic acid and protein sequencing due to the drop in sequencing costs, and the rise in proteomics and genomics applications.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Bioinformatics Market Trends

- Growing demand for protein synthesis to propel market growth

The bioinformatics market is expanding as a result of rising demand for protein sequencing. The process of identifying the amino acid sequence in all or a portion of the proteins included in DNA, from which specific functions, activities, origin, or localization of the protein are identified, is known as protein sequencing. Understanding the distribution of amino acids along sequences and the structure of proteins is made easier by protein sequencing. Protein capacity, structure, and developmental history can all be accurately determined using bioinformatics techniques and databases. The increasing use of target-based medication development by pharmaceutical and biotechnology companies, improvements in clinical mass spectrometry and analytical methods, and other reasons are all likely to increase the demand for protein sequencing. For instance, in 2021, the total number of protein sequences in UniProtKB, a publicly available database of information on the structure and function of proteins, climbed to about 190 million. Thus, this factor is driving the market CAGR for bioinformatics.

Furthermore, globally, numerous business and governmental entities are steadily making investments in the field of bioinformatics. These expenditures have mostly improved bioinformatics services' data and technological capabilities, which has raised the calibre of those services. To improve surveillance, identification, and mitigation of SARS-CoV-2 mutations as well as infrastructure development for upcoming genome sequencing requirements, the US government announced a $1.7 billion expenditure in 2021. Additionally, in 2021, LifeArc (London) announced US$ 6.91 million in funding to support the Gen OMICC COVID-19 study. This funding will also cover costs associated with patient enrollment, sample acquisition, and sample processing, as well as patient bioinformatics analysis. To find the connection between genetics and diseases, many nations are also funding their national population sequencing initiatives. Millions of people are having their genomes sequenced by government agencies in order to progress science and provide new, more effective methods for treating ailments like cancer and uncommon disorders. As a result, funding and investment in bioinformatics are spurring market expansion.

However, according to the World Health Organization (WHO), there are between 27 million and 36 million persons affected by between 5,000 and 8,000 different uncommon diseases in Europe. Similar to this, new diseases that do not yet have a specific prescribed treatment are developing in various regions of the world. Novel vaccinations and treatments are therefore urgently needed to combat these diseases. It appears that diagnosing and treating these rare diseases requires extensive data analytics, which mostly requires bioinformatics and other research approaches. Thus, it is anticipated that this aspect will accelerate bioinformatics market revenue globally.

Bioinformatics Market Segment Insights

Bioinformatics Application Insights

The Bioinformatics Market segmentation, based on application, includes Genomics, Chemoinformatics, Drug Design, Transcriptomics, Molecular Phylogenetics, Proteomics and Metabolomics. The genomics segment held the majority share in 2022 in the Bioinformatics Market data. The advent of technical developments targeted at managing sizable quantities of genomic data and the growing demand for pharmacogenomics in drug development and sequence screening are the main elements contributing to this significant share. Applications of genomics include whole-animal DNA sequencing and fine-scale genetic mapping. Government expenditure on genetic research is expected to increase, which will boost the genomics industry's growth.

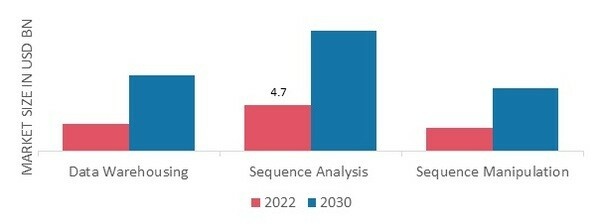

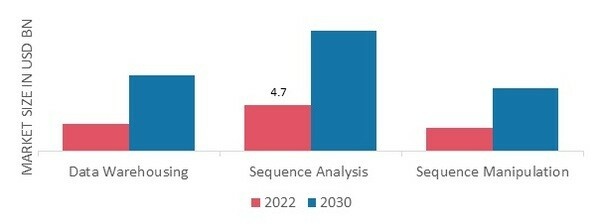

Bioinformatics Technology and Services Insights

The Bioinformatics Market segmentation, based on technology and services, includes Data Warehousing, Sequence Analysis and Sequence Manipulation. The sequence analysis segment dominated the market growth for bioinformatics in 2022 and is projected to be the faster-growing segment during the forecast period, 2022-2030. Sequence analysis in bioinformatics refers to the process of using any of a wide range of analytical techniques to a DNA, RNA, or peptide sequence in order to comprehend its characteristics, functions, structures, or evolution. Microbiome (genetic) research has been significantly impacted by improvements in next-generation sequencing (NGS) technologies in terms of throughput, read length, and accuracy. This progress has greatly enhanced 16S rRNA amplicon sequencing.

Figure 2: Bioinformatics Market, by Technology and Services, 2022 & 2030 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

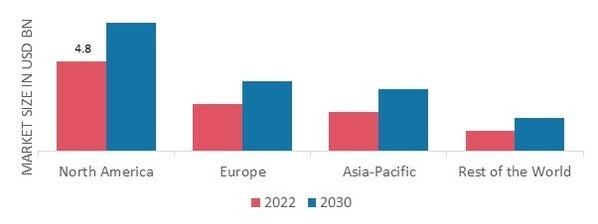

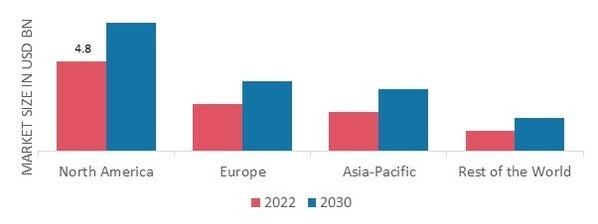

Bioinformatics Regional Insights

By region, the study provides the market insights for bioinformatics into North America, Europe, Asia-Pacific and Rest of the World. North America bioinformatics market accounted for USD 4.8 billion in 2022 with a share of around 45.80% and is expected to exhibit a significant CAGR growth during the study period. The rise of the bioinformatics market is projected to be fueled by the rising need for innovative drug research and development as well as commercial and government financing initiatives to assist that research and development. In addition, it is anticipated that the usage of bioinformatics tools and the acceptance of contemporary technology in Canada and Mexico will boost the regional market.

Further, the major countries studied in the market report for bioinformatics are: The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: BIOINFORMATICS MARKET SHARE BY REGION 2022 (%)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe bioinformatics market accounts for the second-largest market share. The demand for bioinformatics tools for precise and quick analysis of biomarkers discovery programmes, which support toxicity detection during the medication development process, is responsible for the region's growth. Additionally, governments priorities several initiatives to highlight the benefits of bioinformatics by increasing financing for research and development, which benefits the bioinformatics industry in countries that make up the European Union. Further, the UK bioinformatics market held the largest market share, and the Germany bioinformatics market was the fastest growing market in the region.

Asia Pacific bioinformatics Market is expected to grow at the fastest CAGR from 2022 to 2030. It is anticipated that the availability of qualified bioinformaticians and the anticipated growth of the region's IT sector will increase the region's capacity to offer outsourcing services to richer nations. Government initiatives that are encouraging are also anticipated to fuel this region's growth over the projection period. Moreover, China bioinformatics market held the largest market share, and the India bioinformatics market was the fastest growing market in the region.

Bioinformatics Key Market Players & Competitive Insights

Major market players are spending a lot of money on R&D to increase their product lines, which will help the bioinformatics market grow even more. Market participants are also taking a range of strategic initiatives to grow their worldwide footprint, with key market developments such as new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Competitors in the bioinformatics industry must offer cost-effective items to expand and survive in an increasingly competitive and rising market environment.

One of the primary business strategies adopted by manufacturers in the global bioinformatics industry to benefit clients and expand the market sector is to manufacture locally to reduce operating costs. In recent years, bioinformatics industry has provided medicine with some of the most significant benefits. The bioinformatics market major player such as Agilent Technologies, Illumina Inc., QIAGEN N. V., Thermo Fisher Scientific Inc., Dassault Systèmes and QIAGEN.

The global headquarters of the American corporation Agilent Technologies, Inc. are in Santa Clara, California. Hewlett-Packard created Agilent as a spin-off in 1999. The Agilent stock Offering that followed was the biggest in Silicon Valley history at the time. From 1999 to 2014, the business produced electronics test and measurement tools, semiconductors, optics (LED, Laser), and EDA software. That division was later spun off to form Keysight. In August 2022, Agilent Technologies joined forces with Bright Giant, a provider of software for the identification of tiny molecules. Following the partnership, Bright Giant's experience in artificial intelligence solutions and Agilent's cutting-edge mass spectrometry technology are combined for small molecule research.

American company Thermo Fisher Scientific Inc. sells scientific equipment, reagents and supplies, and software services. Thermo Fisher was created in 2006 by the union of Thermo Electron and Fisher Scientific and is headquartered in Waltham, Massachusetts. In January 2022, PeproTech was acquired by Thermo Fisher on December 30, 2021, for a total cash transaction price of roughly US$ 1.85 billion. Recombinant proteins, such as cytokines and growth hormones, are offered by PeproTech, a privately held supplier of bioscience tools.

Key Companies in the bioinformatics market includes

Bioinformatics Industry Developments

May 2022: Bruker Corporation and TOFWERK AG established a collaborative relationship for high-speed, ultra-sensitive applied and industrial analytical solutions, together with a Bruker minority investment in TOWERK. The relationship serves as a foundation for technological partnerships to enhance instrument capabilities and for the creation of novel analytical applications where high speed and ultra-sensitivity matter.

April 2020: A Next-Generation Sequencing (NGS)-based test called StrandAdvantage500, which was unveiled by Healthcare Global Enterprises and Strand Life Sciences, evaluates cancer-relevant genetic alterations using DNA and RNA extracted from a patient's tumour in a single integrated workflow.

Bioinformatics Market Segmentation

Bioinformatics Application Outlook (USD Billion, 2018-2030)

Bioinformatics Technology and Services Outlook (USD Billion, 2018-2030)

- Data Warehousing

- Sequence Analysis

- Sequence Manipulation

Bioinformatics Regional Outlook (USD Billion, 2018-2030)

-

North America

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

-

Rest of the World

- Middle East

- Africa

- Latin America

| Report Attribute/Metric |

Details |

| Market Size 2022 |

USD 10.4 billion |

| Market Size 2023 |

USD 11.9 billion |

| Market Size 2030 |

USD 26.8 billion |

| Compound Annual Growth Rate (CAGR) |

14.50% (2023-2030) |

| Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Historical Data |

2018 - 2021 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Type, Product, Application, End User and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the World |

| Countries Covered |

The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Agilent Technologies, Illumina Inc., QIAGEN N. V., Thermo Fisher Scientific Inc., Dassault Systèmes and QIAGEN |

| Key Market Opportunities |

Joint ventures, strategic alliances, mergers and acquisitions, New product developments |

| Key Market Dynamics |

Increasing research and development investments, government and private organizations initiatives |

Bioinformatics Market Highlights:

Frequently Asked Questions (FAQ) :

The global market size was valued at USD 10.4 Billion in 2022.

The global market is projected to grow at a CAGR of 14.50% during the forecast period, 2022-2030.

North America had the largest share in the global market for bioinformatics.

The key players in the market for bioinformatics are Agilent Technologies, Illumina Inc., QIAGEN N. V., Thermo Fisher Scientific Inc., Dassault Systèmes and QIAGEN.

The genomics dominated the bioinformatics market in 2022.

The sequence analysis had the largest share in the global market.